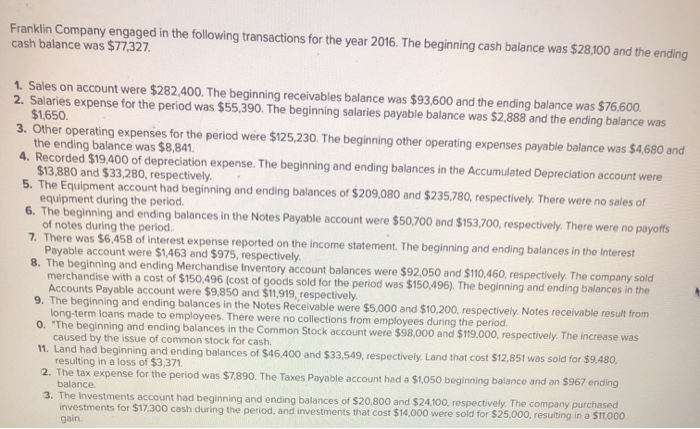

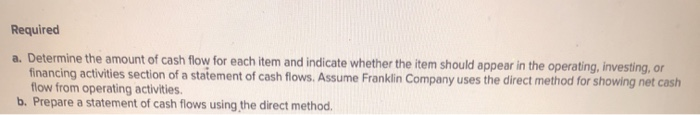

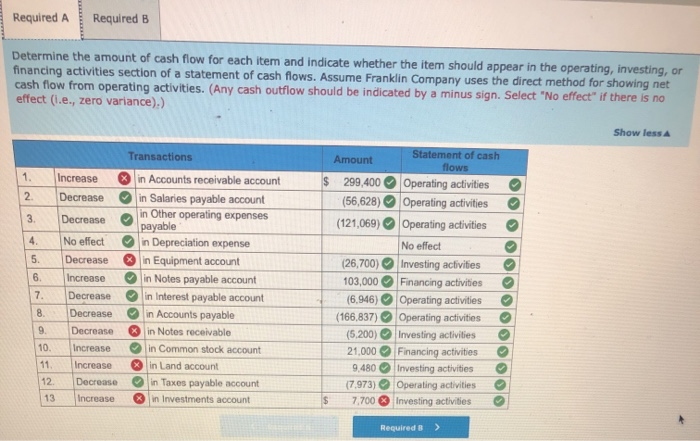

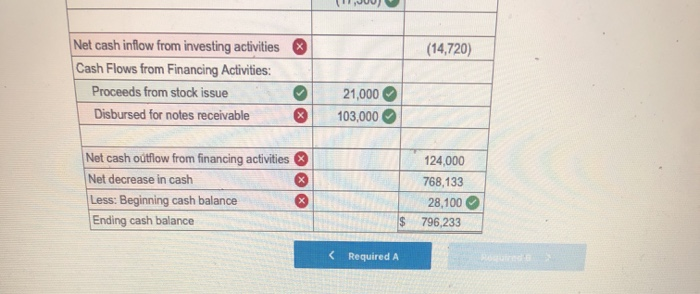

Franklin Company engaged in the following transactions for the year 2016. The beginning cash balance was $28,100 and the ending cash balance was $77,327. 1. Sales on account were $282,400. The beginning receivables balance was $93,600 and the ending balance was $76,600. 2. Salaries expense for the period was $55,390. The beginning salaries payable balance was $2,888 and the ending balance was $1,650. 3. Other operating expenses for the period were $125.230. The beginning other operating expenses payable balance was $4,680 and the ending balance was $8,841 4. Recorded $19.400 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $13,880 and $33,280, respectively. 5. The Equipment account had beginning and ending balances of $209,080 and $235.780, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $50,700 and $153,700, respectively. There were no payoffs of notes during the period 7. There was $6,458 of interest expense reported on the income statement. The beginning and ending balances in the Interest Payable account were $1,463 and $975, respectively. 8. The beginning and ending Merchandise Inventory account balances were $92,050 and $110,460, respectively. The company sold merchandise with a cost of $150,496 (cost of goods sold for the period was $150,496). The beginning and ending balances in the Accounts Payable account were $9,850 and $11.919, respectively. 9. The beginning and ending balances in the Notes Receivable were $5,000 and $10,200, respectively. Notes receivable result from long-term loans made to employees. There were no collections from employees during the period. 0. "The beginning and ending balances in the Common Stock account were $98,000 and $119,000, respectively. The increase was caused by the issue of common stock for cash 11. Land had beginning and ending balances of $46,400 and $33,549, respectively. Land that cost $12,851 was sold for $9.480, resulting in a loss of $3,371. 2. The tax expense for the period was $7,890. The Taxes Payable account had a $1,050 beginning balance and an $967 ending balance. 3. The Investments account had beginning and ending balances of $20,800 and $24100, respectively. The company purchased investments for $17,300 cash during the period, and investments that cost $14,000 were sold for $25.000, resulting in a $11,000 gain Required a. Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing, or financing activities section of a statement of cash flows. Assume Franklin Company uses the direct method for showing net cash flow from operating activities. b. Prepare a statement of cash flows using the direct method. Required A Required B Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing, or financing activities section of a statement of cash flows. Assume Franklin Company uses the direct method for showing net cash flow from operating activities. (Any cash outflow should be indicated by a minus sign. Select "No effect if there is no effect (.e., zero variance).) Show less Amount Increase Decrease Transactions in Accounts receivable account in Salaries payable account in Other operating expenses 299,400 (56,628) (121,069) Decrease payable No effect Decrease Increase Decrease Decrease Decrease Increase Increase Decrease Increase in Depreciation expense in Equipment account in Notes payable account in Interest payable account in Accounts payable in Notes receivable in Common stock account in Land account in Taxes payable account in Investments account (26,700) 103,000 (6,946) (166,837) (5.200) 21,000 9.480 (7.973) 7.700 Statement of cash flows Operating activities Operating activities Operating activities No effect Investing activities Financing activities Operating activities Operating activities Investing activities Financing activities Investing activities Operating activities Investing activities 10 Required s Prepare a statement of cash flows using the direct method. (Amounts to be deducted and cash outflows should be indicated by a minus sign.) FRANKLIN COMPANY Statement of Cash Flows For the Year Ended December 31, 2016 Cash Flows From Operating Activities: Cash Receipts from: 299,400 $ 299400 Total cash inflows Cash Payments for: Paid to purchase equipment Salaries Other operating expenses Inventory purchased 166,837 56.628 121,069 6,946 7,973 X Taxes 359,453 658,853 Total cash outflows Net cash inflow from operating activities Cash Flows from Investing Activities: Proceeds from sale of land Paid to purchase equipment Proceeds from loan Proceeds from sale of investments 9.480 (26.700) (5.200) 25,000 (17,300) 1,JUU (14,720) Net cash inflow from investing activities Cash Flows from Financing Activities: issue Proceeds from stock issue Disbursed for notes receivable EX 21,000 103,000 Net cash outflow from financing activities Net decrease in cash Less: Beginning cash balance Ending cash balance 124,000 768,133 28,100 796,233 $