Question

Franklin Company must follow the Lower of Cost or Net Realizable Value (LCNRV) Rule for its inventory. The following information was taken from Franklins inventory

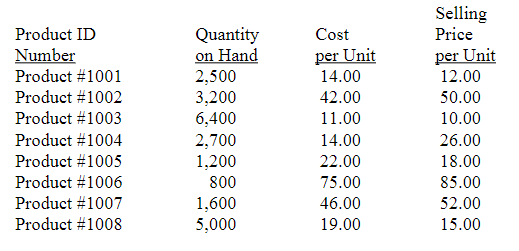

Franklin Company must follow the Lower of Cost or Net Realizable Value (LCNRV) Rule for its inventory. The following information was taken from Franklins inventory records as of December 31, 2020:

Franklin has the following costs to sell associated with all of its products:

1. Sales commission of 6% of the selling price for each product

2. Packaging and delivery costs of 4% of the cost of each product

Requirements:

Complete each of the following independent requirements:

a) Determine the carrying value of inventory at 12/31/20 assuming that Franklin applies the LCNRV Rule to each specific product in its inventory. Also, assuming that Franklin would record any loss recognized as a separate line item in its income statement, determine the amount of the loss (if any) that Franklin would record for 2020.

b) Determine the carrying value of inventory at 12/31/20 assuming that Franklin applies the LCNRV Rule to its total inventory. Also, assuming that Franklin would record any loss recognized as a separate line item in its income statement, determine the amount of the loss (if any) that Franklin would record for 2020.

anyone know how to use Excel to do it?

Selling Price Cost per Unit per Unit Product ID Number Product #1001 Product #1002 Product #1003 Product #1004 Product #1005 Product #1006 Product #1007 Product #1008 Quantity on Hand 2,500 3,200 6,400 2,700 1,200 800 1,600 5,000 14.00 42.00 11.00 14.00 22.00 75.00 46.00 19.00 12.00 50.00 10.00 26.00 18.00 85.00 52.00 15.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started