Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Franks business plan in the Appendix (Chapter 16 Appendix: A Sample Business Plan) provides projected income statements and balance sheets for a five-year forecast horizon.

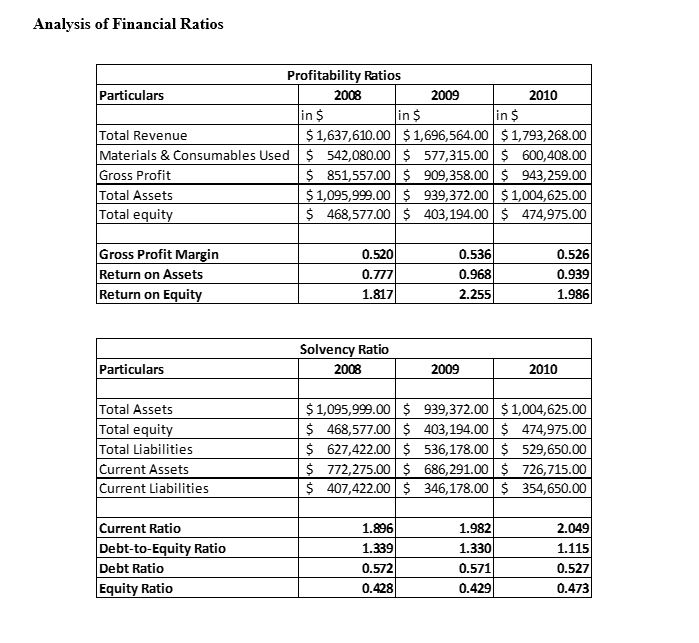

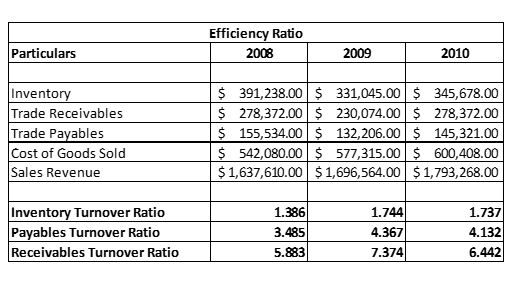

Franks business plan in the Appendix (Chapter 16 "Appendix: A Sample Business Plan") provides projected income statements and balance sheets for a five-year forecast horizon. Compute the same ratios as in Exercise 8 and comment on your results.

Below is the same ratios as the exercise 8

the business plan can be found below pdf book last chapter 16

https://www.saylor.org/site/textbooks/Small%20Business%20Management%20in%20the%2021st%20Century.pdf

Analysis of Financial Ratios Profitability Ratios 2008 Particulars 2009 2010 in in in $1,637,610.00 $1,696,564.00 $1,793,268.00 Total Revenue Materials & Consumables Used 542,080.00 $ 577,315.00$ 600,408.00 Gross Profit Total Assets Total equit 5 851,557.00 S 909.358.00 943,259.00 1,095.999.00 939,372.00 $1,004,625.00 468,577.00 403,194.00 474,975.00 0.520 Gross Profit Margir Return on Assets Return on Equit 0.536 0.968 2.255 0.526 0.939 1.986 1.817 Solvency Ratio 2008 Particulars 2009 2010 Total Assets Total equit Total Liabilities Current Assets Current Liabilities $1,095,999.00$ 939,372.00 $1,004,625.00 468,577.00403,194.00 474,975.00 627,422.00 536,178.00 529,650.00 5 772,275.00 S 686,291.00 726,715.00 407,422.00 346,178.00 354,650.00 Current Ratio Debt-to-Equity Ratio Debt Ratio Equity Ratio 1.896 1.339 0.572 0.428 1.982 1.330 0.571 0.429 2.049 1.115 0.527 0.473 Analysis of Financial Ratios Profitability Ratios 2008 Particulars 2009 2010 in in in $1,637,610.00 $1,696,564.00 $1,793,268.00 Total Revenue Materials & Consumables Used 542,080.00 $ 577,315.00$ 600,408.00 Gross Profit Total Assets Total equit 5 851,557.00 S 909.358.00 943,259.00 1,095.999.00 939,372.00 $1,004,625.00 468,577.00 403,194.00 474,975.00 0.520 Gross Profit Margir Return on Assets Return on Equit 0.536 0.968 2.255 0.526 0.939 1.986 1.817 Solvency Ratio 2008 Particulars 2009 2010 Total Assets Total equit Total Liabilities Current Assets Current Liabilities $1,095,999.00$ 939,372.00 $1,004,625.00 468,577.00403,194.00 474,975.00 627,422.00 536,178.00 529,650.00 5 772,275.00 S 686,291.00 726,715.00 407,422.00 346,178.00 354,650.00 Current Ratio Debt-to-Equity Ratio Debt Ratio Equity Ratio 1.896 1.339 0.572 0.428 1.982 1.330 0.571 0.429 2.049 1.115 0.527 0.473

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started