Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fred is 46 years of age and in 2019 has employment income of $148,000. His partner Jean is 41 and has Net Income for

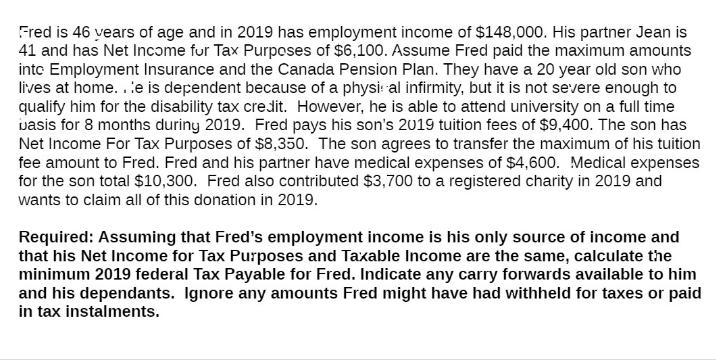

Fred is 46 years of age and in 2019 has employment income of $148,000. His partner Jean is 41 and has Net Income for Tax Purposes of $6,100. Assume Fred paid the maximum amounts into Employment Insurance and the Canada Pension Plan. They have a 20 year old son who lives at home...e is dependent because of a physi al infirmity, but it is not severe enough to qualify him for the disability tax credit. However, he is able to attend university on a full time vasis for 8 months during 2019. Fred pays his son's 2019 tuition fees of $9,400. The son has Net Income For Tax Purposes of $8,350. The son agrees to transfer the maximum of his tuition fee amount to Fred. Fred and his partner have medical expenses of $4,600. Medical expenses for the son total $10,300. Fred also contributed $3,700 to a registered charity in 2019 and wants to claim all of this donation in 2019. Required: Assuming that Fred's employment income is his only source of income and that his Net Income for Tax Purposes and Taxable Income are the same, calculate the minimum 2019 federal Tax Payable for Fred. Indicate any carry forwards available to him and his dependants. Ignore any amounts Fred might have had withheld for taxes or paid in tax instalments.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the minimum 2019 federal Tax Payable for Fred we need to consider various factors such as income deductions and credits Lets break down t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started