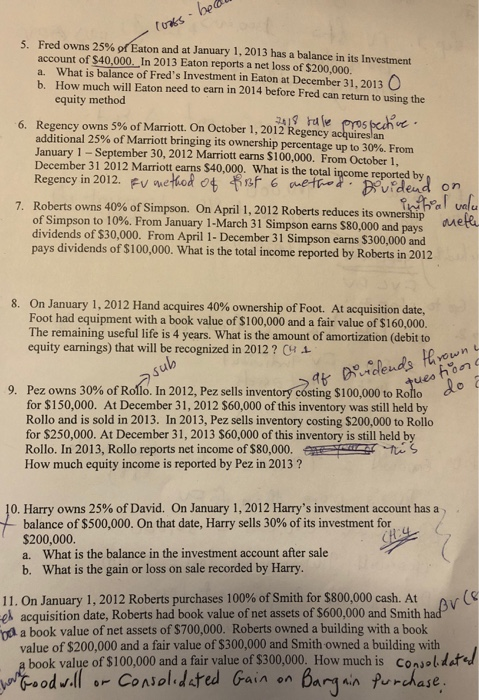

Fred owns 25%Eaton and at January 1, 2013 has a balance in its investment account of $40,000. In 2013 Eaton reports a net loss of $200,000 a. What is balance of Fred's Investment in Eaton at December 31, 2013 b. How much will Eaton need to earn in 2014 before Fred can return to using the 5, equity method 6. Regency owns 5% of Marriott. On October 1, 2012 Regency additional 25% of Marriott bringing its ownership percentage up to 30%. From January 1 - September 30, 2012 Marriott earns $100,000. From October 1, December 31 2012 Marriott earns $40,000. What is the total income reported by Regency in 2012. Fv wefhod ot 6ne-t d end on Roberts owns 40% of Simpson. On April 1, 2012 Roberts reduces its ownership of Simpson to 10%. From January 1-March 31 Simpson earns S80.000 and pays dividends of $30,000. From April 1-December 31 Simpson earns $300,000 and pays dividends of $100,000. What is the total income reported by Roberts in 2012 7. , due On January 1, 2012 Hand acquires 40% ownership of Foot. At acquisition date, Foot had equipment with a book value of $100,000 and a fair value of $160,000. The remaining useful life is 4 years. What is the amount of amortization (debit to equity earnings) that will be recognized in 2012 ? Pez owns 30% ofRoflo. In 2012, Pez sells inventory costing $100,000 to Roho for $150,000. At December 31, 2012 $60,000 of this inventory was still held by Rollo and is sold in 2013. In 2013, Pez sells inventory costing $200,000 to Rollo for $250,000. At December 31, 2013 S60,000 of this inventory is still held by Rollo. In 2013, Rollo reports net income of $80,000. How much equity income is reported by Pez in 2013? 9, do 0, Harry owns 25% of David. On January 1, 2012 Harry's investment account has a balance of $500,000. On that date, Harry sells 30% of its investment for $200,000 a. What is the balance in the investment account after sale b. What is the gain or loss on sale recorded by Harry 11.0n January 1,2012 Roberts purchases 100% of Smith for $800,000 cash. At ek acquisition date, Roberts had book value of net assets of $600,000 and Smith oa a book value of net assets of $700,000. Roberts owned a building with a book value of $200,000 and a fair value of $300,000 and Smith owned a building with book value of $100,000 and a fair value of $300,000. How much is consoldafe