Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fred pressed the 'retum' key, carrying out the trades he had figured would give him a good return. He had opened the online stock

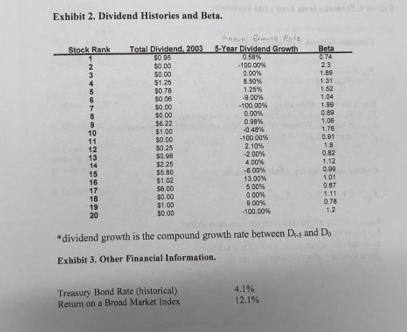

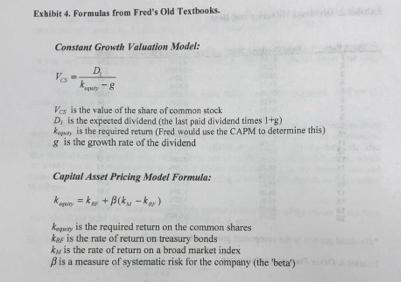

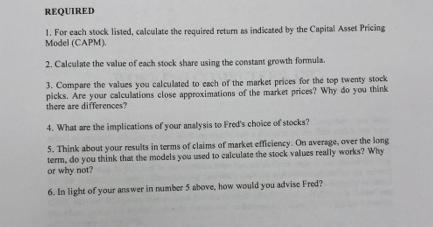

Fred pressed the 'retum' key, carrying out the trades he had figured would give him a good return. He had opened the online stock trading account in order to learn about the process of trading and to take advantage of his academic knowledge of how the markets determine stock values. He had taken several finance classes in his undergraduate degree, and had enjoyed learning the way investors decide how much to bid on stocks. Fred figured he could take advantage of this knowledge in creating more wealth than he could if he just invested in an investment fund. THE BROKER'S ADVICE When he opened the trading account, Fred had signed up for telephone access to a broker. The account allowed him a certain number of calls and a certain amount of time in consultation with the broker each month. Now, Fred had quite a sum of free cash in the account, money he had transferred from an investment fund that he was not very happy with. The amount he had to invest was about $68,000. He decided to take advantage of the advisement service, and made his first telephone call. "Welcome to Bettertrade services, Mr. Alberts. My name is Brad Cendron. How can I assist you today?", the voice asked. "Yes; I would like to get your advice on how to invest a sum of money. My objective is to invest this amount in stocks that appear to be undervalued by the market. Can you recommend about ten stocks that would fit that description?", Fred asked. "Oh, yes, I'd be happy to. We have listed our top bargains on the top stock picks" list on the website. Are you online now?", Brad asked. "Yes, I am," Fred replied. "Oh, I see it here. They are in order, according to your idea. of how much of a bargain they are, right?" "That's correct, Mr. Albert. We believe that these 20 stocks are going to have greater upside potential over time. I can help you make the transactions, if you'd like." "Well, I'm going to do a little more research on my own first, but thank you for the link. I'll just carry out transactions via the website, since the transaction fees are lower that way," Fred said. "OK. Mr. Albert, Brad replied. Let us know if you have other questions, or if we can assist you further." Fred printed out the list of stocks, and set about the task of collecting information about them. He went to the "market data" link on the company's website to get some information. For each firm, he downloaded the history of dividend payments, and the beta. He also downloaded current treasury bond rates and the rate of return on a broad market index, which he would use as an indicator of the market return. Fred summarized the information and prepared to determine the value of the stocks according to the financial models he had studied in college. Fred's collection of information and the current market prices of the stocks in the "top stock picks" list from his broker appear in Exhibits 1, 2, and 3. Exhibit 1. Top 20 Stock Picks List. Stock Rank 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Price, 1/05/04 $14.89 529.02 $18.83 $93.48 $67.29 $3.28 $9.00 $55.91 $98.47 $43.07 $37 55 $38 30 $76.33 $57.09 $193.065 $38.33 $71.11 39:23 $19.36 $29.92 Exhibit 2. Dividend Histories and Beta. Stock Rank Total Dividend, 2003 $0.05 $0.00 $0.00 $1.25 $0.78 $0.00 $0.00 $0.00 56.22 $1.00 $0.00 $0.25 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 $0.08 $2.25 $5.80 $1.02 $8,00 $0.00 $1.00 $0.00 main with hole 5-Year Dividend Growth 0.58% -100.00% 0.00% 8.50% Treasury Bond Rate (historical) Return on a Broad Market Index 1.25% -9.00% -100.00% 0.00% 0.98% 0.48% -100.00% 2.10% -2.00% 4.00% -8.00% 13.00% 5.00% 0.00% 9:00% -100.00% Beta 0.74 23 1.89 1.31 1.52 4.1% 12.1% 1.04 1.99 0.89 1.06 1.76 0.91 18 0.82 1.12 0.00 101 *dividend growth is the compound growth rate between D, and D Exhibit 3. Other Financial Information. 0.87 1.11 0.78 1.2 Exhibit 4. Formulas from Fred's Old Textbooks. Constant Growth Valuation Model: D g Ves is the value of the share of common stock D, is the expected dividend (the last paid dividend times 1+g) Ky is the required return (Fred would use the CAPM to determine this) g is the growth rate of the dividend Capital Asset Pricing Model Formula: k=k+B(-k) Keity is the required return on the common shares kas is the rate of return on treasury bonds ky is the rate of return on a broad market index B is a measure of systematic risk for the company (the 'beta') REQUIRED 1. For each stock listed, calculate the required return as indicated by the Capital Asset Pricing Model (CAPM). 2. Calculate the value of each stock share using the constant growth formula. 3. Compare the values you calculated to each of the market prices for the top twenty stock picks. Are your calculations close approximations of the market prices? Why do you think there are differences? 4. What are the implications of your analysis to Fred's choice of stocks? 5. Think about your results in terms of claims of market efficiency. On average, over the long term, do you think that the models you used to calculate the stock values really works? Why or why not? 6. In light of your answer in number 5 above, how would you advise Fred?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started