Question

Frederic's Designs Ltd. purchased a $250,000 Lexus for Frederic Vanguard's personal use. The Lexus replaced the only other existing company car, a $150,000 BMW, which

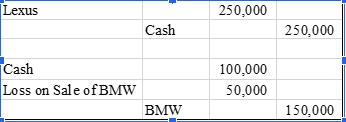

Frederic's Designs Ltd. purchased a $250,000 Lexus for Frederic Vanguard's personal use. The Lexus replaced the only other existing company car, a $150,000 BMW, which was purchased in 2017. The BMW, which was sold for $100,000, was used solely by Frederic Vanguard. The BMW was never amortized by Frederic's Designs Ltd. Frederic's Designs Ltd. reported the above transactions as follows:

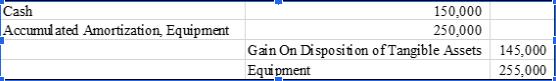

The $145,000 Gain on Disposition of Tangible Assets consisted of the following:

Frederic's Designs Ltd. purchased shares in 2018 for a cost of $30,000; in 2019, Frederic's Designs Ltd. sold those shares for $150,000. The capital gain on these shares was $120,000, and Frederic Vanguard credited the capital gain to retained earnings.

computer item acquired on Aug,2019: software: $30,000 hardware:$60,000

How should I include the above info when calculating minimum net business income for tax purpose excluding CCA deduction. Ignore GST/PST/HST implications.

Should I include Membership in Yacht club when calculate home work space cost?

Lexus Cash Loss on Sale of BMW Cash BMW 250,000 100,000 50,000 250,000 150,000

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

When calculating minimum net business income for tax purposes we typically need to consider only the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started