Answered step by step

Verified Expert Solution

Question

1 Approved Answer

work 3 ework 3 ork 3 K K As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity.

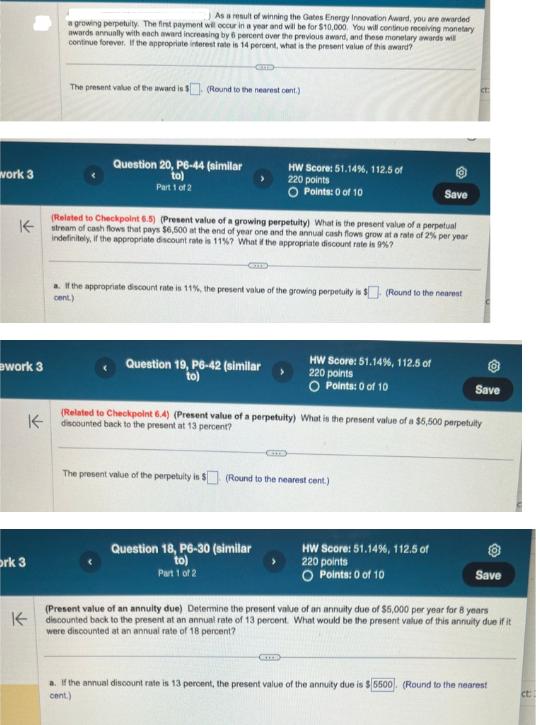

work 3 ework 3 ork 3 K K As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $10,000. You will continue receiving monetary awards annually with each award increasing by 6 percent over the previous award, and these monetary awards will continue forever. If the appropriate interest rate is 14 percent, what is the present value of this award? The present value of the award is 5 (Round to the nearest cent.) Question 20, P6-44 (similar to) Part 1 of 2 CID COTTO (Related to Checkpoint 6.5) (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash flows that pays $6,500 at the end of year one and the annual cash flows grow at a rate of 2% per year indefinitely, if the appropriate discount rate is 11%? What if the appropriate discount rate is 9%? Question 19, P6-42 (similar to) HW Score: 51.14%, 112.5 of 220 points O Points: 0 of 10 a. If the appropriate discount rate is 11%, the present value of the growing perpetuity is $(Round to the nearest cent.) Question 18, P6-30 (similar Part 1 of 2 HW Score: 51.14%, 112.5 of 220 points O Points: 0 of 10 The present value of the perpetuity is $ (Round to the nearest cent.) Save CETTS) (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $5,500 perpetuity discounted back to the present at 13 13 percent? HW Score: 51.14%, 112.5 of 220 points O Points: 0 of 10 CE Save Save (Present value of an annuity due) Determine the present value of an annuity due of $5,000 per year for 8 years discounted back to the present at an annual rate of 13 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 18 percent? a. If the annual discount rate is 13 percent, the present value of the annuity due is $5500. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of the growing perpetuity we can use the formula PV C r g Where PV Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started