Answered step by step

Verified Expert Solution

Question

1 Approved Answer

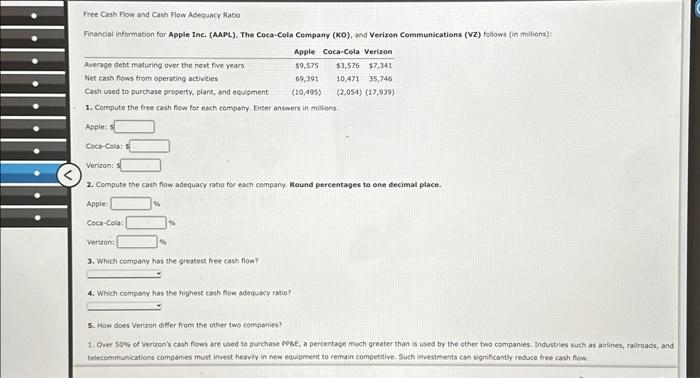

Free Cash Flow and Cash Flow Adequacy Ratio Financial information for Apple Inc. (AAPL), The Coca-Cola Company (KO), and Verizon Communications (VZ) follows (in

Free Cash Flow and Cash Flow Adequacy Ratio Financial information for Apple Inc. (AAPL), The Coca-Cola Company (KO), and Verizon Communications (VZ) follows (in millions): Average debt maturing over the next five years Net cash flows from operating activities Cash used to purchase property, plant, and equipment Apple Coca-Cola Verizon $9,575 $3,576 $7,341 69,391 10,471 35,746 (10,495) (2,054) (17,939) 1. Compute the free cash flow for each company. Enter answers in millions Apple: Coca-Cola: Verizon: 2. Compute the cash flow adequacy ratio for each company. Round percentages to one decimal place. Apple: Coca-Cola: Verizon % % 3. Which company has the greatest free cash flow? 4. Which company has the highest cash flow adequacy ratio 5. How does Verizon differ from the other two companies? 1. Over 50% of Verizon's cash flows are used to purchase PP&E, a percentage much greater than is used by the other two companies. Industries such as airlines, railroads, and telecommunications companies must invest heavily in new equipment to remain competitive. Such investments can significantly reduce free cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started