Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Free Cash Flow. Net Income - Net Sales - EBITDA . Trade Of - Put Option - Call option Obligation. Terminal Value. Buy Back. Acavisition.

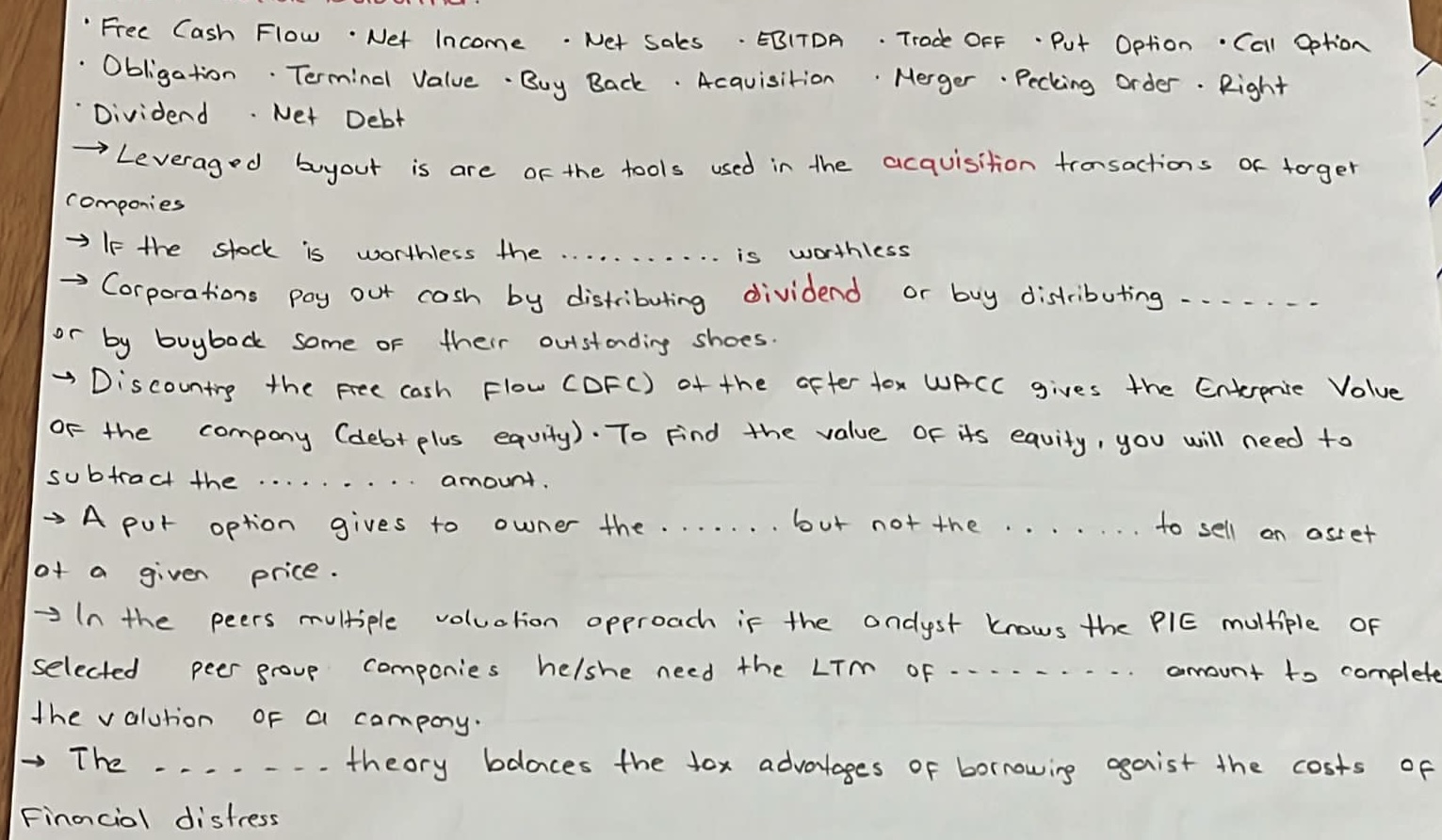

Free Cash Flow. Net Income Net Sales EBITDA Trade Of Put Option Call option

Obligation. Terminal Value. Buy Back. Acavisition. Merger. Pecking Order. Right

Dividend Net Debt

Leveraged buyout is are of the tools used in the transactions of torget

companies

If the stock is worthless the is worthless

Corporations pay out cash by distributing or buy distributing

or by buybock some of their outstanding shoes.

Discounting the free cash Flow DFC of the ofter tax WACC gives the Enterprie Volve

of the company debtplus equity To find the value of its equity, you will need to

subtract the amount.

A put option gives to owner the but not the to sell an asset

of a given price.

In the peers multiple voluation approach if the andyst knows the P multiple of

selected peer group companies heshe need the LTM of amount to complete

the valution of a company.

The theory bdaces the tox advatages of borrowing aganist the costs of

Finacial distress

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started