Answered step by step

Verified Expert Solution

Question

1 Approved Answer

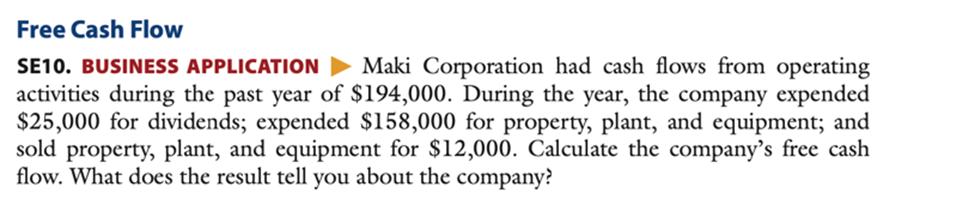

Free Cash Flow SE10. BUSINESS APPLICATION Maki Corporation had cash flows from operating activities during the past year of $194,000. During the year, the

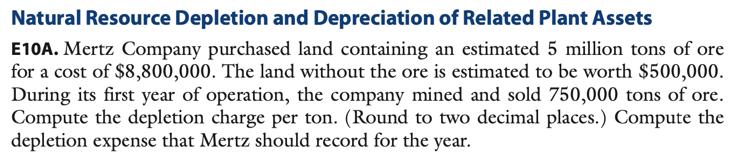

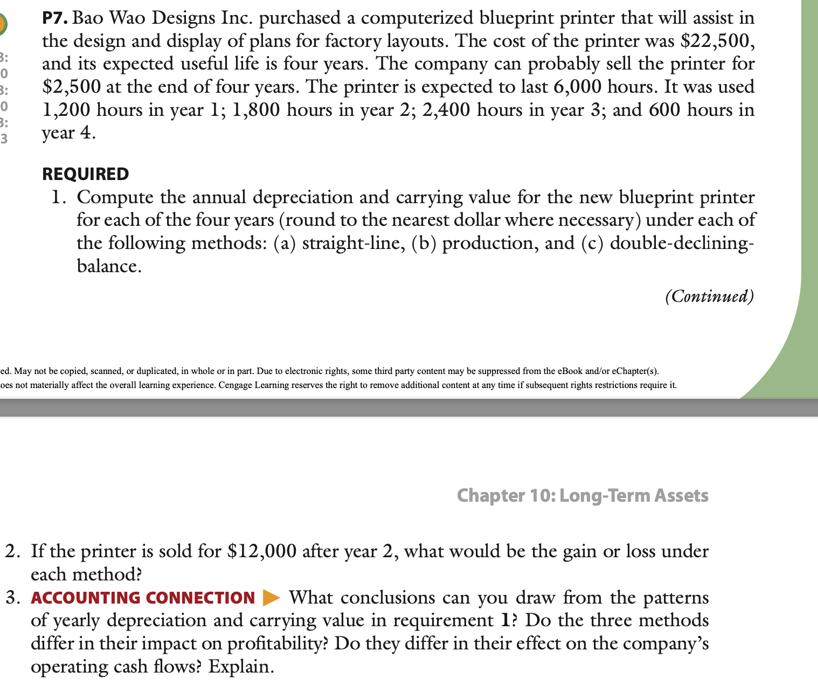

Free Cash Flow SE10. BUSINESS APPLICATION Maki Corporation had cash flows from operating activities during the past year of $194,000. During the year, the company expended $25,000 for dividends; expended $158,000 for property, plant, and equipment; and sold property, plant, and equipment for $12,000. Calculate the company's free cash flow. What does the result tell you about the company? Natural Resource Depletion and Depreciation of Related Plant Assets E10A. Mertz Company purchased land containing an estimated 5 million tons of ore for a cost of $8,800,000. The land without the ore is estimated to be worth $500,000. During its first year of operation, the company mined and sold 750,000 tons of ore. Compute the depletion charge per ton. (Round to two decimal places.) Compute the depletion expense that Mertz should record for the year. 3: 0 3: 0 3 P7. Bao Wao Designs Inc. purchased a computerized blueprint printer that will assist in the design and display of plans for factory layouts. The cost of the printer was $22,500, and its expected useful life is four years. The company can probably sell the printer for $2,500 at the end of four years. The printer is expected to last 6,000 hours. It was used 1,200 hours in year 1; 1,800 hours in year 2; 2,400 hours in year 3; and 600 hours in year 4. REQUIRED 1. Compute the annual depreciation and carrying value for the new blueprint printer for each of the four years (round to the nearest dollar where necessary) under each of the following methods: (a) straight-line, (b) production, and (c) double-declining- balance. (Continued) ed. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). oes not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it Chapter 10: Long-Term Assets 2. If the printer is sold for $12,000 after year 2, what would be the gain or loss under each method? 3. ACCOUNTING CONNECTION What conclusions can you draw from the patterns of yearly depreciation and carrying value in requirement 1? Do the three methods differ in their impact on profitability? Do they differ in their effect on the company's operating cash flows? Explain.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SE10 Free cash flow Particular Amount Net cash flow from Operating activities 194000 Add Sold proper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started