Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer: LO 7 CASH FLOW LO 1 LO 2 Free Cash Flow SE10. BUSINESS APPLICATION Maki Corporation had cash flows from operating activities during the

Answer:

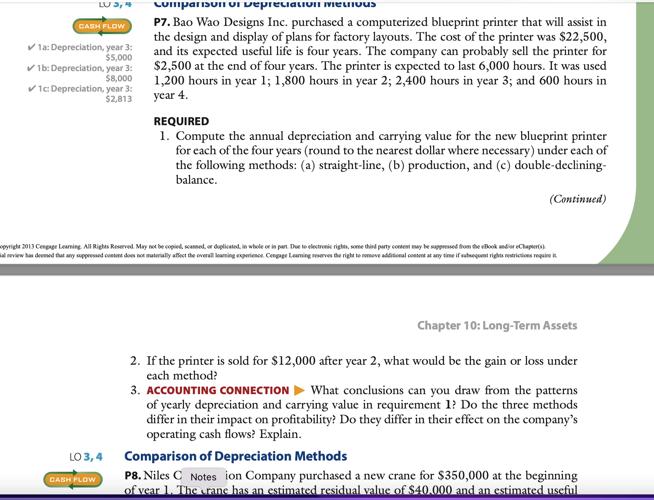

LO 7 CASH FLOW LO 1 LO 2 Free Cash Flow SE10. BUSINESS APPLICATION Maki Corporation had cash flows from operating activities during the past year of $194,000. During the year, the company expended $25,000 for dividends; expended $158,000 for property, plant, and equipment; and sold property, plant, and equipment for $12,000. Calculate the company s free cash flow. What does the result tell you about the company? EXERCISES: SET A Recognition and Classification of Capital Expenditures E1A. CONCEPT Tell whether each of the following transactions related to an office building is a revenue expenditure (RE) or a capital expenditure (CE). In addition, indi- cate whether each transaction is an ordinary repair (OR), an extraordinary repair (ER), an addition (A), a betterment (B), or none of these (N). 1. The hallways and ceilings in the building are repainted at a cost of $4,150. 2. The hallways, which have tile floors, are carpeted at a cost of $14,000. 3. A new wing is added to the building at a cost of $87,500. 4. Furniture is purchased for the entrance to the building at a cost of $8,250. 5. The air-conditioning system is overhauled at a cost of $14,250. The overhaul extends the useful life of the air-conditioning system by 10 years. 6. A cleaning firm is paid $100 per week to clean the newly installed carpets. Recognizing and Classifying the Cost of Long-Term Assets E2A. CONCEPT Fraser Manufacturing purchased land next to its factory to be used as a parking lot. The following expenditures were incurred by the company: purchase price, $300,000; broker s fees, $24,000; title search and other fees, $2,200; demoli- 60.000 C1300 204 LO 5 LO 6 LO 6 Disposar a la E9A. Star Company purchased a computer on January 2, 2012, at a cost of $2,500. The computer is expected to have a useful life of five years and a residual value of $250. Assume that the computer is disposed of on July 1, 2015. Using the straight line method, record the depreciation expense for half a year and the disposal under each of the following assumptions: 1. The computer is discarded. 2. The computer is sold for $400. 3. The computer is sold for $1,100. Natural Resource Depletion and Depreciation of Related Plant Assets E10A. Mertz Company purchased land containing an estimated 5 million tons of ore for a cost of $8,800,000. The land without the ore is estimated to be worth $500,000. During its first year of operation, the company mined and sold 750,000 tons of ore. Compute the depletion charge per ton. (Round to two decimal places.) Compute the depletion expense that Mertz should record for the year. Amortization of Copyrights and Trademarks E11A. Complete the following requirements regarding amortizing copyrights and trademarks: 1. Argyle Publishing Company purchased the copyright to a basic computer textbook for $40,000. The usual life of a textbook is about four years. However, the copyright will remain in effect for another 50 years. Calculate the annual amortization of the copyright. 2. ACCOUNTING CONNECTION Scion Company purchased a trademark from a well- known supermarket for $320,000. The company s management argued that the trademark s useful life was indefinite. Explain how the cost should be accounted for. Accounting for a Patent E12A. At the beginning of the fiscal year, David Company purchased for $1,030,000 a patent that applies to the manufacture of a unique tamper-proof lid for medicine bottles. David incurred legal costs of $450,000 in successfully defending use of the lid by a competitor. David estimated that the patent would be valuable for at least ten years. LU 3, 4 CASH FLOW 1a: Depreciation, year 3: $5,000 1b: Depreciation, year 3: $8,000 1c: Depreciation, year 3: $2,813 LO 3,4 CASH FLOW comparison of Depreciation mecious P7. Bao Wao Designs Inc. purchased a computerized blueprint printer that will assist in the design and display of plans for factory layouts. The cost of the printer was $22,500, and its expected useful life is four years. The company can probably sell the printer for $2,500 at the end of four years. The printer is expected to last 6,000 hours. It was used 1,200 hours in year 1; 1,800 hours in year 2; 2,400 hours in year 3; and 600 hours in year 4. REQUIRED 1. Compute the annual depreciation and carrying value for the new blueprint printer for each of the four years (round to the nearest dollar where necessary) under each of the following methods: (a) straight-line, (b) production, and (c) double-declining- balance. opyright 2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the look and Chapter(s) al review has deved that any suppressed contine does not materially affect the overall learning experience Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require (Continued) Chapter 10: Long-Term Assets 2. If the printer is sold for $12,000 after year 2, what would be the gain or loss under each method? 3. ACCOUNTING CONNECTION What conclusions can you draw from the patterns of yearly depreciation and carrying value in requirement 1? Do the three methods differ in their impact on profitability? Do they differ in their effect on the company s operating cash flows? Explain. Comparison of Depreciation Methods P8. Niles C Notes ion Company purchased a new crane for $350,000 at the beginning of year 1. The crane has an estimated residual value of $40.000 and an estimated useful

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SE10 Free cash flow Particular Amount Net cash flow from Operating activities 194000 Add Sold proper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

627e396d7d841_101844.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started