Answered step by step

Verified Expert Solution

Question

1 Approved Answer

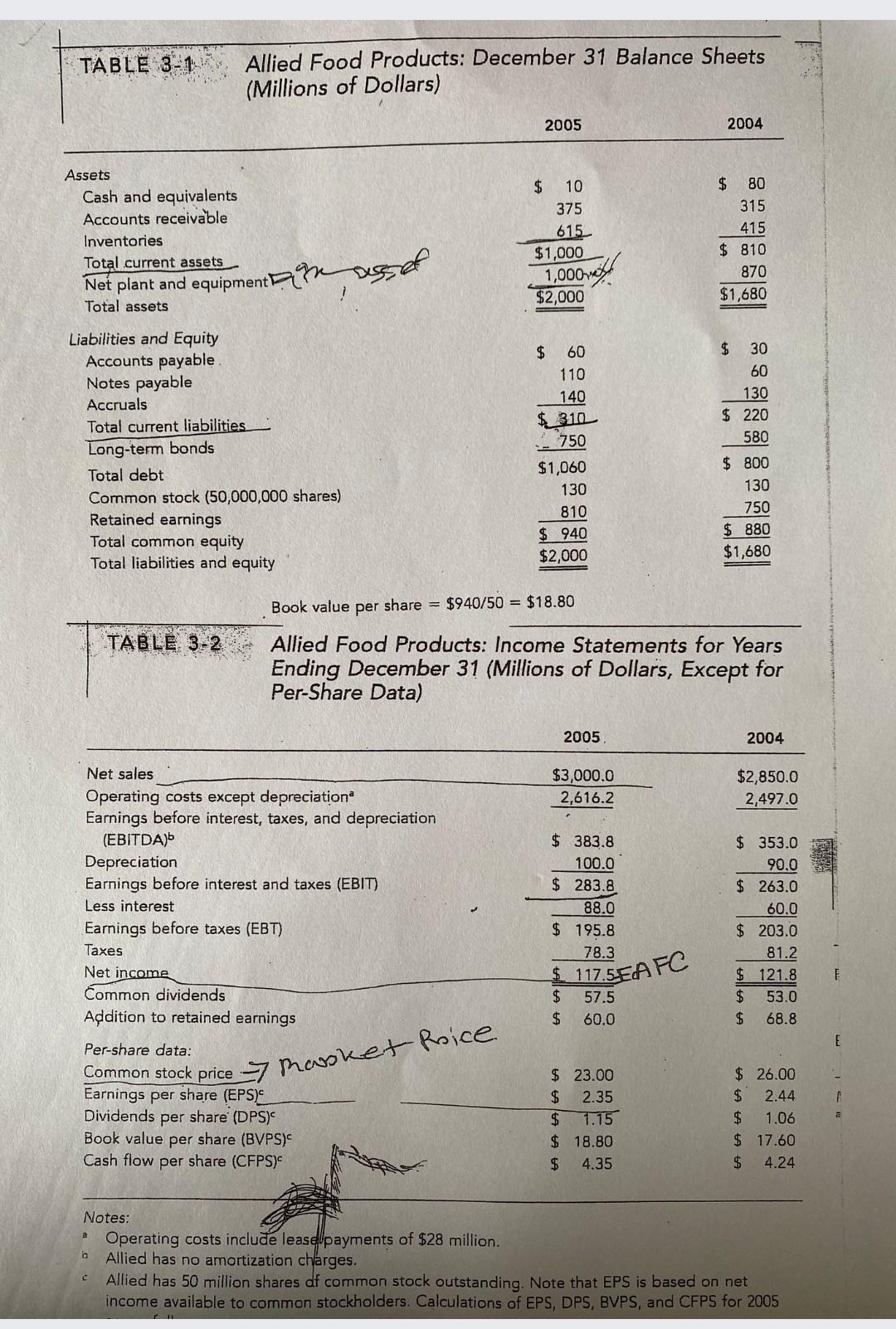

free cash flow?? TABLE 3-1 Allied Food Products: December 31 Balance Sheets (Millions of Dollars) 2005 2004 Assets Cash and equivalents Accounts receivable Inventories Total

free cash flow??

TABLE 3-1 Allied Food Products: December 31 Balance Sheets (Millions of Dollars) 2005 2004 Assets Cash and equivalents Accounts receivable Inventories Total current assets $ 10 375 6151 $1,000 1,000ve $2,000 $ 80 315 415 $ 810 870 $1,680 Net plant and equipment Bussef Total assets $ 30 60 130 $ 220 580 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock (50,000,000 shares) Retained earnings Total common equity Total liabilities and equity $ 60 110 140 $_310 750 $1,060 130 810 $ 940 $2,000 $ 800 130 750 $ 880 $1,680 Book value per share = $940/50 = $18.80 TABLE 3-2 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per-Share Data) 2005 2004 $3,000.0 2,616.2 $2,850.0 2,497.0 Net sales Operating costs except depreciations Earnings before interest, taxes, and depreciation (EBITDA) Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income Common dividends Addition to retained earnings $ 383.8 100.0 $ 283.8 88.0 $ 195.8 78.3 $ 353.0 90.0 $ 263.0 60.0 $ 203.0 81.2 $ 121.8 $ 53.0 $ 68.8 $117.5EA FC $ $ 57.5 60.0 E Per-share data: Common stock price -> Meusket Roice Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Cash flow per share (CFPS) $ 23.00 $ 2.35 $ 1.15 $ 18.80 $ 4.35 $ 26.00 $ 2.44 $ 1.06 $ 17.60 $ 4.24 b Notes: Operating costs include lease payments of $28 million. Allied has no amortization charges. Allied has 50 million shares of common stock outstanding. Note that EPS is based on net income available to common stockholders. Calculations of EPS, DPS, BVPS, and CFPS for 2005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started