Answered step by step

Verified Expert Solution

Question

1 Approved Answer

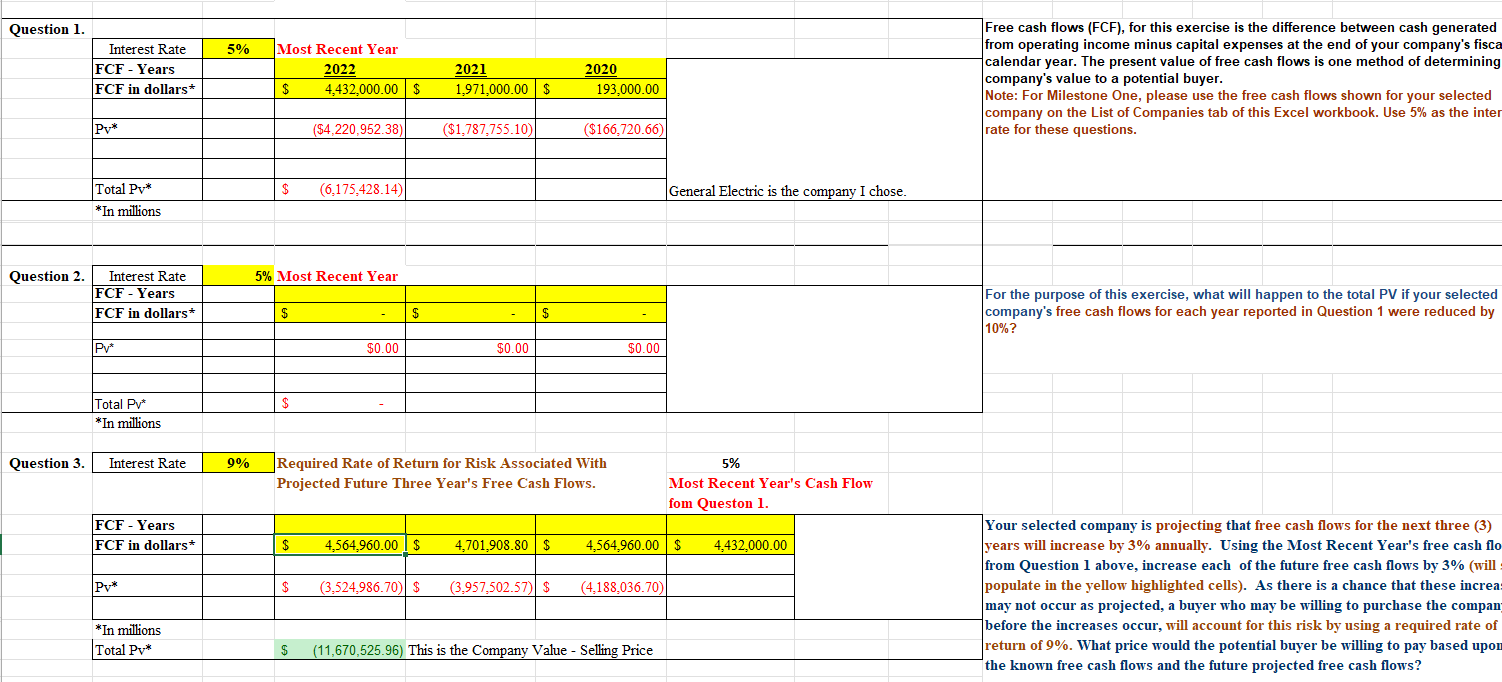

Free cash flows ( FCF ) , for this exercise is the difference between cash generated from operating income minus capital expenses at the end

Free cash flows FCF for this exercise is the difference between cash generated

from operating income minus capital expenses at the end of your company's fisca

calendar year. The present value of free cash flows is one method of determining

company's value to a potential buyer

Note: For Milestone One, please use the free cash flows shown for your selected

company on the List of Companies tab of this Excel workbook. Use as the inter

rate for these questions.

For the purpose of this exercise, what will happen to the total PV if your selected

company's free cash flows for each year reported in Question were reduced by

Your selected company is projecting that free cash flows for the next three

years will increase by annually. Using the Most Recent Year's free cash flo

from Question above, increase each of the future free cash flows by will

populate in the yellow highlighted cells As there is a chance that these increa

may not occur as projected, a buyer who may be willing to purchase the compan

before the increases occur, will account for this risk by using a required rate of

return of What price would the potential buyer be willing to pay based upor

the known free cash flows and the future projected free cash flows?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started