Answered step by step

Verified Expert Solution

Question

1 Approved Answer

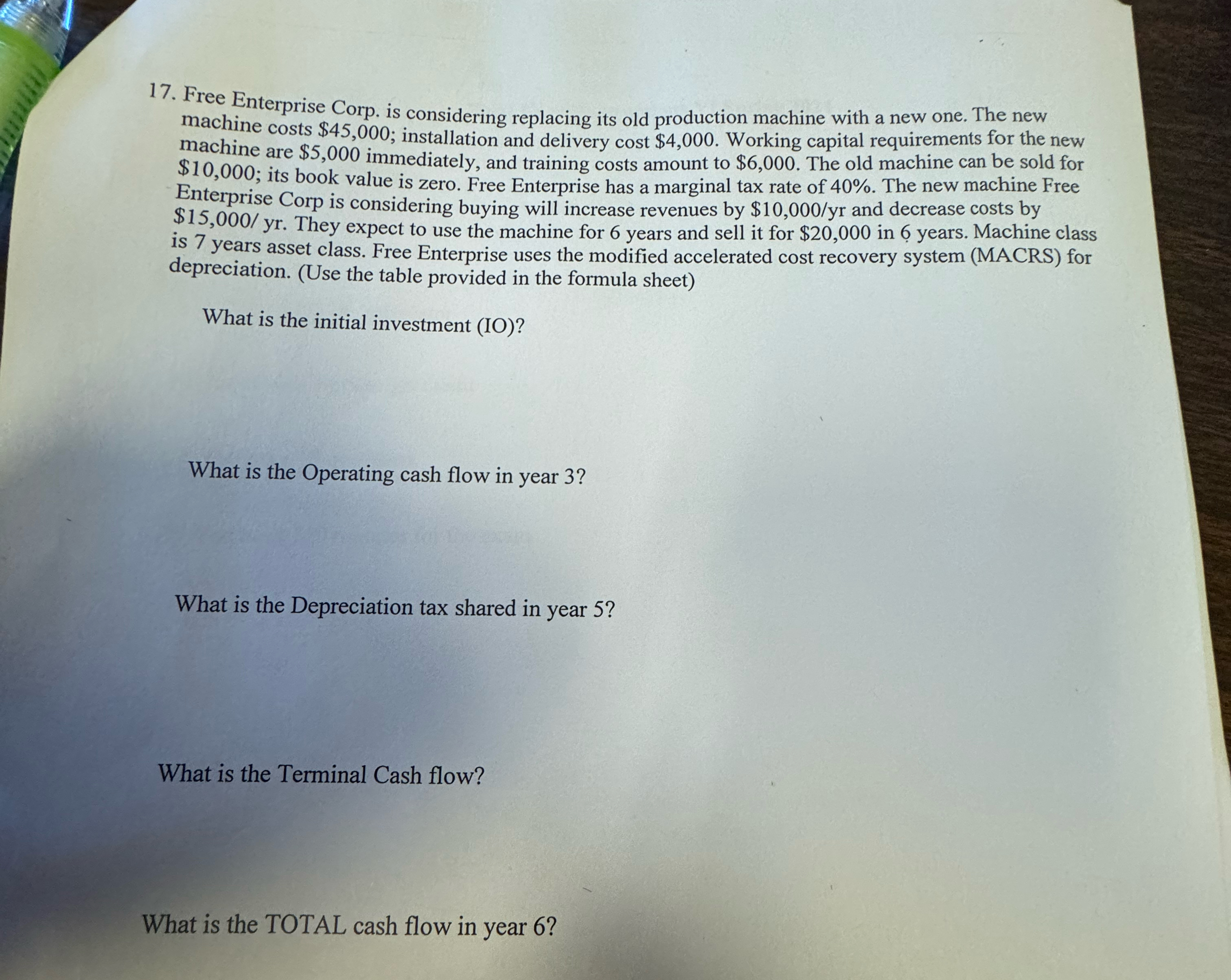

Free Enterprise Corp. is considering replacing its old production machine with a new one. The new machine costs $ 4 5 , 0 0 0

Free Enterprise Corp. is considering replacing its old production machine with a new one. The new machine costs $; installation and delivery cost $ Working capital requirements for the new machine are $ immediately, and training costs amount to $ The old machine can be sold for $; its book value is zero. Free Enterprise has a marginal tax rate of The new machine Free Enterprise Corp is considering buying will increase revenues by $ and decrease costs by $ They expect to use the machine for years and sell it for $ in years. Machine class is years asset class. Free Enterprise uses the modified accelerated cost recovery system MACRS for depreciation. Use the table provided in the formula sheet

What is the initial investment IO

What is the Operating cash flow in year

What is the Depreciation tax shared in year

What is the Terminal Cash flow?

What is the TOTAL cash flow in year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started