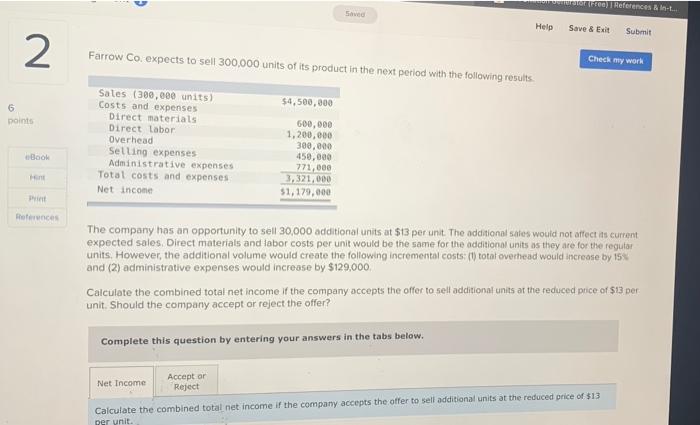

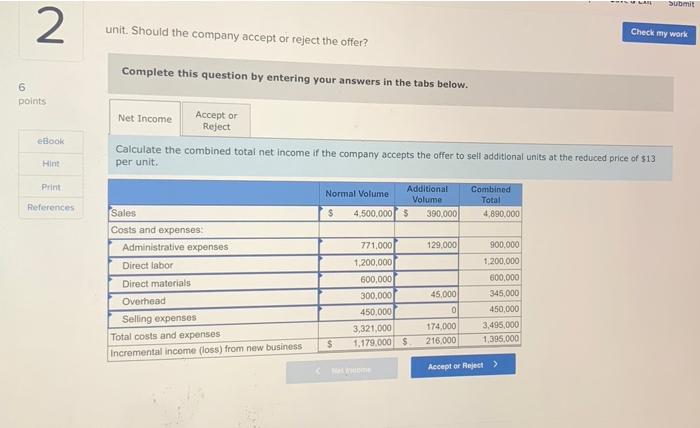

Free References & In- Sad Help Save & Exit Submit 2 Farrow Co. expects to sell 300,000 units of its product in the next period with the following results Check my work $4,500,000 6 points Sales (380,000 units) Costs and expenses Direct materials Direct Labor Overhead Selling expenses Administrative expenses Total costs and expenses Net Income Book 600,000 1,200,000 300,000 450,000 271,000 3,321,000 $1,179,000 HE Print Borces The company has an opportunity to sell 30,000 additional units at $13 per unit. The additional sites would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 15 and (2) administrative expenses would increase by $129,000 Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit. Should the company accept or reject the offer? Complete this question by entering your answers in the tabs below. Net Income Acceptar Reject Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit LA Submit 2 unit. Should the company accept or reject the offer? Check my work Complete this question by entering your answers in the tabs below. 6 points Net Income Accept or Reject eBook Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit. Hint Print References Normal Volume Additional Volume $ 4,500,000 3 390,000 Combined Total 4890,000 129,000 Sales Costs and expenses: Administrative expenses Direct labor Direct materials Overhead Selling expenses Total costs and expenses Incremental income (loss) from new business 771,000 1.200,000 600,000 300,000 450,000 3,321,000 1,179,000 $ 900.000 1,200,000 600,000 345,000 450,000 45,000 0 174,000 216.000 3,495,000 1,395,000 $ Acceptar Reject>