Answered step by step

Verified Expert Solution

Question

1 Approved Answer

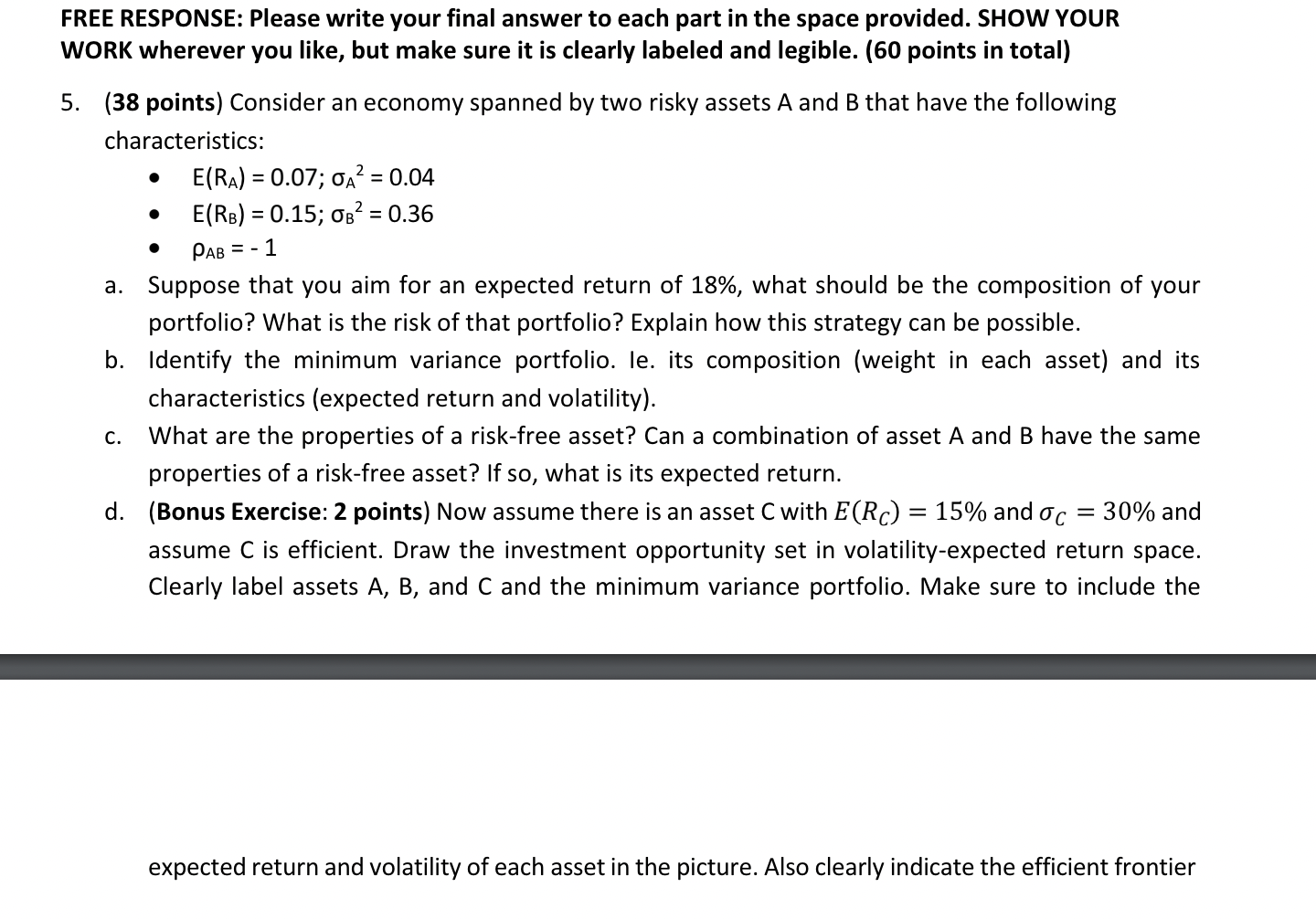

FREE RESPONSE: Please write your final answer to each part in the space provided. SHOW YOUR WORK wherever you like, but make sure it

FREE RESPONSE: Please write your final answer to each part in the space provided. SHOW YOUR WORK wherever you like, but make sure it is clearly labeled and legible. (60 points in total) 5. (38 points) Consider an economy spanned by two risky assets A and B that have the following characteristics: E(RA) = 0.07; A = 0.04 = E(RB) 0.15; OB = 0.36 PAB = -1 a. Suppose that you aim for an expected return of 18%, what should be the composition of your portfolio? What is the risk of that portfolio? Explain how this strategy can be possible. b. Identify the minimum variance portfolio. le. its composition (weight in each asset) and its characteristics (expected return and volatility). C. What are the properties of a risk-free asset? Can a combination of asset A and B have the same properties of a risk-free asset? If so, what is its expected return. d. (Bonus Exercise: 2 points) Now assume there is an asset C with E(Rc) = 15% and c = 30% and assume C is efficient. Draw the investment opportunity set in volatility-expected return space. Clearly label assets A, B, and C and the minimum variance portfolio. Make sure to include the expected return and volatility of each asset in the picture. Also clearly indicate the efficient frontier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started