Question

Frenchies: Creating and Using a Master Budget Sales Department _ 3 of 3 PART 1: CREATING THE BUDGET MEETING WITH DIVISIONAL MANAGERS Production Department We

Frenchies: Creating and Using a Master Budget Sales Department _ 3 of 3

PART 1: CREATING THE BUDGET MEETING WITH DIVISIONAL MANAGERS

Production Department

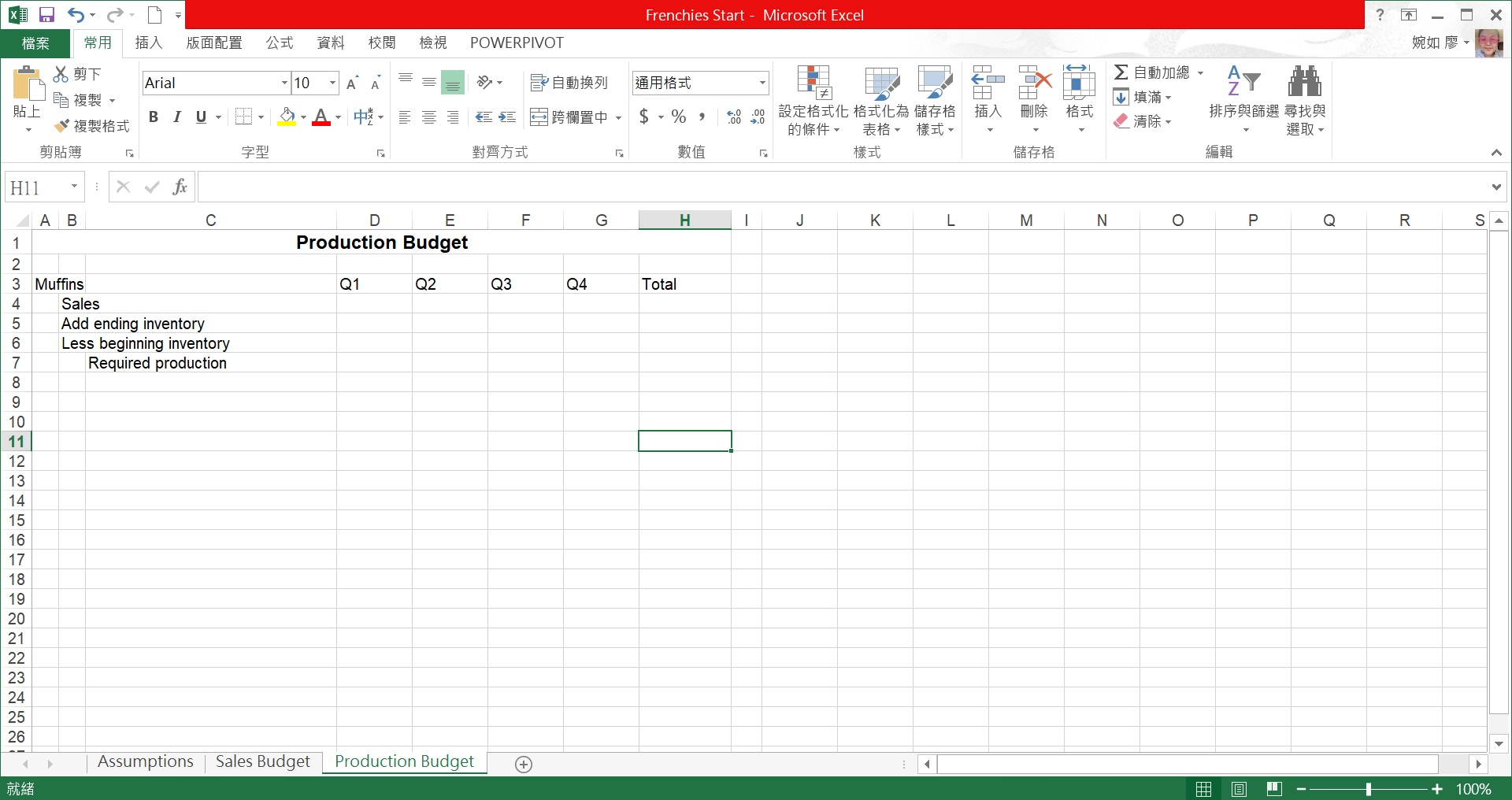

We cant keep much in the way of finished goods on hand. My cookies and bread would dry out if we kept them too long. The chef would say that we normally keep only about two days worth of inventory on hand to avoid shipping issues or problems with the caf that I make my estimates based on a 90-day quarter. Normally, try to keep 15 percent of the next quarters raw materials on hand at all times. Raising price estimate of a 20 percent drop in demand. Can you give me some estimates of how long it takes to make each package of cookies, bread, and muffins? I can tell you that one of my mixers can mix together either 12 dozen cookies, 8 dozen muffins, or 4 dozen loaves of bread in 15 minutes. The bakers then take another half an hour to get the dough ready and bake it. The batch sizes are the same for each product?

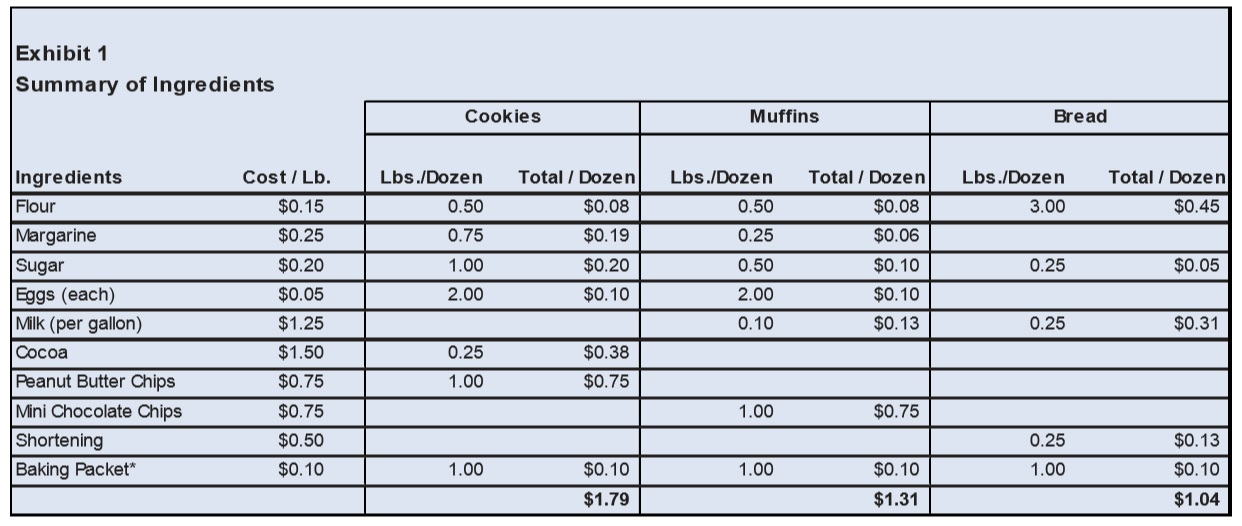

* The Baking Packet consists of ingredients too small to be purchased by the pound, so the bakery buys them in prepared packets.

Do you happen to know what we are paying each group of employees? We pay the mixers $7.50 an hour, the bakers $8.00 an hour, and the packers $6.50 an hour.

CEO

Board of directors now wants us to have $40,000 worth of cash on hand at all times and to pay $25,000 in dividends each quarter. Issue another 50,000 shares of common stock to the venture capital firm in the first week of the third quarter. We wont plan on changing our dividend payment schedule this year, but we will probably have to increase the amount we pay in future years. For now, though, the big factor is the capital infusion of $400,000 well get from selling our stock. So increase common stock issued by 50,000 shares and paid-in-capital by $400,000 in the third quarter. My next question is about the expansion to our PPE that you just mentioned. I estimate that we will need to buy $75,000 worth of new equipment in the first quarter, $100,000 in the second, $50,000 in the third, and $35,000 in the fourth. Since many of our long-term assets have already been fully depreciated, this new expansion shouldnt significantly change my depreciation estimates. What we are really hoping for, other than the purchase of 50,000 shares of stock of course, is a $1 million revolving line of credit. Basically, if we need additional funding we can pull on the line of credit. The interest rate on the new credit line will be 8 percent and they will require that we pay off any accumulated interest before we repay any principal. Use simple interest calculations for the interest estimates. Its not 100 percent accurate, but it is typical for creating a master budget. It also simplifies things considerably and ensures that information flows through the budget easily. Ill also assume that any additional debt from the line of credit is taken out on the first day of the quarter and any payments are made at the end of the quarter. That ensures that the interest estimates should be fairly accurate, even with the simple interest calculation. To get our interest payments when we repay our line of credit (assuming that we have any to repay and the funds to make a payment), I will multiply the amount Im repaying times the quarterly interest rate times the number of quarters the money has been outstanding. So, if we draw $1,000 on the line of credit in the second quarter and repay it in the third quarter, I will multiply $1,000 by 2 percent and again by 2 percent for the two quarters that I assume its been outstanding.

PART 2: USING THE MASTER BUDGET MEETING OF THE SENIOR STAFF (TWO WEEKS LATER)

We could increase our sales commissions to 2 percent. That should motivate our sales force to sell more. Id say that would increase our sales growth from 5 to 8 percent each quarter. For my part, the chef jumped in, we could switch to a JIT inventory system, keeping only about 3 percent of our needed raw materials on hand. That would cut down on some of our costs, but it would also require us to pay for our entire inventory in the quarter it is purchased rather than paying 15 percent in the following quarter like we do now. If we were to add an additional collections specialist to our office staff, we could improve our collections to be 80 percent in the first quarter, 15 percent in the second quarter, and 5 percent in the third quarter. That would certainly improve our cash flows. Given the job market right now, I think we could hire a good collections specialist for $30,000 a year. They might help collections, but those kinds of tactics could hurt our sales. Our relaxed collections policy is one of the things that set us apart from other vendors. If you decide to try that, youd better plan on an additional 3 percent drop in sales the first quarter. If we changed our current 20 percent estimate to a more realistic drop, it would take care of everything! Based on the research Ive been doing in the industry; we could use 10 percent instead of 20. Think about it. Our EPS would be higher and so would our cash flow from operations. Why, even our profit margin would increase because our fixed costs would be allocated over more units. Another option, lets say we only increased our prices to $5.75 for muffins, $5.00 for cookies, and $5.50 for bread. By my calculations, that would lead to only a 12 percent drop in sales in quarter one with 7 percent growth in each of the following quarters. Why dont you run the numbers, including how these changes would affect our use of the line of credit, to see which of the changes will give us the most bang. Well go ahead and make that change now and add the others to our improvement plan. That way, we can go to them with a current improvement and a plan to keep improving. And if anyone gets any other ideas, let us know. The more improvements we take to the table, the better our chances of signing the deal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started