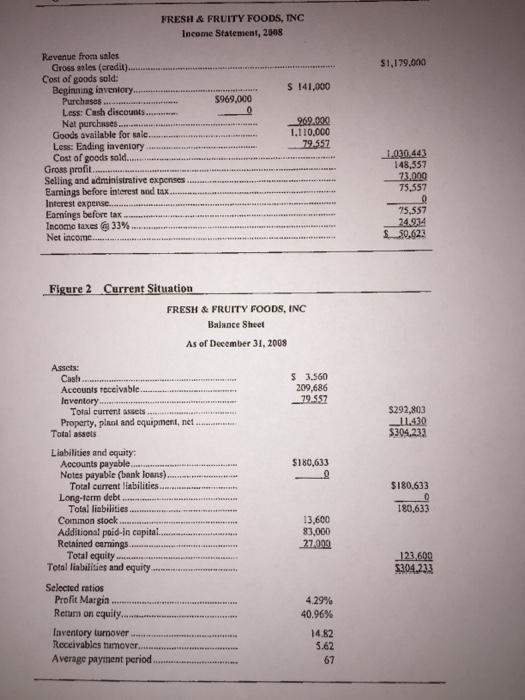

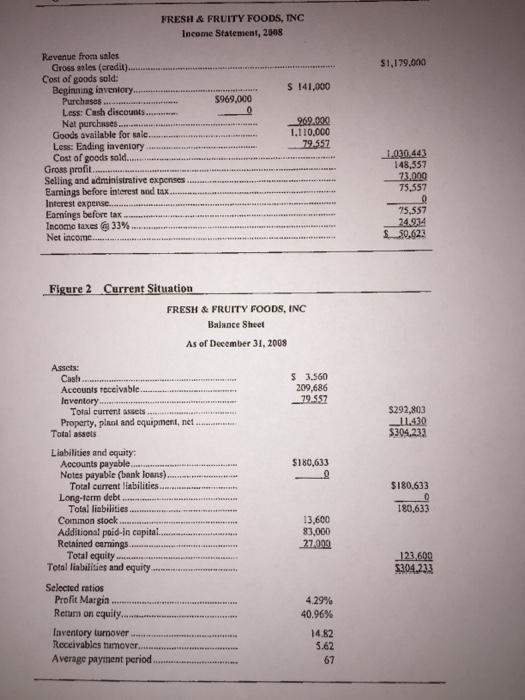

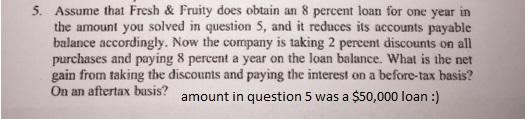

FRESH & FRUITY FOODS, INC Income Statement, 2008 $1,179.000 $ 141,000 $969.000 Revenue from sales Gross sales (credit)... Cost of goods sold: Beginning inventory..... Purchases Less: Cash discounts. Nat purchases. Goods available for sale. Less: Ending inventory Cost of goods sold...... Gross profit...... Selling and administrative expenses Eamings before interest and tax Interest expense.. Earnings before tak Income taxes33% Net income 969.000 1.110,000 79.552 1.030,443 148,557 73.000 75.557 9 75,557 24.934 50,623 Figure 2 Current Situation FRESH & FRUITY FOODS, INC Balance Sheet As of December 31, 2008 Assets: Cash- S 3.560 209,686 __79.357 Accounts receivable. Inventory Total current assets Property, plant and equipment, net. Total assets $292,803 _11.430 $304,233 $180,633 9 $180.633 Liabilities and equity Accounts payable Notes payable (bank loans). Total current liabilities. Long-term debt Total liabilities Common stock Additional poid-in capital Retained on mings Total equity Total liabilities and equity 180.633 13,600 83,000 27.000 123,600 5304,233 4.29% 40.96% ***** Selected ratios Profit Margin Return on equity. Inventory turnover Receivables tumover Average payment period 14.82 5.62 67 5. Assume that Fresh & Fruity does obtain an 8 percent loan for one year in the amount you solved in question 5, and it reduces its accounts payable balance accordingly. Now the company is taking 2 percent discounts on all purchases and paying 8 percent a year on the loan balance. What is the net gain from taking the discounts and paying the interest on a before-tax basis? On an aftertax busis? amount in question 5 was a $50,000 loan :) FRESH & FRUITY FOODS, INC Income Statement, 2008 $1,179.000 $ 141,000 $969.000 Revenue from sales Gross sales (credit)... Cost of goods sold: Beginning inventory..... Purchases Less: Cash discounts. Nat purchases. Goods available for sale. Less: Ending inventory Cost of goods sold...... Gross profit...... Selling and administrative expenses Eamings before interest and tax Interest expense.. Earnings before tak Income taxes33% Net income 969.000 1.110,000 79.552 1.030,443 148,557 73.000 75.557 9 75,557 24.934 50,623 Figure 2 Current Situation FRESH & FRUITY FOODS, INC Balance Sheet As of December 31, 2008 Assets: Cash- S 3.560 209,686 __79.357 Accounts receivable. Inventory Total current assets Property, plant and equipment, net. Total assets $292,803 _11.430 $304,233 $180,633 9 $180.633 Liabilities and equity Accounts payable Notes payable (bank loans). Total current liabilities. Long-term debt Total liabilities Common stock Additional poid-in capital Retained on mings Total equity Total liabilities and equity 180.633 13,600 83,000 27.000 123,600 5304,233 4.29% 40.96% ***** Selected ratios Profit Margin Return on equity. Inventory turnover Receivables tumover Average payment period 14.82 5.62 67 5. Assume that Fresh & Fruity does obtain an 8 percent loan for one year in the amount you solved in question 5, and it reduces its accounts payable balance accordingly. Now the company is taking 2 percent discounts on all purchases and paying 8 percent a year on the loan balance. What is the net gain from taking the discounts and paying the interest on a before-tax basis? On an aftertax busis? amount in question 5 was a $50,000 loan :)