Question

Fresh Veggies, Incorporated (FVI), purchases land and a warehouse for $430,000. In addition to the purchase price, FVI makes the following expenditures related to the

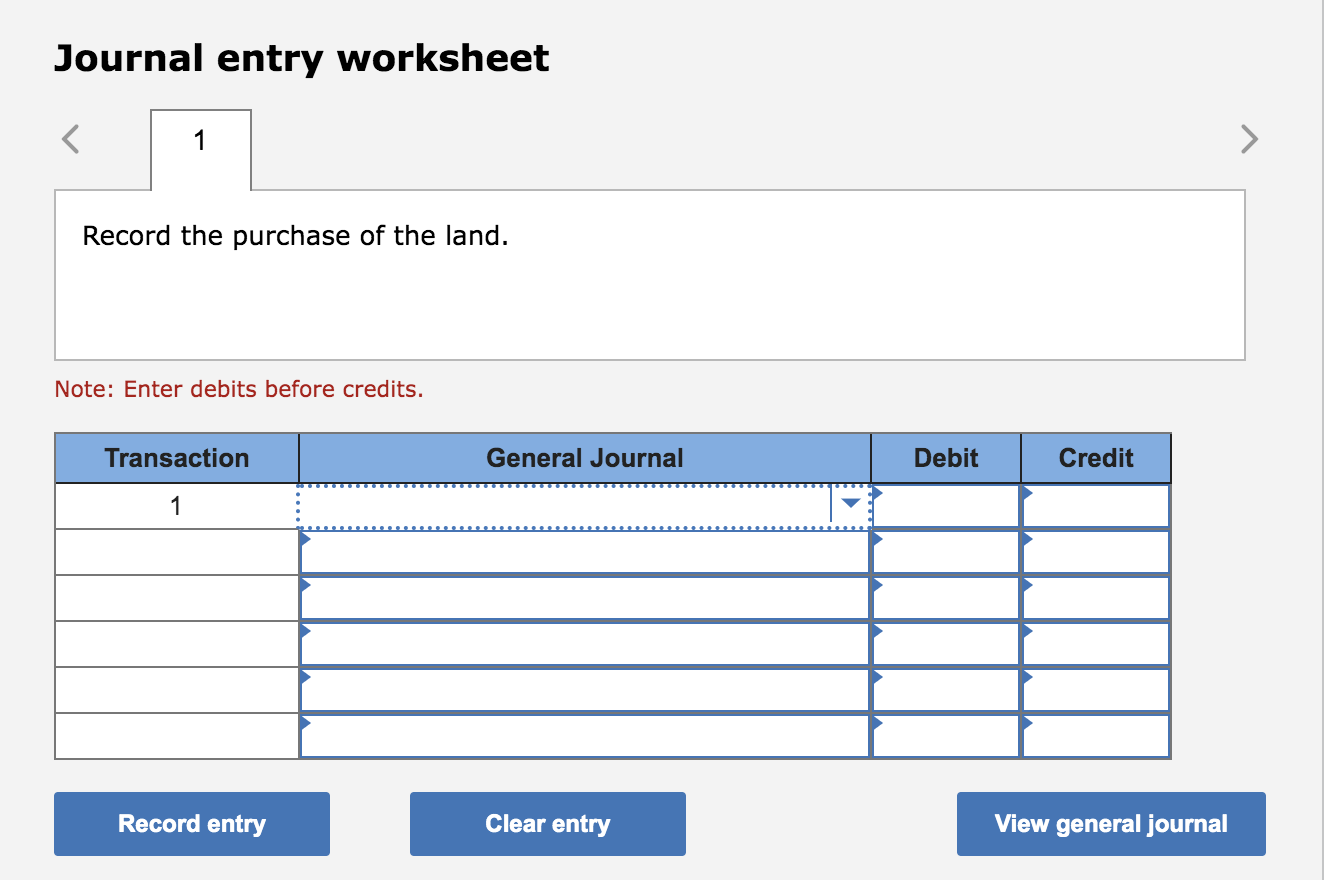

Fresh Veggies, Incorporated (FVI), purchases land and a warehouse for $430,000. In addition to the purchase price, FVI makes the following expenditures related to the acquisition: broker's commission, $23,000; title insurance, $1,300; and miscellaneous closing costs, $4,600. The warehouse is immediately demolished at a cost of $23,000 in anticipation of building a new warehouse. Determine the cost of the land and record the purchase (assuming cash was paid for all expenditures).

The options for the journal entries are: Accounts Payable, Accounts Receivable, Accumulated Depreciation, Advertising Expense, Amortization Expense, Buildings, Cash, Common Stock, Copyrights, Delivery Expense, Depreciation Expense, Dividends, Equipment, Franchises, Gain, Goodwill, Interest Expense, Interest Revenue, Land, Legal Fees Expense, Loss, Natural Resources, Notes Payable, Patents, Prepaid Insurance, Property Tax Expense, Property, Plant and Equipment, Rent Expense, Repairs and Maintenance Expense, Research and Development Expense, Retained Earnings, Salaries Expense, Sales Revenue, Service Fee Expense, Service Revenue, Supplies, Supplies Expense, Trademarks, Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started