Answered step by step

Verified Expert Solution

Question

1 Approved Answer

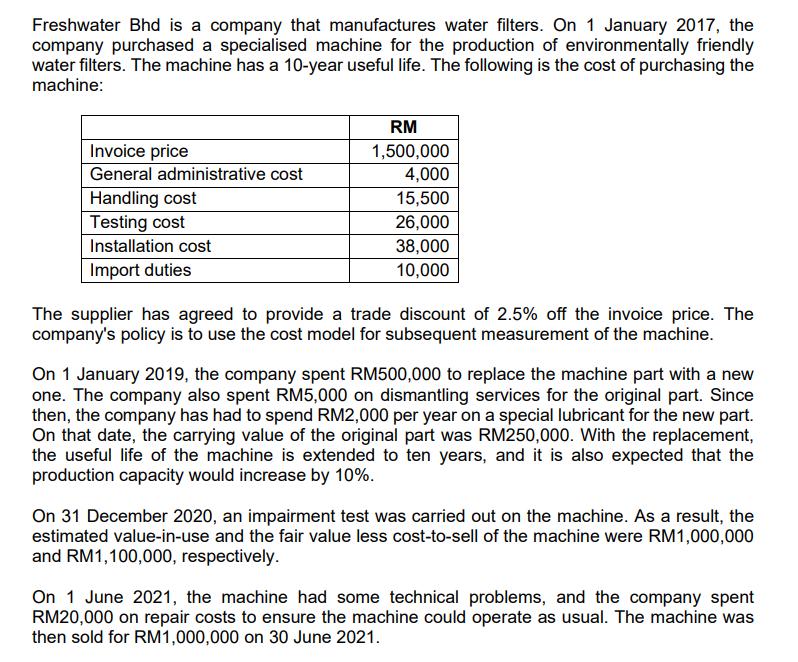

Freshwater Bhd is a company that manufactures water filters. On 1 January 2017, the company purchased a specialised machine for the production of environmentally

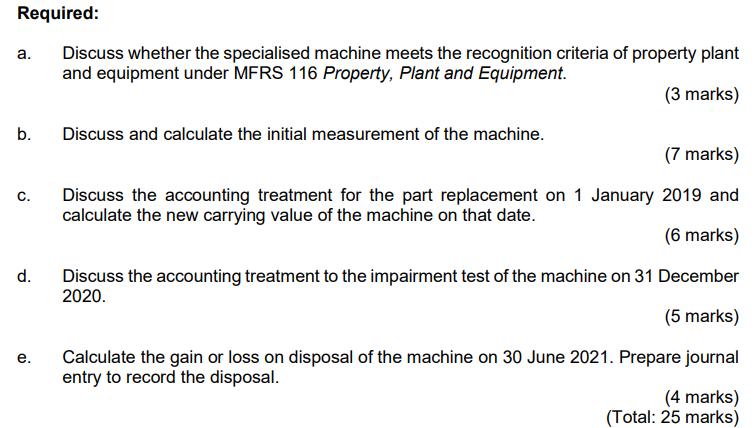

Freshwater Bhd is a company that manufactures water filters. On 1 January 2017, the company purchased a specialised machine for the production of environmentally friendly water filters. The machine has a 10-year useful life. The following is the cost of purchasing the machine: Invoice price General administrative cost Handling cost Testing cost Installation cost Import duties RM 1,500,000 4,000 15,500 26,000 38,000 10,000 The supplier has agreed to provide a trade discount of 2.5% off the invoice price. The company's policy is to use the cost model for subsequent measurement of the machine. On 1 January 2019, the company spent RM500,000 to replace the machine part with a new one. The company also spent RM5,000 on dismantling services for the original part. Since then, the company has had to spend RM2,000 per year on a special lubricant for the new part. On that date, the carrying value of the original part was RM250,000. With the replacement, the useful life of the machine is extended to ten years, and it is also expected that the production capacity would increase by 10%. On 31 December 2020, an impairment test was carried out on the machine. As a result, the estimated value-in-use and the fair value less cost-to-sell of the machine were RM1,000,000 and RM1,100,000, respectively. On 1 June 2021, the machine had some technical problems, and the company spent RM20,000 on repair costs to ensure the machine could operate as usual. The machine was then sold for RM1,000,000 on 30 June 2021. Required: a. b. C. d. e. Discuss whether the specialised machine meets the recognition criteria of property plant and equipment under MFRS 116 Property, Plant and Equipment. (3 marks) Discuss and calculate the initial measurement of the machine. (7 marks) Discuss the accounting treatment for the part replacement on 1 January 2019 and calculate the new carrying value of the machine on that date. (6 marks) Discuss the accounting treatment to the impairment test of the machine on 31 December 2020. (5 marks) Calculate the gain or loss on disposal of the machine on 30 June 2021. Prepare journal entry to record the disposal. (4 marks) (Total: 25 marks)

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Yes the specialised machine meets the recognition criteria of property plant and equipment under MFRS 116 Property Plant and Equipment The machine h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started