Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Freya Woods and her husband, Dante Woods, decided to retire in Cape Town. They are married out of community of property. They resided in Pretoria

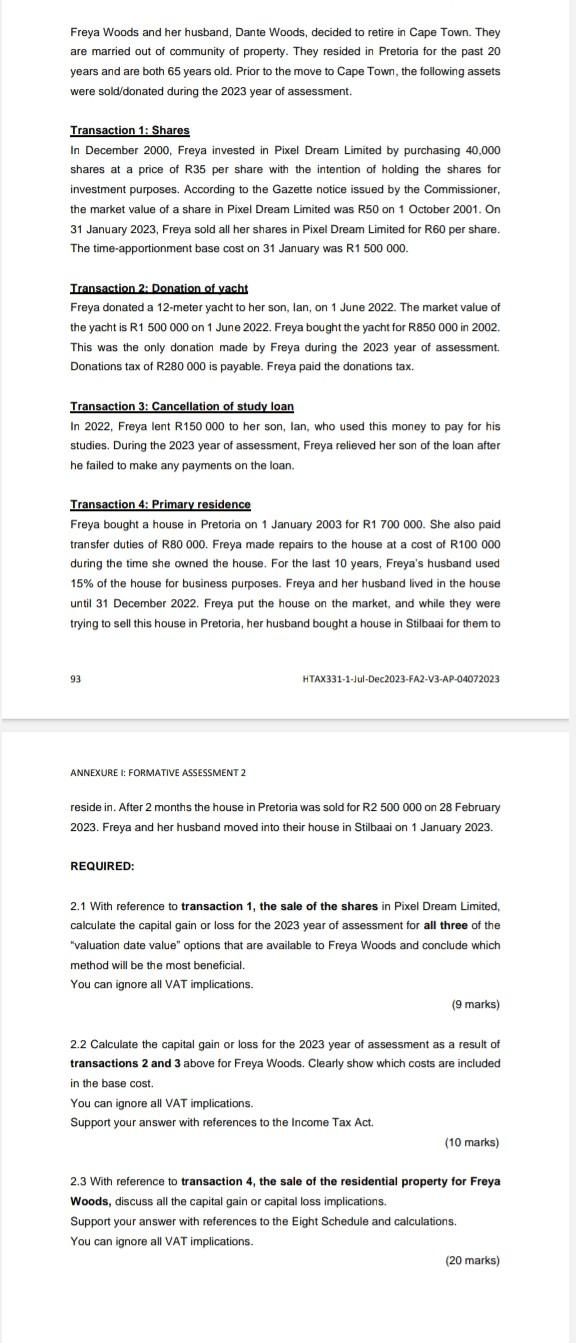

Freya Woods and her husband, Dante Woods, decided to retire in Cape Town. They are married out of community of property. They resided in Pretoria for the past 20 years and are both 65 years old. Prior to the move to Cape Town, the following assets were sold/donated during the 2023 year of assessment. Transaction 1: Shares In December 2000, Freya invested in Pixel Dream Limited by purchasing 40,000 shares at a price of R35 per share with the intention of holding the shares for investment purposes. According to the Gazette notice issued by the Commissioner, the market value of a share in Pixel Dream Limited was R50 on 1 October 2001. On 31 January 2023, Freya sold all her shares in Pixel Dream Limited for R60 per share. The time-apportionment base cost on 31 January was R1 500000 . Iransaction 2: Denation of yacht Freya donated a 12-meter yacht to her son, lan, on 1 June 2022. The market value of the yacht is R1 500000 on 1 June 2022. Freya bought the yacht for R850 000 in 2002. This was the only donation made by Freya during the 2023 year of assessment. Donations tax of R280000 is payable. Freya paid the donations tax. Transaction 3: Cancellation of study loan In 2022, Freya lent R150 000 to her son, lan, who used this money to pay for his studies. During the 2023 year of assessment, Freya relieved her son of the loan after he failed to make any payments on the loan. Transaction 4: Primary residence Freya bought a house in Pretoria on 1 January 2003 for R1 700 000. She also paid transfer duties of R80 000. Freya made repairs to the house at a cost of R100 000 during the time she owned the house. For the last 10 years, Freya's husband used 15% of the house for business purposes. Freya and her husband lived in the house until 31 December 2022. Freya put the house on the market, and while they were trying to sell this house in Pretoria, her husband bought a house in Stilbaai for them to 93 HTAX331-1-Jul-Dec2023-FA2-V3-AP-04072023 ANNEXURE I: FORMATIVE ASSESSMENT 2 reside in. After 2 months the house in Pretoria was sold for R2 500000 on 28 February 2023. Freya and her husband moved into their house in Stilbaai on 1 January 2023. REQUIRED: 2.1 With reference to transaction 1, the sale of the shares in Pixel Drearn Limited, calculate the capital gain or loss for the 2023 year of assessment for all three of the "valuation date value" options that are available to Freya Woods and conclude which method will be the most beneficial. You can ignore all VAT implications. (9 marks) 2.2 Calculate the capital gain or loss for the 2023 year of assessment as a result of transactions 2 and 3 above for Freya Woods. Clearly show which costs are included in the base cost. You can ignore all VAT implications. Support your answer with references to the Income Tax Act. (10 marks) 2.3 With reference to transaction 4 , the sale of the residential property for Freya Woods, discuss all the capital gain or capital loss implications. Support your answer with references to the Eight Schedule and calculations. You can ignore all VAT implications. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started