Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Friendly Gas Co. purchases a gas station and convenience store on January 1, 2022, at a cost of 875,000. Friendly expects to operate the

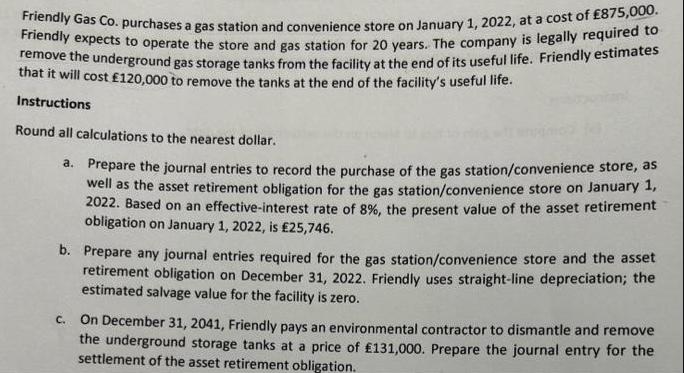

Friendly Gas Co. purchases a gas station and convenience store on January 1, 2022, at a cost of 875,000. Friendly expects to operate the store and gas station for 20 years. The company is legally required to remove the underground gas storage tanks from the facility at the end of its useful life. Friendly estimates that it will cost 120,000 to remove the tanks at the end of the facility's useful life. Instructions Round all calculations to the nearest dollar. a. Prepare the journal entries to record the purchase of the gas station/convenience store, as well as the asset retirement obligation for the gas station/convenience store on January 1, 2022. Based on an effective-interest rate of 8%, the present value of the asset retirement obligation on January 1, 2022, is 25,746. b. Prepare any journal entries required for the gas station/convenience store and the asset retirement obligation on December 31, 2022. Friendly uses straight-line depreciation; the estimated salvage value for the facility is zero. c. On December 31, 2041, Friendly pays an environmental contractor to dismantle and remove the underground storage tanks at a price of 131,000. Prepare the journal entry for the settlement of the asset retirement obligation.

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries on January 1 2022 1 To record the purchase of the gas stationconvenience store Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started