Question

Friendly Tests Inc. is a commercial testing lab, performing a variety of lab tests for hospitals in the area. The management is considering an addition

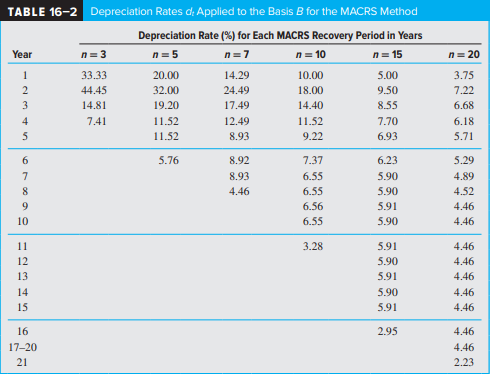

Friendly Tests Inc. is a commercial testing lab, performing a variety of lab tests for hospitals in the area. The management is considering an addition of a new type of test. There is plenty of room in its existing lab facility, but the new test would require an acquisition of new test equipment. The purchase price of the equipment is $215,000. It will be depreciated using MACRS 7-year recovery period (use the rates listed in Table 16-2 in the textbook). The management expects the demand for the new test type to only last 6 years, and therefore the project is expected to end in 6 years, and the equipment to be sold for $60,000 at the end of year 6. The company will also need to hire a part-time lab technician, for $30,000 in the first year of the project, with an annual pay increase of 5% each year after. Equipment maintenance and operating cost is expected to be $4,000 per year. It is also expected additional supplies will be needed, costing $10,000 per year. The additional revenues from the new test are expected to be $70,000 in year 1, $80,000 in year 2, $90,000 in year 3, $100,000 in year 4, $85,000 in year 5, and $65,000 in year 6. Compute the after-tax cash flows for each year of the project. Assume 30% tax rate, and 9% minimum attractive rate of return. Determine whether the company should launch the new testing service, and explain why. Please include a written answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started