Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Friend's Tire Shop (V17.0) Worksheet Page 1 (D4) For the Month Ended December 31, 20XX Account Titles Trial Balance Dr. Cr. 1 Cash 5,318.96 2

| Friend's Tire Shop (V17.0) | |||

| Worksheet Page 1 (D4) | |||

| For the Month Ended December 31, 20XX | |||

| Account Titles | Trial Balance | ||

| Dr. | Cr. | ||

| 1 | Cash | 5,318.96 | |

| 2 | Accounts Receivable | 8,182.30 | |

| 3 | Merchandise Inventory | 36,615.60 | |

| 4 | Prepaid Insurance | 5,423.95 | |

| 5 | Office Supplies | 423.20 | |

| 6 | Shop Supplies | 2,361.75 | |

| 7 | Delivery Van | 17,250.00 | |

| 8 | Accum. Depr. - Delivery Van | 16,962.50 | |

| 9 | Shop Equipment | 27,699.81 | |

| 10 | Accum. Depr. - Shop Equiq | 14,260.29 | |

| 11 | Notes Payable | 4,505.88 | |

| 12 | Accounts Payable | 15,357.30 | |

| 13 | Salaries and Wages Payable | ||

| 14 | Interest Payable | 627.42 | |

| 15 | Notes Payable - Long Term | 6,573.30 | |

| 16 | Robert Friend, Capital | 45,439.03 | |

| 17 | Robert Friend, Drawing | 7,900.00 | |

| 18 | |||

| 19 | |||

| 20 | |||

| 21 | |||

| 22 | |||

| 23 | |||

| 24 | |||

| 25 | Totals | 111,175.57 | 103,725.72 |

| Friend's Tire Shop (V17.0) | |||

| Worksheet Page 2 (D5) | |||

| For the Month Ended December 31, 20XX | |||

| Account Titles | Trial Balance | ||

| Dr. | Cr. | ||

| Total Forward | 111,175.57 | 103,725.72 | |

| 1 | Sales | 37,187.17 | |

| 2 | Sales Returns and Allow. | 778.20 | |

| 3 | Sales Discounts | 539.46 | |

| 4 | Repair Service Revenue | 3,613.43 | |

| 5 | Cost of Goods Sold | 18,229.78 | |

| 6 | Advertising Expense | 661.88 | |

| 7 | Bank Charges | 25.00 | |

| 8 | Depr. Expense - Del. Van | ||

| 9 | Depr. Expense - Shop Eq | ||

| 10 | Insurance Expense | ||

| 11 | Office Salaries Expense | 3,025.00 | |

| 12 | Office Supplies Expense | ||

| 13 | Rent Expense | 1,200.00 | |

| 14 | Repair & Maint. Delivery Van | 488.27 | |

| 15 | Shop Salaries Expense | 7,450.00 | |

| 16 | Shop Supplies Expense | ||

| 17 | Utilities Expense | 949.93 | |

| 18 | Telephone Expense | 68.23 | |

| 19 | Accounting/Legal Expense | 225.00 | |

| 20 | Rental Revenue | 290.00 | |

| 21 | Interest Expense | ||

| 22 | Total | 144,816.32 | 144,816.32 |

| 23 | Net Income or Loss | ||

| 24 | Total | ||

I

I

I need help with the adjusting Entries! I included the first columns of the worksheet so you have the accounts! any help would be awesome

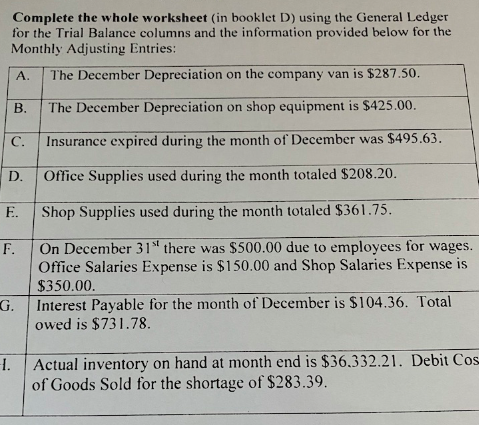

Complete the whole worksheet (in booklet D) using the General Ledger for the Trial Balance columns and the information provided below for the Monthly Adjusting Entries: A. The December Depreciation on the company van is $287.50. B. The December Depreciation on shop equipment is $425.00. C. Insurance expired during the month of December was $495.63. D. Office Supplies used during the month totaled $208.20. E. Shop Supplies used during the month totaled $361.75. F. On December 31" there was $500.00 due to employees for wages. Office Salaries Expense is $150.00 and Shop Salaries Expense is $350.00 Interest Payable for the month of December is $104.36. Total owed is $731.78. G. Actual inventory on hand at month end is $36.332.21. Debit Cos of Goods Sold for the shortage of $283.39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started