Answered step by step

Verified Expert Solution

Question

1 Approved Answer

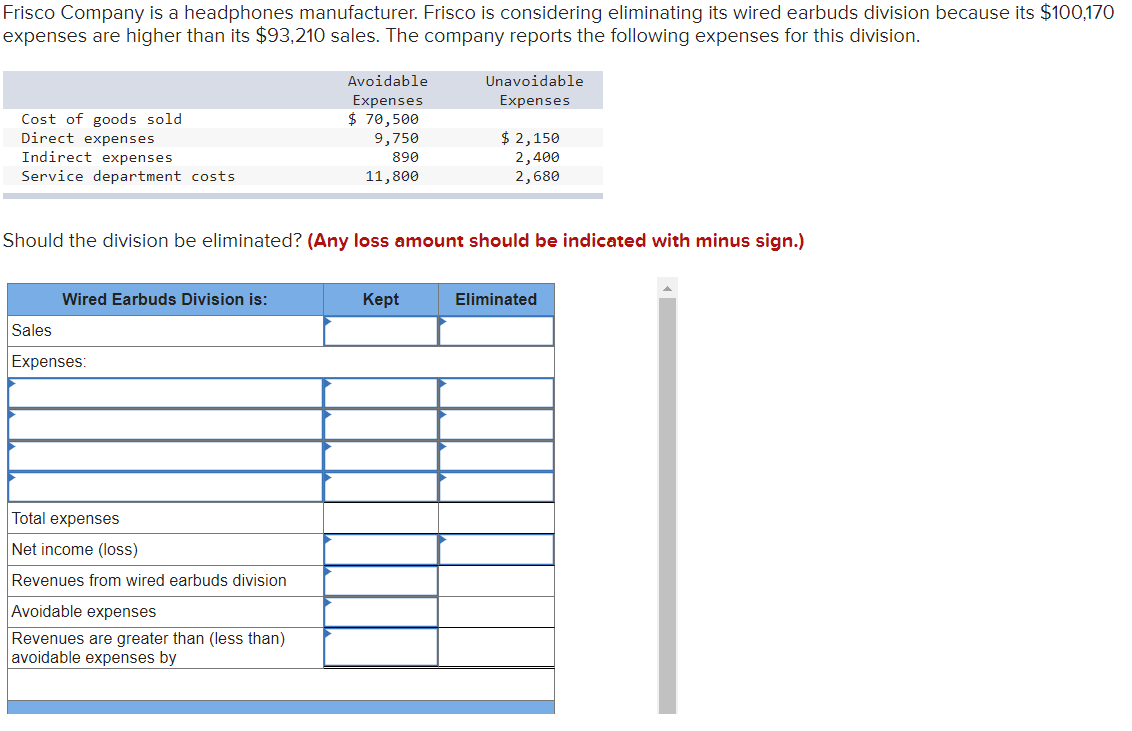

Frisco Company is a headphones manufacturer. Frisco is considering eliminating its wired earbuds division because its $100,170 expenses are higher than its $93,210 sales.

Frisco Company is a headphones manufacturer. Frisco is considering eliminating its wired earbuds division because its $100,170 expenses are higher than its $93,210 sales. The company reports the following expenses for this division. Cost of goods sold Direct expenses Indirect expenses Service department costs Wired Earbuds Division is: Sales Expenses: Avoidable Expenses $ 70,500 9,750 890 11,800 Should the division be eliminated? (Any loss amount should be indicated with minus sign.) Total expenses Net income (loss) Revenues from wired earbuds division Avoidable expenses Revenues are greater than (less than) avoidable expenses by Unavoidable Expenses Kept $ 2,150 2,400 2,680 Eliminated Kept Eliminated

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the differential analysis as follows Frisco Company division is Kept Eliminated Sales 93...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started