Answered step by step

Verified Expert Solution

Question

1 Approved Answer

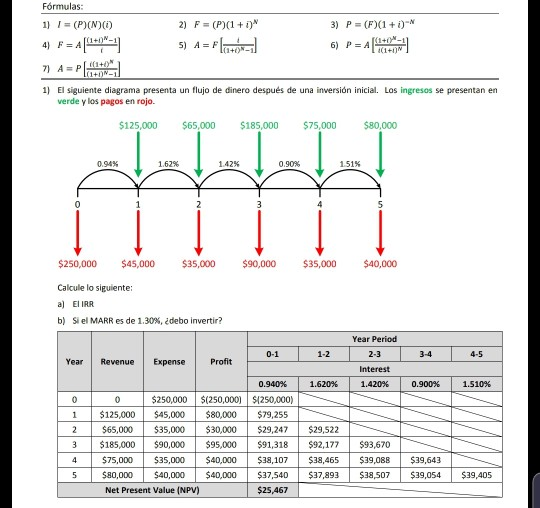

Frmulas 3) P (F+ 5)A 1 El siguiente diagrama presenta un flujo de dinero despus de una inversin inicial. Los ingresos se presentan en verde

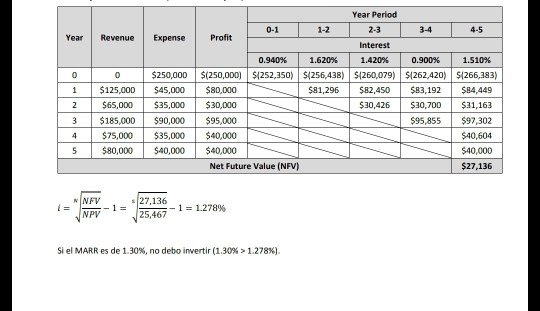

Frmulas 3) P (F+ 5)A 1 El siguiente diagrama presenta un flujo de dinero despus de una inversin inicial. Los ingresos se presentan en verde y los pagos en rojo. $125,000 $65,000 $185,000 75,000 $80,000 0.94% 1.62% 1 42% 0.90% 1.51% $250,000 $45,000 35,000 $90,000 Calcule lo siguiente a) EI IRR b) Si ei MARR es de 1,30%, debo invertir? $35,000 $40,000 Year Period 0-1 1-2 4-5 3-4 Profit ar Revenue Expense Interest 0.940% 1.620% 1.420% 0.900% 1.510% 250,000 $(250,000) $250,000) 1 125,000 $45,000 80,000 79,255 2 $65,000 35,000 30,000 29,247$29,522 3 $185,000$90,000 $95,000 91,31892,177 $93,670 $75,000$35,000 $40,000$38,107 $38,465 $39,088$39,643 $80,000$40,000 $40,000$37,540 37,893 $38,507$39,054 $39,405 Net Present Value (NPV) 25,467 Year Period 2-3 Interest 1.420% 0-1 1-2 3-4 4-5 Profit ear Revenue Expense 0.940% | 1.620% 0.900% 1.510% 250,000$(250,00D $1252,350) (256,438) 1260,079) $1262,420) $266,383) 1 $125,000 $45,000 0,000 $65,000$35,000 $30,000 3 $185,000$90,000 $95,000 $75,00035,000 $40,000 5 $80,000$40,000 $40,000 $81,296 $82,450 $83,192 $84,449 $30,426 $30,700 $31,163 $95,855 $97,302 40,604 $40,000 $27,136 Net Future Value (NFV) NNFV NPV 27,136 25,467 -1 1.27896 Si el MARR es de 1.30%, no debo invertir (1,30% > 1.278%). Frmulas 3) P (F+ 5)A 1 El siguiente diagrama presenta un flujo de dinero despus de una inversin inicial. Los ingresos se presentan en verde y los pagos en rojo. $125,000 $65,000 $185,000 75,000 $80,000 0.94% 1.62% 1 42% 0.90% 1.51% $250,000 $45,000 35,000 $90,000 Calcule lo siguiente a) EI IRR b) Si ei MARR es de 1,30%, debo invertir? $35,000 $40,000 Year Period 0-1 1-2 4-5 3-4 Profit ar Revenue Expense Interest 0.940% 1.620% 1.420% 0.900% 1.510% 250,000 $(250,000) $250,000) 1 125,000 $45,000 80,000 79,255 2 $65,000 35,000 30,000 29,247$29,522 3 $185,000$90,000 $95,000 91,31892,177 $93,670 $75,000$35,000 $40,000$38,107 $38,465 $39,088$39,643 $80,000$40,000 $40,000$37,540 37,893 $38,507$39,054 $39,405 Net Present Value (NPV) 25,467 Year Period 2-3 Interest 1.420% 0-1 1-2 3-4 4-5 Profit ear Revenue Expense 0.940% | 1.620% 0.900% 1.510% 250,000$(250,00D $1252,350) (256,438) 1260,079) $1262,420) $266,383) 1 $125,000 $45,000 0,000 $65,000$35,000 $30,000 3 $185,000$90,000 $95,000 $75,00035,000 $40,000 5 $80,000$40,000 $40,000 $81,296 $82,450 $83,192 $84,449 $30,426 $30,700 $31,163 $95,855 $97,302 40,604 $40,000 $27,136 Net Future Value (NFV) NNFV NPV 27,136 25,467 -1 1.27896 Si el MARR es de 1.30%, no debo invertir (1,30% > 1.278%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started