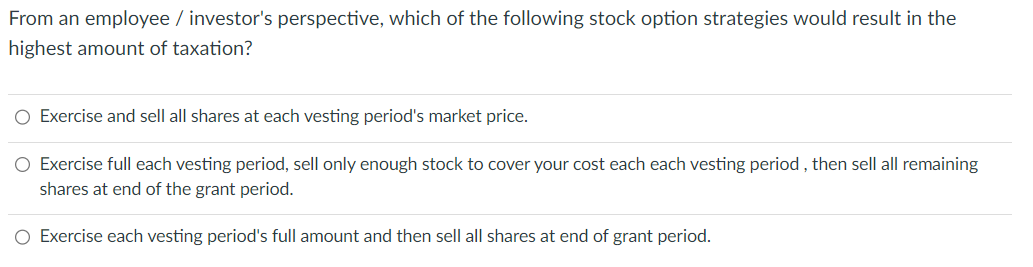

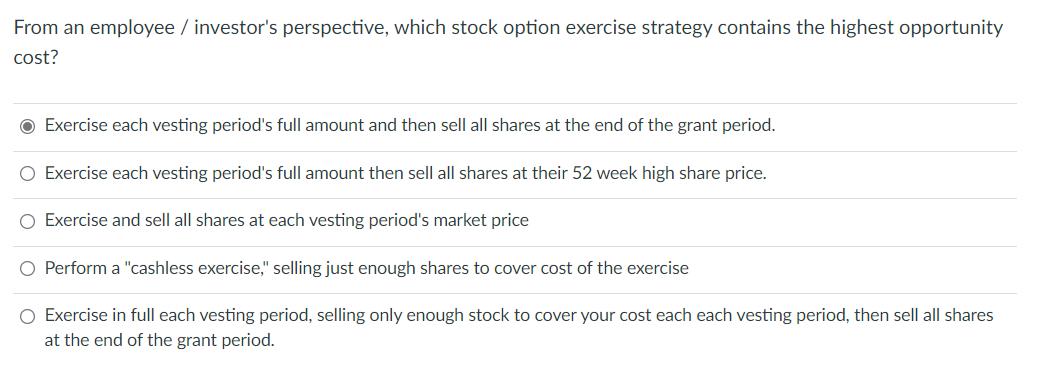

From an employee / investor's perspective, which of the following stock option strategies would result in the highest amount of taxation? O Exercise and sell all shares at each vesting period's market price. O Exercise full each vesting period, sell only enough stock to cover your cost each each vesting period, then sell all remaining shares at end of the grant period. O Exercise each vesting period's full amount and then sell all shares at end of grant period. From an employee / investor's perspective, which stock option exercise strategy contains the highest opportunity cost? Exercise each vesting period's full amount and then sell all shares at the end of the grant period. O Exercise each vesting period's full amount then sell all shares at their 52 week high share price. O Exercise and sell all shares at each vesting period's market price O Perform a "cashless exercise," selling just enough shares to cover cost of the exercise O Exercise in full each vesting period, selling only enough stock to cover your cost each each vesting period, then sell all shares at the end of the grant period. From an employee / investor's perspective, which of the following stock option strategies would result in the highest amount of taxation? O Exercise and sell all shares at each vesting period's market price. O Exercise full each vesting period, sell only enough stock to cover your cost each each vesting period, then sell all remaining shares at end of the grant period. O Exercise each vesting period's full amount and then sell all shares at end of grant period. From an employee / investor's perspective, which stock option exercise strategy contains the highest opportunity cost? Exercise each vesting period's full amount and then sell all shares at the end of the grant period. O Exercise each vesting period's full amount then sell all shares at their 52 week high share price. O Exercise and sell all shares at each vesting period's market price O Perform a "cashless exercise," selling just enough shares to cover cost of the exercise O Exercise in full each vesting period, selling only enough stock to cover your cost each each vesting period, then sell all shares at the end of the grant period