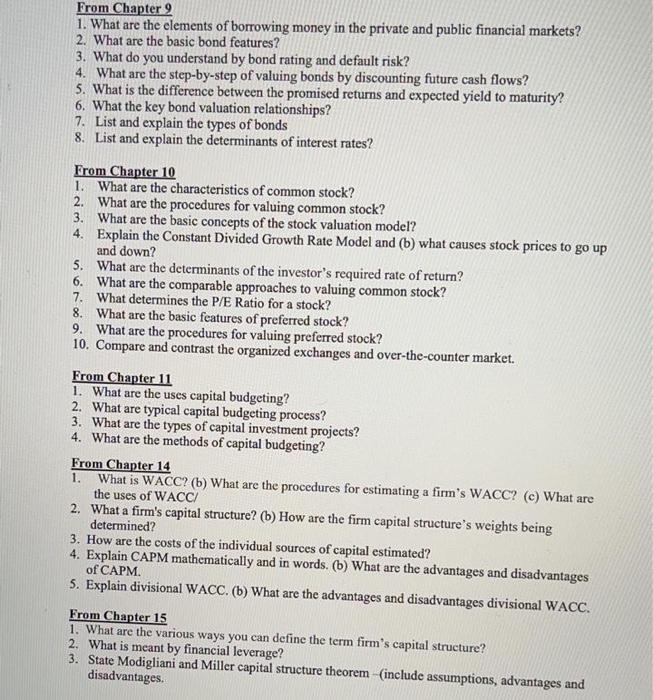

From Chapter 9 1. What are the elements of borrowing money in the private and public financial markets? What are the basic bond features? 3. What do you understand by bond rating and default risk? 4. What are the step-by-step of valuing bonds by discounting future cash flows? 5. What is the difference between the promised returns and expected yield to maturity? 6. What the key bond valuation relationships? 7. List and explain the types of bonds 8. List and explain the determinants of interest rates? From Chapter 10 1. What are the characteristics of common stock? 2. What are the procedures for valuing common stock? 3. What are the basic concepts of the stock valuation model? 4. Explain the Constant Divided Growth Rate Model and (b) what causes stock prices to go up and down? 5. What are the determinants of the investor's required rate of retur 6. What are the comparable approaches to valuing common stock? 7. What determines the P/E Ratio for a stock? 8. What are the basic features of preferred stock? 9. What are the procedures for valuing preferred stock? 10. Compare and contrast the organized exchanges and r-the-counter market. From Chapter 11 1. What are the uses capital budgeting? 2. What are typical capital budgeting process? 3. What are the types of capital investment projects? 4. What are the methods of capital budgeting? From Chapter 14 1. What is WACC? (b) What are the procedures for estimating a firm's WACC? (@) What are the uses of WACC/ 2. What a firm's capital structure? (b) How are the firm capital structure's weights being determined? 3. How are the costs of the individual roes of capital estimated? 4. Explain CAPM mathematically and in words. (b) What are the advantages and disadvantages of CAPM. 5. Explain divisional WACC. (b) What are the advantages and disadvantages divisional WACC. From Chapter 15 1. What are the various ways you can define the term firm's capital structure? 2. What is meant by financial leverage? 3. State Modigliani and Miller capital structure theorem - (include assumptions, advantages and disadvantages