Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From data provided please calculate the following and provide working . ebida , enterprise value , total revenue , capital expenditjre , market value of

From data provided please calculate the following and provide working .

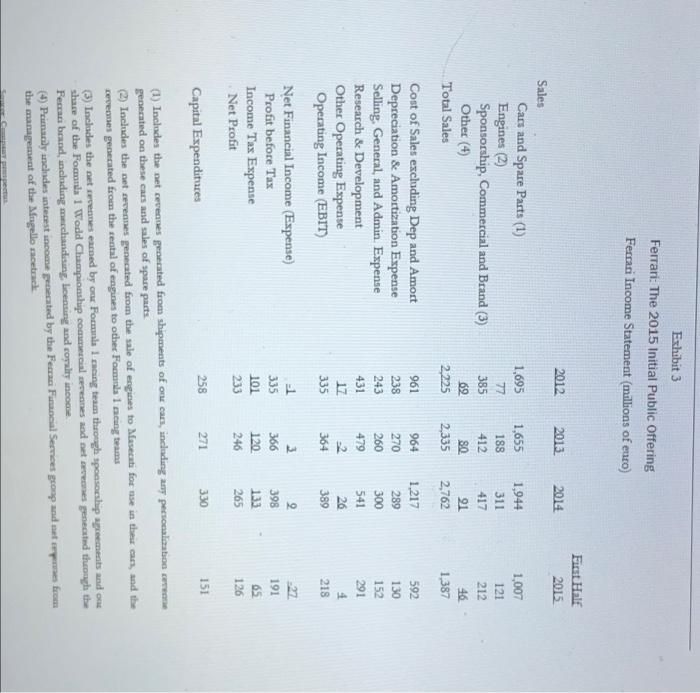

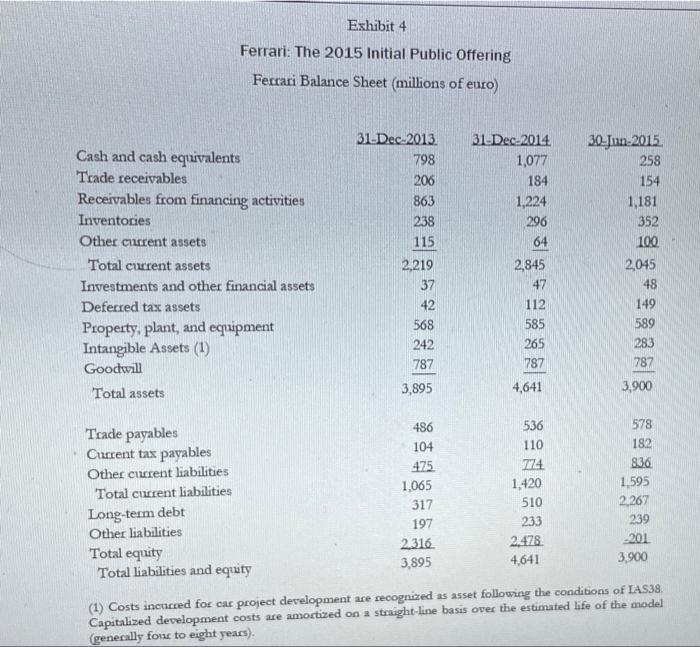

Exhibit 3 Ferrari: The 2015 Initial Public Offering Ferrari Income Statement (millions of enco) First Half 2015 2012 2013 2014 Sales Cars and Spare Parts (1) Engines (2) Sponsorship, Commercial and Brand (3) Other (4) Total Sales 1,695 77 385 69 2.225 1,655 188 412 SO 1,944 311 417 91 2,762 1,007 121 212 46 1,387 2,335 Cost of Sales excluding Dep and Amort Depreciation & Amortization Expense Selling, General, and Admin Expense Research & Development Other Operating Expense Operating Income (EBIT) Net Financial Income (Expense) Profit before Tax Income Tax Expense Net Profit 961 238 243 431 17 335 964 270 260 479 -2 364 1.217 289 300 541 26 389 592 130 152 291 4 218 3 -27 191 1 335 101 233 366 120 246 9 398 133 265 126 258 271 330 151 Capital Expenditures (1) Includes the net cevennes generated from shipments of our cars, including 2107 personalization cene generated on these cars and sales of spare parts (2) Includes the net evenes gerecated from the sale of engines to Mesecati fornise in the cames, and the ceveres generated from the rental of engines to other Formula 1 ning teams (3) Includes the net wees earned by our Formula 1 cacing team through sponsorship agreements and on share of the Fools 1 Wodd Championship comercial evenes and art cremes penected through the Ferrus beund, including mechandising Licensing and coyalty income (4) Primucily includes antecest income generated by the Ferrari Financial Services group and met mes ficom the management of the Mugello macetrack cu Eshibit 4 Ferrari: The 2015 Initial Public Offering Ferrari Balance Sheet (millions of euro) Cash and cash equivalents Trade receivables Receivables from financing activities Inventories Other current assets Total current assets Investments and other financial assets Deferred tax assets Property, plant, and equipment Intangible Assets (1) Goodwill Total assets 31. Dec 2013 798 206 863 238 115 2,219 37 42 568 242 787 3,895 31-Dec-2014 1,077 184 1,224 296 64 2,845 47 112 585 265 787 30-Jun-2015 258 154 1,181 352 100 2,045 48 149 589 283 787 3,900 4,641 Trade payables Current tax payables Other current liabilities Total current liabilities Long-term debt Other liabilities Total equity Total liabilities and equity 486 104 475 1,065 317 197 2.316 3,895 536 110 774 1,420 510 233 2.478 4,641 578 182 836 1.595 2,267 239 -201 3,900 (1) Costs incuced for car project development are recognized as asset following the conditions of IAS38. Capitalized development costs are amortized on a straight-line basis over the estimated life of the model (generally fou to eight years). Exhibit 3 Ferrari: The 2015 Initial Public Offering Ferrari Income Statement (millions of enco) First Half 2015 2012 2013 2014 Sales Cars and Spare Parts (1) Engines (2) Sponsorship, Commercial and Brand (3) Other (4) Total Sales 1,695 77 385 69 2.225 1,655 188 412 SO 1,944 311 417 91 2,762 1,007 121 212 46 1,387 2,335 Cost of Sales excluding Dep and Amort Depreciation & Amortization Expense Selling, General, and Admin Expense Research & Development Other Operating Expense Operating Income (EBIT) Net Financial Income (Expense) Profit before Tax Income Tax Expense Net Profit 961 238 243 431 17 335 964 270 260 479 -2 364 1.217 289 300 541 26 389 592 130 152 291 4 218 3 -27 191 1 335 101 233 366 120 246 9 398 133 265 126 258 271 330 151 Capital Expenditures (1) Includes the net cevennes generated from shipments of our cars, including 2107 personalization cene generated on these cars and sales of spare parts (2) Includes the net evenes gerecated from the sale of engines to Mesecati fornise in the cames, and the ceveres generated from the rental of engines to other Formula 1 ning teams (3) Includes the net wees earned by our Formula 1 cacing team through sponsorship agreements and on share of the Fools 1 Wodd Championship comercial evenes and art cremes penected through the Ferrus beund, including mechandising Licensing and coyalty income (4) Primucily includes antecest income generated by the Ferrari Financial Services group and met mes ficom the management of the Mugello macetrack cu Eshibit 4 Ferrari: The 2015 Initial Public Offering Ferrari Balance Sheet (millions of euro) Cash and cash equivalents Trade receivables Receivables from financing activities Inventories Other current assets Total current assets Investments and other financial assets Deferred tax assets Property, plant, and equipment Intangible Assets (1) Goodwill Total assets 31. Dec 2013 798 206 863 238 115 2,219 37 42 568 242 787 3,895 31-Dec-2014 1,077 184 1,224 296 64 2,845 47 112 585 265 787 30-Jun-2015 258 154 1,181 352 100 2,045 48 149 589 283 787 3,900 4,641 Trade payables Current tax payables Other current liabilities Total current liabilities Long-term debt Other liabilities Total equity Total liabilities and equity 486 104 475 1,065 317 197 2.316 3,895 536 110 774 1,420 510 233 2.478 4,641 578 182 836 1.595 2,267 239 -201 3,900 (1) Costs incuced for car project development are recognized as asset following the conditions of IAS38. Capitalized development costs are amortized on a straight-line basis over the estimated life of the model (generally fou to eight years) ebida , enterprise value , total revenue , capital expenditjre , market value of equity , debt and cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started