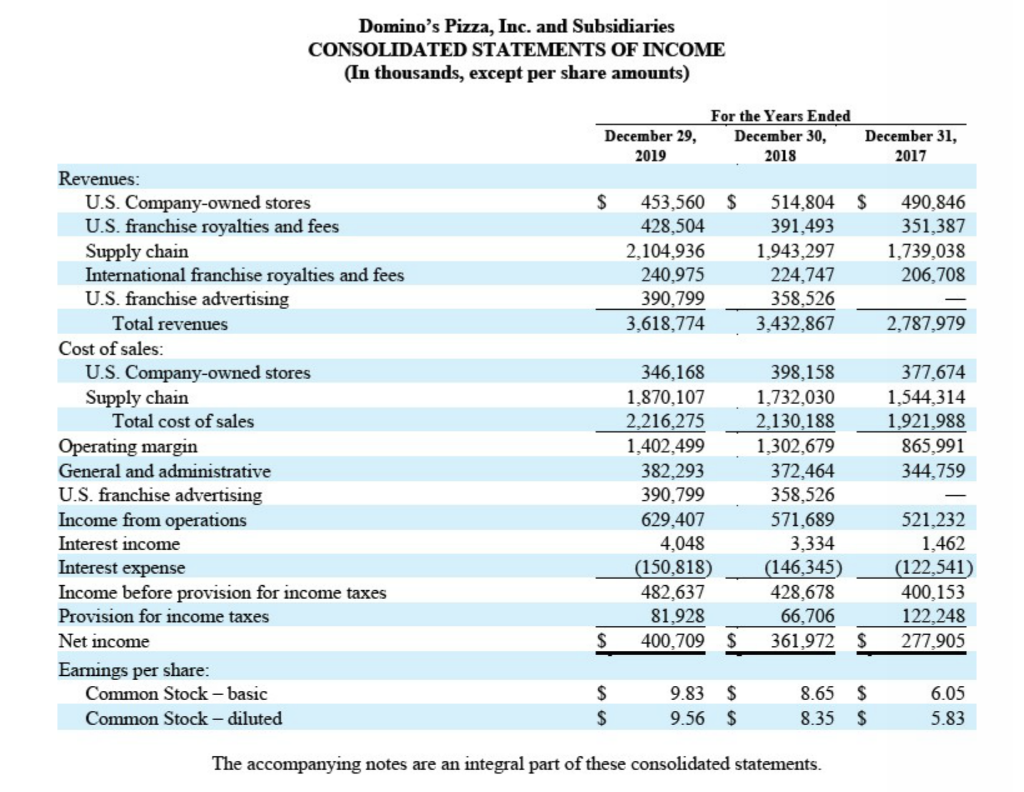

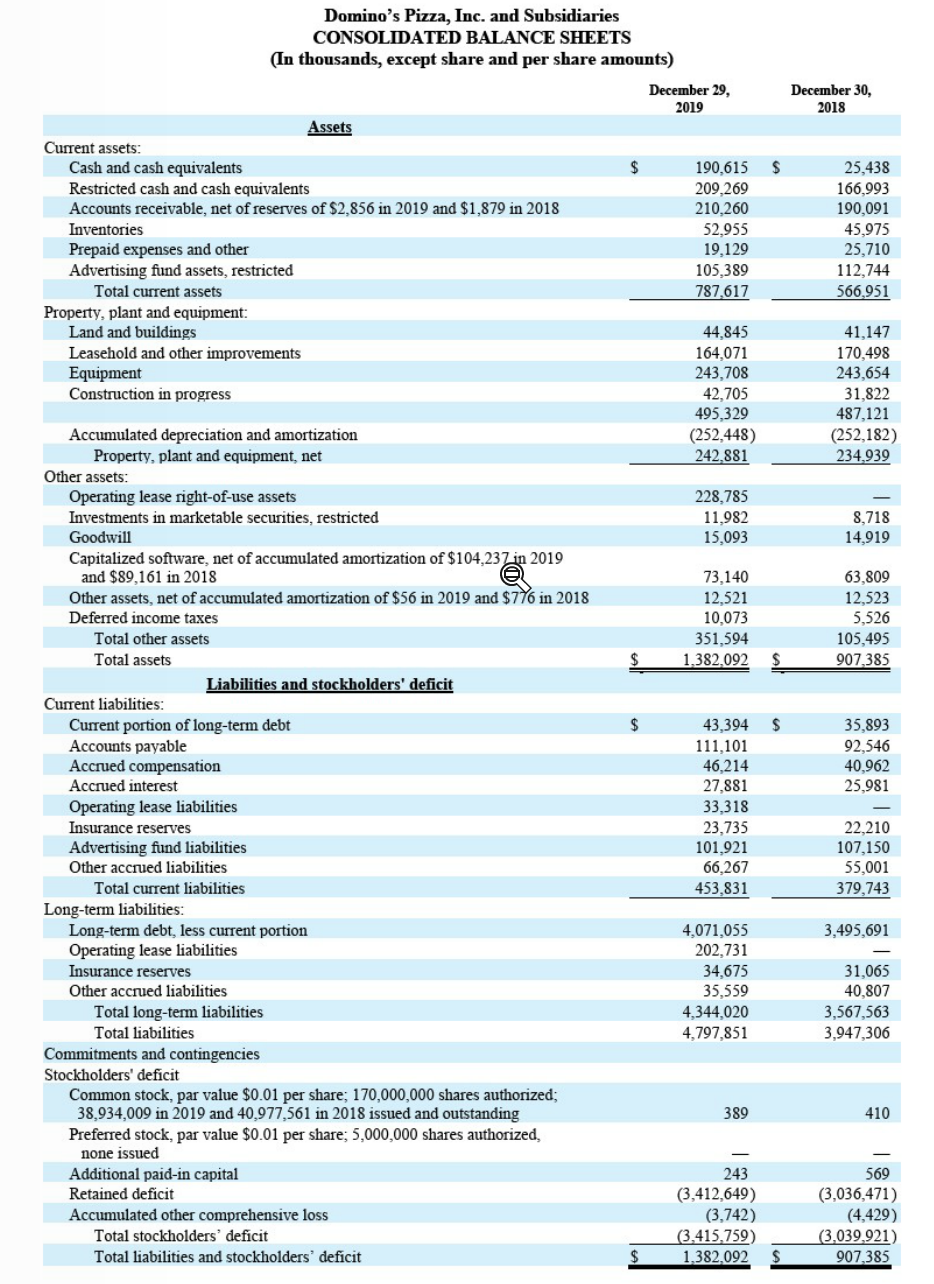

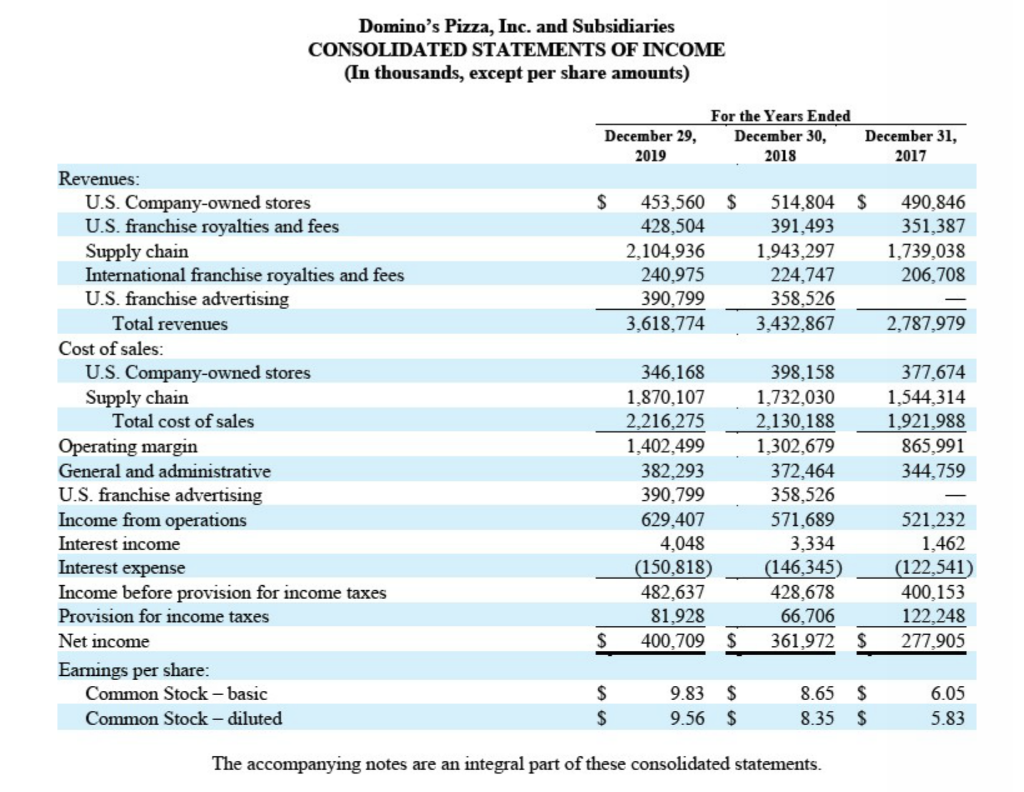

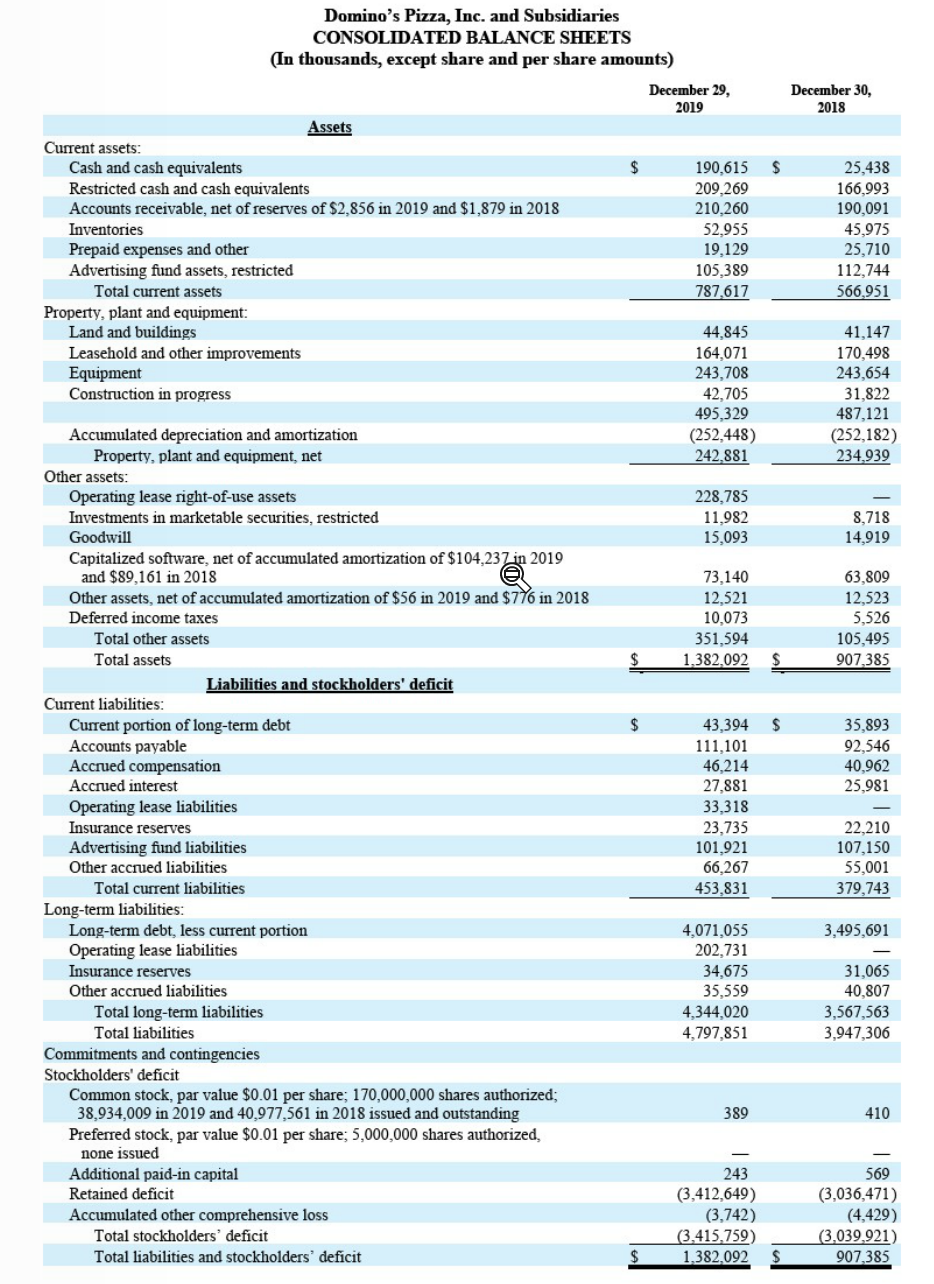

From Domino's Pizza financial statements. How much of Net Income is linked to operations vs. other gains/losses? What are these other gains/losses and how persistent these gains/losses you expect to be in the future? How do you assess the companys operating efficiency and leverage in building up ROE?

Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts) December 29, For the Years Ended December 30, 2018 December 31, 2017 2019 $ $ 453,560 428,504 2,104,936 240,975 390.799 3,618,774 514.804 391,493 1,943,297 224,747 358,526 3,432,867 490.846 351.387 1,739,038 206,708 2,787,979 1 Revenues: U.S. Company-owned stores U.S. franchise royalties and fees Supply chain International franchise royalties and fees U.S. franchise advertising Total revenues Cost of sales: U.S. Company-owned stores Supply chain Total cost of sales Operating margin General and administrative U.S. franchise advertising Income from operations Interest income Interest expense Income before provision for income taxes Provision for income taxes Net income Earnings per share: Common Stock - basic Common Stock - diluted 377,674 ,544,314 1,921,988 865,991 344,759 346,168 1,870,107 2,216,275 1,402,499 382 293 390,799 629,407 4,048 (150,818) 482,637 81,928 400,709 398,158 1,732,030 2,130,188 1,302,679 372,464 3 58,526 571,689 3,334 (146,345) 428,678 66,706 361,972 521,232 1,462 (122,541) 400,153 122,248 277,905 $ $ $ $ $ 9.83 9.56 $ $ 8.65 8.35 $ $ 6.05 5.83 The accompanying notes are an integral part of these consolidated statements. Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 29, 2019 December 30, 2018 $ Assets Current assets: Cash and cash equivalents Restricted cash and cash equivalents Accounts receivable, net of reserves of $2,856 in 2019 and $1,879 in 2018 Inventories Prepaid expenses and other Advertising fund assets, restricted Total current assets Property, plant and equipment: Land and buildings Leasehold and other improvements Equipment Construction in progress 190,615 209.269 210,260 52,955 19,129 105,389 787,617 25,438 166,993 190,091 45,975 25,710 112,744 566,951 44,845 164,071 243,708 42,705 495,329 (252,448) 242,881 41,147 170,498 243,654 31,822 487,121 (252,182) 234,939 228,785 11,982 15,093 8,718 14,919 73,140 12,521 10,073 351,594 1,382,092 63,809 12,523 5,526 105,495 907,385 $ $ $ 35,893 92,546 40.962 25,981 Accumulated depreciation and amortization Property, plant and equipment, net Other assets: Operating lease right-of-use assets Investments in marketable securities, restricted Goodwill Capitalized software, net of accumulated amortization of $104,237 in 2019 and $89,161 in 2018 Other assets, net of accumulated amortization of $56 in 2019 and $776 in 2018 Deferred income taxes Total other assets Total assets Liabilities and stockholders' deficit Current liabilities: Current portion of long-term debt Accounts payable Accrued compensation Accrued interest Operating lease liabilities Insurance reserves Advertising fund liabilities Other accrued liabilities Total current liabilities Long-term liabilities: Long-term debt, less current portion Operating lease liabilities Insurance reserves Other accrued liabilities Total long-term liabilities Total liabilities Commitments and contingencies Stockholders' deficit Common stock, par value $0.01 per share; 170,000,000 shares authorized; 38,934,009 in 2019 and 40,977,561 in 2018 issued and outstanding Preferred stock, par value $0.01 per share; 5,000,000 shares authorized, none issued Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 43,394 111,101 46,214 27,881 33,318 23,735 101,921 66.267 453,831 22,210 107,150 55,001 379,743 3,495,691 4,071,055 202,731 34,675 35,559 4,344,020 4,797,851 31,065 40.807 3,567,563 3,947,306 389 410 569 (3,036,471) 243 (3,412,649) (3,742) (3.415.759) 1.382.092 (4.429) (3,039,921) 907,385 $ $ Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts) December 29, For the Years Ended December 30, 2018 December 31, 2017 2019 $ $ 453,560 428,504 2,104,936 240,975 390.799 3,618,774 514.804 391,493 1,943,297 224,747 358,526 3,432,867 490.846 351.387 1,739,038 206,708 2,787,979 1 Revenues: U.S. Company-owned stores U.S. franchise royalties and fees Supply chain International franchise royalties and fees U.S. franchise advertising Total revenues Cost of sales: U.S. Company-owned stores Supply chain Total cost of sales Operating margin General and administrative U.S. franchise advertising Income from operations Interest income Interest expense Income before provision for income taxes Provision for income taxes Net income Earnings per share: Common Stock - basic Common Stock - diluted 377,674 ,544,314 1,921,988 865,991 344,759 346,168 1,870,107 2,216,275 1,402,499 382 293 390,799 629,407 4,048 (150,818) 482,637 81,928 400,709 398,158 1,732,030 2,130,188 1,302,679 372,464 3 58,526 571,689 3,334 (146,345) 428,678 66,706 361,972 521,232 1,462 (122,541) 400,153 122,248 277,905 $ $ $ $ $ 9.83 9.56 $ $ 8.65 8.35 $ $ 6.05 5.83 The accompanying notes are an integral part of these consolidated statements. Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 29, 2019 December 30, 2018 $ Assets Current assets: Cash and cash equivalents Restricted cash and cash equivalents Accounts receivable, net of reserves of $2,856 in 2019 and $1,879 in 2018 Inventories Prepaid expenses and other Advertising fund assets, restricted Total current assets Property, plant and equipment: Land and buildings Leasehold and other improvements Equipment Construction in progress 190,615 209.269 210,260 52,955 19,129 105,389 787,617 25,438 166,993 190,091 45,975 25,710 112,744 566,951 44,845 164,071 243,708 42,705 495,329 (252,448) 242,881 41,147 170,498 243,654 31,822 487,121 (252,182) 234,939 228,785 11,982 15,093 8,718 14,919 73,140 12,521 10,073 351,594 1,382,092 63,809 12,523 5,526 105,495 907,385 $ $ $ 35,893 92,546 40.962 25,981 Accumulated depreciation and amortization Property, plant and equipment, net Other assets: Operating lease right-of-use assets Investments in marketable securities, restricted Goodwill Capitalized software, net of accumulated amortization of $104,237 in 2019 and $89,161 in 2018 Other assets, net of accumulated amortization of $56 in 2019 and $776 in 2018 Deferred income taxes Total other assets Total assets Liabilities and stockholders' deficit Current liabilities: Current portion of long-term debt Accounts payable Accrued compensation Accrued interest Operating lease liabilities Insurance reserves Advertising fund liabilities Other accrued liabilities Total current liabilities Long-term liabilities: Long-term debt, less current portion Operating lease liabilities Insurance reserves Other accrued liabilities Total long-term liabilities Total liabilities Commitments and contingencies Stockholders' deficit Common stock, par value $0.01 per share; 170,000,000 shares authorized; 38,934,009 in 2019 and 40,977,561 in 2018 issued and outstanding Preferred stock, par value $0.01 per share; 5,000,000 shares authorized, none issued Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 43,394 111,101 46,214 27,881 33,318 23,735 101,921 66.267 453,831 22,210 107,150 55,001 379,743 3,495,691 4,071,055 202,731 34,675 35,559 4,344,020 4,797,851 31,065 40.807 3,567,563 3,947,306 389 410 569 (3,036,471) 243 (3,412,649) (3,742) (3.415.759) 1.382.092 (4.429) (3,039,921) 907,385 $ $