Answered step by step

Verified Expert Solution

Question

1 Approved Answer

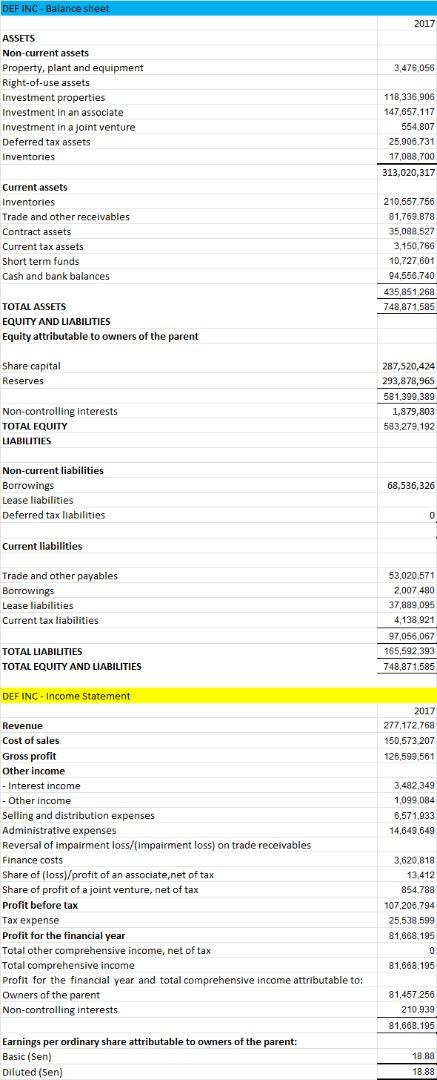

From given income statement & balance sheet, Calculate: 1) Average Payment Period 2) Times Interest Earned Ratio 3) Fixed-Payment Coverage Ratio 4) Debt Equity Ratio

From given income statement & balance sheet, Calculate: 1) Average Payment Period 2) Times Interest Earned Ratio 3) Fixed-Payment Coverage Ratio 4) Debt Equity Ratio 5) Operating Profit Margin 6) Net Profit Margin

DEF INC-Balance sheet ASSETS Non-current assets. Property, plant and equipment Right-of-use assets Investment properties Investment in an associate Investment in a joint venture Deferred tax assets Inventories Current assets Inventories Trade and other receivables Contract assets Current tax assets Short term funds Cash and bank balances : TOTAL ASSETS EQUITY AND LIABILITIES Equity attributable to owners of the parent Share capital Reserves Non-controlling interests TOTAL EQUITY LIABILITIES Non-current liabilities Borrowings Lease liabilities Deferred tax liabilities. Current liabilities Trade and other payables. Borrowings Lease liabilities Current tax liabilities TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES DEFINC-Income Statement Revenue Cost of sales Gross profit Other income - Interest income - Other income Selling and distribution expenses Administrative expenses Reversal of impairment loss/(impairment loss) on trade receivables Finance costs Share of (loss)/profit of an associate,net of tax Share of profit of a joint venture, net of tax Profit before tax Tax expense Profit for the financial year Total other comprehensive income, net of tax Total comprehensive income Profit for the financial year and total comprehensive income attributable to: Owners of the parent Non-controlling interests Earnings per ordinary share attributable to owners of the parent: Basic (Sen) Diluted (Sen) 2017 3,476,056 118,336,906 147.657,117 554,807 25,906,731 17,088,700 313,020,317 210,557,756 81,769,878 35,088,527 3,150,766 10,727,601 94,556,740 435,851,268 748,871,585 287,520,424 293,878,965 581,399,389 1,879,803 583,279,192 68,536,326 0 53,020,571 2,007,480 37,889,095 4,138.921 97,056,067 165,592,393 748,871,585 2017 277,172,768 150,573,207 126,599,561 3,482,349 1,099,084 6,571,933 14,649,649 3,620,818 13,412 854,788 107,206,794 25,538,599 81,668,195 0 81,668,195 81,457.256 210,939 81,668,195 18.88 18.88Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started