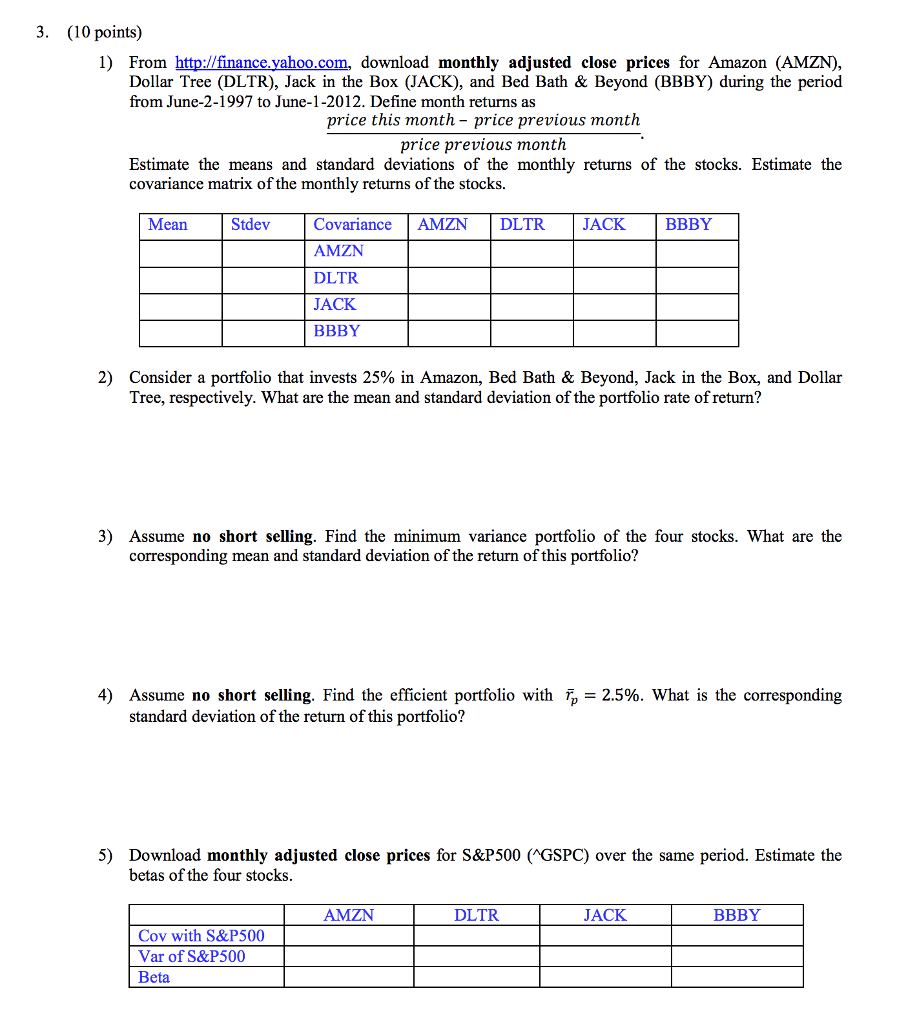

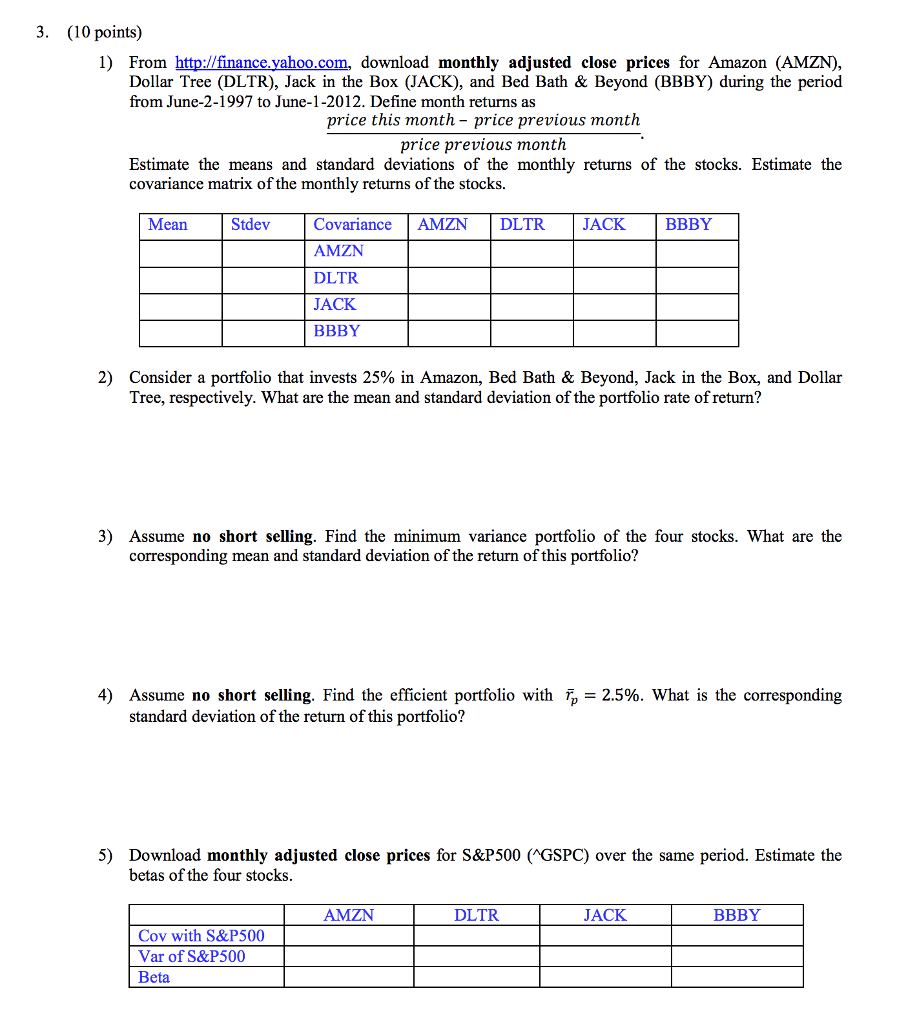

From http://finance.yahoo.com, download monthly adjusted close prices for Amazon (AMZN), Dollar Tree (DLTR), Jack in the Box (JACK), and Bed Bath & Beyond (BBBY) during the period from June-2-1997 to June-1-2012. Define month returns as price this month - price previous month/price previous month. Estimate the means and standard deviations of the monthly returns of the stocks. Estimate the covariance matrix of the monthly returns of the stocks. Consider a portfolio that invests 25% in Amazon, Bed Bath & Beyond, Jack in the Box, and Dollar Tree, respectively. What are the mean and standard deviation of the portfolio rate of return? Assume no short selling. Find the minimum variance portfolio of the four stocks. What are the corresponding mean and standard deviation of the return of this portfolio? Assume no short selling. Find the efficient portfolio with r_p = 2.5%. What is the corresponding standard deviation of the return of this portfolio? Download monthly adjusted close prices for S&P500 (^GSPC) over the same period. Estimate the betas of the four stocks. From http://finance.yahoo.com, download monthly adjusted close prices for Amazon (AMZN), Dollar Tree (DLTR), Jack in the Box (JACK), and Bed Bath & Beyond (BBBY) during the period from June-2-1997 to June-1-2012. Define month returns as price this month - price previous month/price previous month. Estimate the means and standard deviations of the monthly returns of the stocks. Estimate the covariance matrix of the monthly returns of the stocks. Consider a portfolio that invests 25% in Amazon, Bed Bath & Beyond, Jack in the Box, and Dollar Tree, respectively. What are the mean and standard deviation of the portfolio rate of return? Assume no short selling. Find the minimum variance portfolio of the four stocks. What are the corresponding mean and standard deviation of the return of this portfolio? Assume no short selling. Find the efficient portfolio with r_p = 2.5%. What is the corresponding standard deviation of the return of this portfolio? Download monthly adjusted close prices for S&P500 (^GSPC) over the same period. Estimate the betas of the four stocks