Answered step by step

Verified Expert Solution

Question

1 Approved Answer

from question 10 question 12 each question is worth 10 points. Other questions are seven points. The total point for this assignment is 100 points.

from question 10 question 12 each question is worth 10 points. Other questions are seven points. The total point for this assignment is 100 points. you should show your work processes and upload your response. All bonds are semi annual. All yield measures are stated as annual percentage rates.

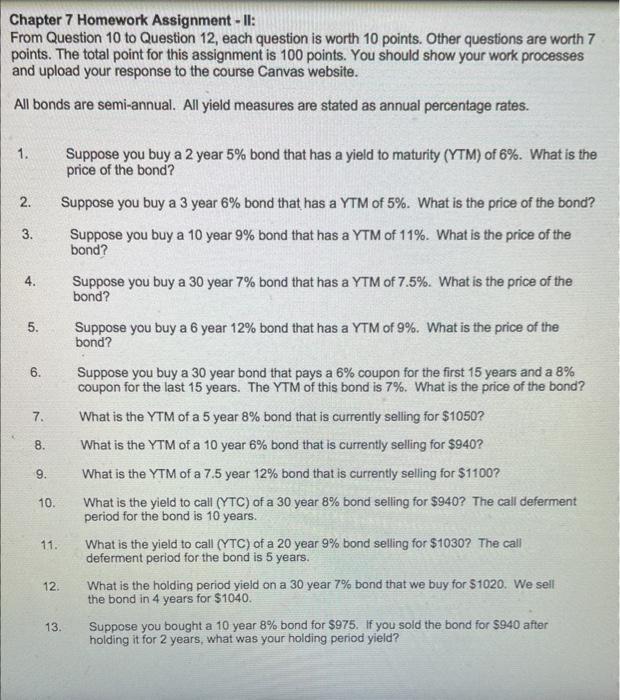

Chapter 7 Homework Assignment - II: From Question 10 to Question 12, each question is worth 10 points. Other questions are worth 7 points. The total point for this assignment is 100 points. You should show your work processes and upload your response to the course Canvas website. All bonds are semi-annual. All yield measures are stated as annual percentage rates. 1. Suppose you buy a 2 year 5% bond that has a yield to maturity (YTM) of 6%. What is the price of the bond? 2. Suppose you buy a 3 year 6% bond that has a YTM of 5%. What is the price of the bond? 3. Suppose you buy a 10 year 9% bond that has a YTM of 11%. What is the price of the bond? 4. Suppose you buy a 30 year 7% bond that has a YTM of 7.5%. What is the price of the bond? 5. Suppose you buy a 6 year 12% bond that has a YTM of 9%. What is the price of the bond? 6. Suppose you buy a 30 year bond that pays a 6% coupon for the first 15 years and a 8% coupon for the last 15 years. The YTM of this bond is 7%. What is the price of the bond? 7. What is the YTM of a 5 year 8% bond that is currently selling for $1050 ? 8. What is the YTM of a 10 year 6% bond that is currently selling for $940 ? 9. What is the YTM of a 7.5 year 12% bond that is currently selling for $1100 ? 10. What is the yield to call (YTC) of a 30 year 8% bond selling for $940 ? The call deferment period for the bond is 10 years. 11. What is the yield to call (YTC) of a 20 year 9% bond selling for $1030 ? The call deferment period for the bond is 5 years. 12. What is the holding period yield on a 30 year 7% bond that we buy for $1020. We sell the bond in 4 years for $1040. 13. Suppose you bought a 10 year 8% bond for $975. If you sold the bond for $940 after holding it for 2 years, what was your holding period yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started