Question

From question 7.03 Each bond has a face value of $1000 Recall that earlier in Problem 7.03, you constructed a yield curve from t =

From question 7.03

Each bond has a face value of $1000

Recall that earlier in Problem 7.03, you constructed a yield curve from t = 0 to 3 years via converting the prices of zero-coupon bonds into their respective YTMs.

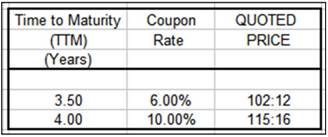

The table below provides additional bond data beyond time 3, but only for coupon bonds.

As usual, the coupon bonds make semi-annual payments and have a face value of $1000.

In the next question youll be asked to extend the yield curve from t = 3 to 3.50 by utilizing the coupon bond information given in the table below.

The coupon bonds make semi-annual payments and have a face value of $1000.

Update the yield curve to include the two YTM new points. Estimate the YTMs to 5 significant digits.

a. Using the newly supplied coupon-bond pricing information (along with the yield curve you already constructed earlier from t = 0 to 3), please extend the yield curve so that the YTMEAR for a 3.5 year horizon is also included on the graph. Report the YTMEAR for a 3.5 year horizon as a percentage, not as a decimal, using at least 4 digits of precision.

b. What is the YTMEAR for a 4 year horizon?

Given the 3.5 year YTM you found in the previous question, determine the no-arbitrage price of a 3.5 year zero-coupon bond.

c. in Question 9, it was disclosed that (via bootstrapping), the YTMEAR for the 4 year horizon was (as a decimal) 0.05935.

Given that, what is the no-arbitrage price for a 4 year zero coupon bond with a $1000 face value? Report the dollar price (not the quoted pricewhich uses the 32nd convention).

d. Using the yield curve you just constructed (extending from t = 0 to t = 4) visually estimate (i.e. via doing no formal math) what the YTM would be for the 4 year, 10% coupon bond described in the table (via Problem 7.05). That is, using only your graph of the yield curve, provide a rough guess as to what the YTM of the 4 year, 10% coupon bond would be.

- More than 6.00%

- Between 5.93% and 6.00%

- A bit less than 5.93%

- Approx. 4.28% (the average of the 8 different yields).

- A bit above 4.28%

- Below 4.28%

Time to Maturity Coupon (TTM) Rate (Years) Trading Price (in dollars) YTM (EAR) 0.50 1.00 1.50 2.00 2.50 3.00 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% $986.05 $967.31 $950.67 $927.23 $899.02 $863.84 Time to Maturity Coupon (TTM) Rate (Years) QUOTED PRICE 3.50 4.00 6.00% 10.00% 102:12 115:16 Time to Maturity Coupon (TTM) Rate (Years) Trading Price (in dollars) YTM (EAR) 0.50 1.00 1.50 2.00 2.50 3.00 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% $986.05 $967.31 $950.67 $927.23 $899.02 $863.84 Time to Maturity Coupon (TTM) Rate (Years) QUOTED PRICE 3.50 4.00 6.00% 10.00% 102:12 115:16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started