Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From Table, the equity value based on the average EV/EBITDA ratio from its comparable firms is calculate as ? IDEKO has outstanding debt of S2

From Table, the equity value based on the average EV/EBITDA ratio from its comparable firms is calculate as ?

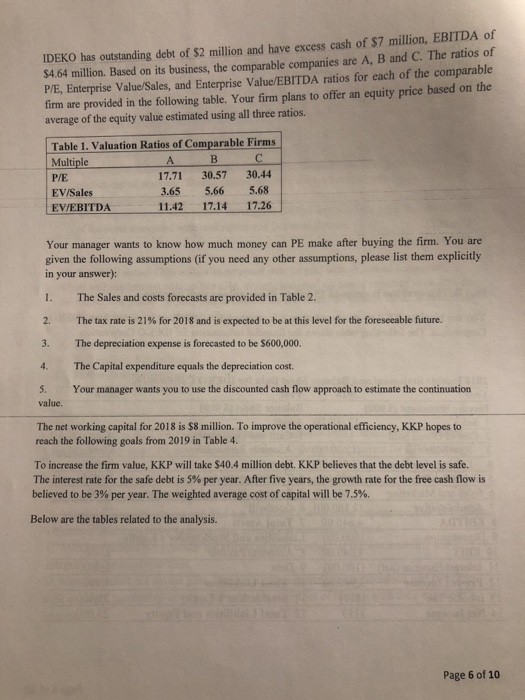

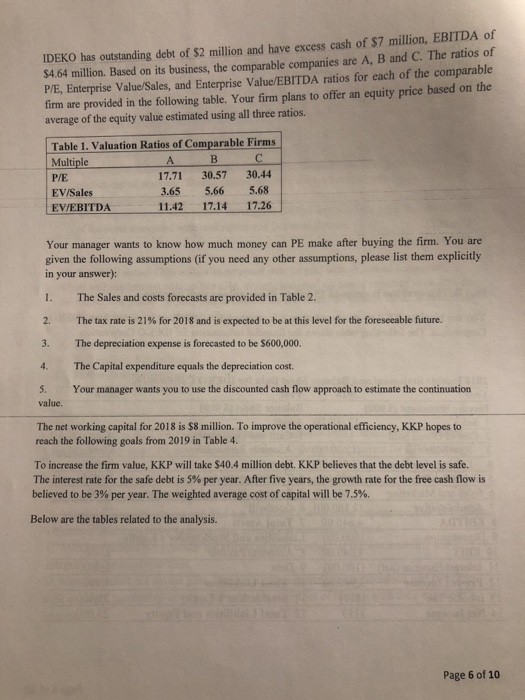

IDEKO has outstanding debt of S2 milion and have excess cash of $7 million, EBITDA of $4.64 million. Based on its business, the comparable companies are A, B and C. The ratios of P/E, Enterprise Value/Sales, and Enterprise Value/EBITDA ratios for each of the comparable firm are provided in the following table. Your firm plans to offer an equity price based on the average of the equity value estimated using all three ratios. Table 1. Valuation Ratios of Comparable Firms Multiple P/E EV/Sales EV/EBITDA 17.71 30.57 30.44 3.65 5.66 5.68 11.42 17.14 17.26 Your manager wants to know how much money can PE make after buying the firm. You are given the following assumptions (if you need any other assumptions, please list them explicitly in your answer): 1. The Sales and costs forecasts are provided in Table 2. The tax rate is 21% for 2018 and is expected to be at this level for the foreseeable future. The depreciation expense is forecasted to be $600,000. The Capital expenditure equals the depreciation cost. Your manager wants you to use the discounted cash flow approach to estimate the continuation 3. 4. value. The net working capital for 2018 is $8 million. To improve the operational efficiency, KKP hopes to reach the following goals from 2019 in Table 4. To increase the firm value, KKP will take $40.4 million debt. KKP believes that the debt level is safe. The interest rate for the safe debt is 5% per year. After five years, the growth rate for the free cash flow is believed to be 3% per year. The weighted average cost of capital will be 7.5%. Below are the tables related to the analysis. Page 6 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started