Question

From the above table we can see that the companys total liabilities are increasing at a much faster rate than its assets over the years.

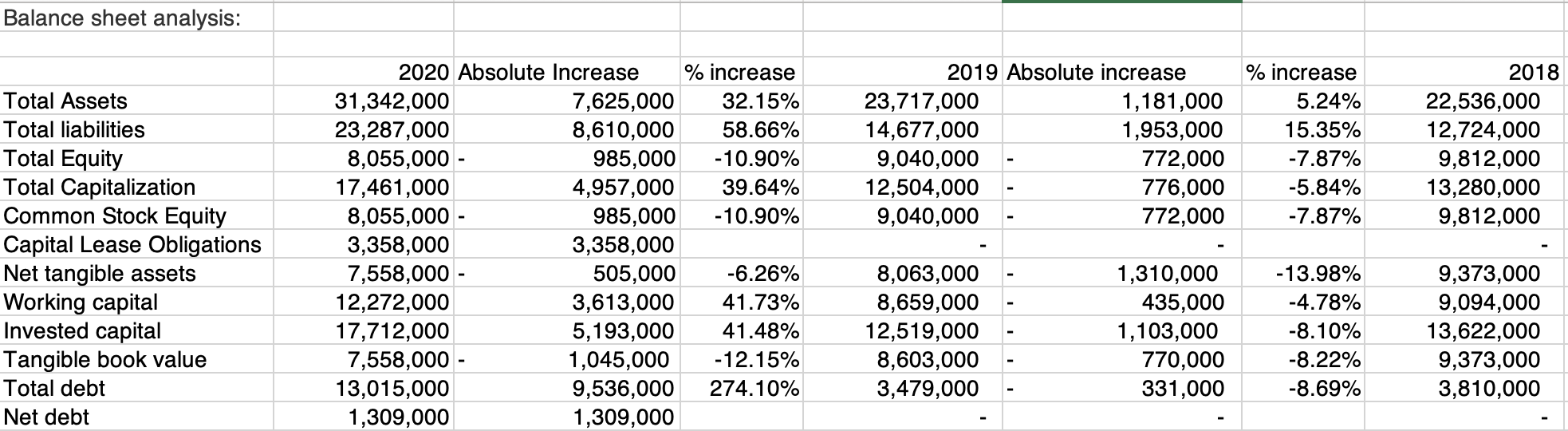

From the above table we can see that the companys total liabilities are increasing at a much faster rate than its assets over the years. On the other hand its equity is falling. This is a cause of concern as it shows that the companys debt ratio is increasing and the company is making higher use of leverage exposing it to financial risks associated with high use of debt. In fact total debt for the company increased by an alarmingly high rate of 274% in 2020 over the last period of 2019. We can see the negative repercussion of all this in the form of fall in the companys tangible book value both in 2020 and 2019 compared to their previous years.

From the above table we can see that the companys total liabilities are increasing at a much faster rate than its assets over the years. On the other hand its equity is falling. This is a cause of concern as it shows that the companys debt ratio is increasing and the company is making higher use of leverage exposing it to financial risks associated with high use of debt. In fact total debt for the company increased by an alarmingly high rate of 274% in 2020 over the last period of 2019. We can see the negative repercussion of all this in the form of fall in the companys tangible book value both in 2020 and 2019 compared to their previous years.

1. What are the total assets, liabilities, and shareholder equity for each year? How have these numbers changed over the three years and what could be some reasons why these numbers have changed the way they have?

Balance sheet analysis: 2019 Absolute increase 23,717,000 1,181,000 14,677,000 1,953,000 9,040,000 772,000 12,504,000 776,000 9,040,000 772,000 % increase 5.24% 15.35% -7.87% -5.84% -7.87% 2018 22,536,000 12,724,000 9,812,000 13,280,000 9,812,000 Total Assets Total liabilities Total Equity Total Capitalization Common Stock Equity Capital Lease Obligations Net tangible assets Working capital Invested capital Tangible book value Total debt Net debt 2020 Absolute Increase % increase 31,342,000 7,625,000 32.15% 23,287,000 8,610,000 58.66% 8,055,000 - 985,000 -10.90% 17,461,000 4,957,000 39.64% 8,055,000 - 985,000 -10.90% 3,358,000 3,358,000 7,558,000 - 505,000 -6.26% 12,272,000 3,613,000 41.73% 17,712,000 5,193,000 41.48% 7,558,000 - 1,045,000 -12.15% 13,015,000 9,536,000 274.10% 1,309,000 1,309,000 8,063,000 8,659,000 12,519,000 8,603,000 3,479,000 1,310,000 435,000 1,103,000 770,000 331,000 -13.98% -4.78% -8.10% -8.22% -8.69% 9,373,000 9,094,000 13,622,000 9,373,000 3,810,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started