Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the available financial information to you, Please demonstrate the following: a) Cost Benefit Analysis b) Break even Analysis as we discussed in the

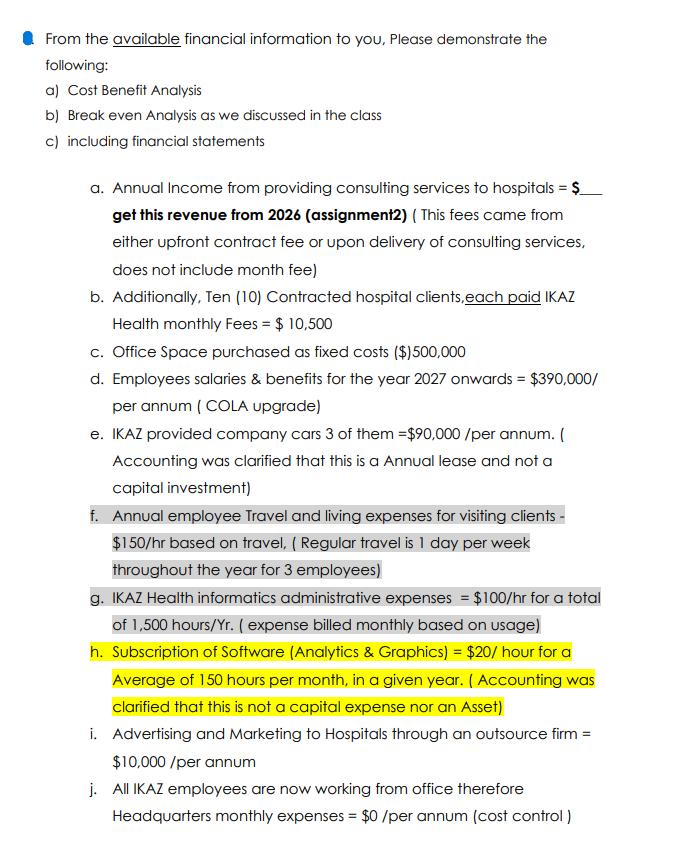

From the available financial information to you, Please demonstrate the following: a) Cost Benefit Analysis b) Break even Analysis as we discussed in the class c) including financial statements a. Annual Income from providing consulting services to hospitals = $ get this revenue from 2026 (assignment2) (This fees came from either upfront contract fee or upon delivery of consulting services, does not include month fee) b. Additionally, Ten (10) Contracted hospital clients, each paid IKAZ Health monthly Fees = $10,500 c. Office Space purchased as fixed costs ($)500,000 d. Employees salaries & benefits for the year 2027 onwards = $390,000/ per annum (COLA upgrade) e. IKAZ provided company cars 3 of them =$90,000/per annum. ( Accounting was clarified that this is a Annual lease and not a capital investment) f. Annual employee Travel and living expenses for visiting clients - $150/hr based on travel, (Regular travel is 1 day per week throughout the year for 3 employees) g. IKAZ Health informatics administrative expenses = $100/hr for a total of 1,500 hours/Yr. ( expense billed monthly based on usage) h. Subscription of Software (Analytics & Graphics) = $20/hour for a Average of 150 hours per month, in a given year. (Accounting was clarified that this is not a capital expense nor an Asset) i. Advertising and Marketing to Hospitals through an outsource firm = $10,000/per annum j. All IKAZ employees are now working from office therefore Headquarters monthly expenses = $0 /per annum (cost control)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

IKAZ Health Financial Analysis CostBenefit Analysis Benefits Annual income from consulting services to hospitals to be determined from 2026 assignment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started