Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the below Excel, please analyze the: - Cost of Equity - Cost of Debt - Cost of Capital 40 41 Current beta- 1.47 42

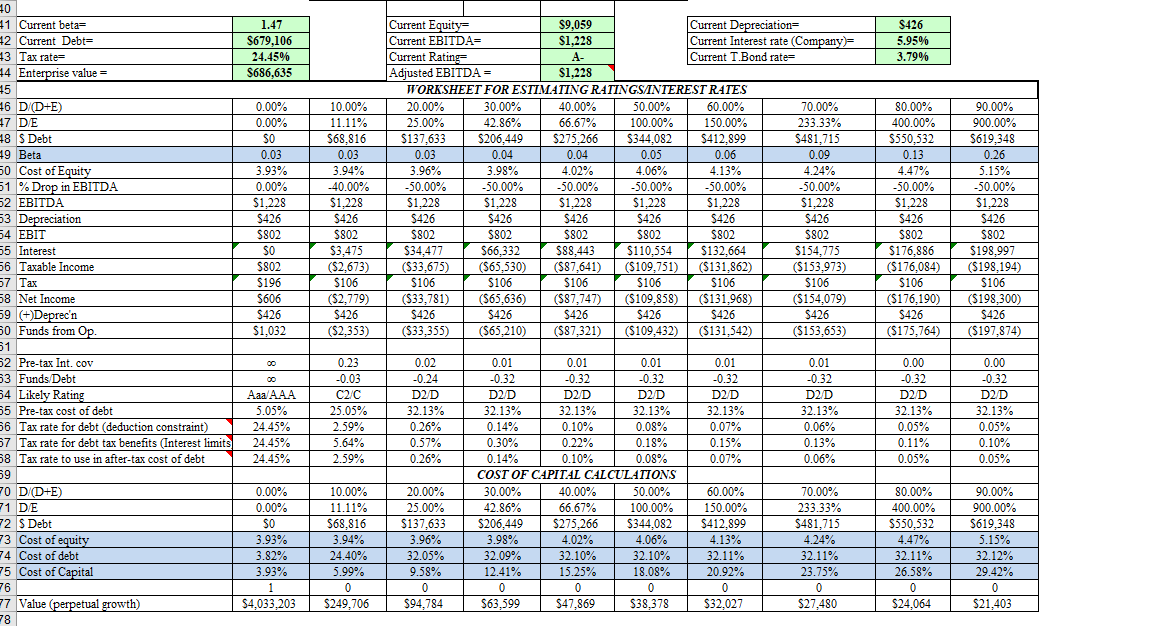

From the below Excel, please analyze the:

- Cost of Equity

- Cost of Debt

- Cost of Capital

40 41 Current beta- 1.47 42 Current Debt= $679,106 43 Tax rate= 24.45% 44 Enterprise value = $686,635 15 46 |D/(D+E) 47 D/E Current Equity Current EBITDA= $9,059 $1,228 Current Rating A- Current Depreciation= $426 Current Interest rate (Company)= 5.95% Current T.Bond rate= 3.79% Adjusted EBITDA = $1,228 WORKSHEET FOR ESTIMATING RATINGS/INTEREST RATES 0.00% 10.00% 20.00% 30.00% 40.00% 0.00% 11.11% 25.00% 42.86% 48 S Debt SO $68,816 $137,633 $206,449 49 Beta 0.03 0.03 0.03 0.04 66.67% $275,266 0.04 50.00% 100.00% 150.00% $344,082 $412,899 60.00% 70.00% 80.00% 90.00% 233.33% 400.00% 900.00% $481,715 $550,532 $619,348 0.05 0.06 0.09 0.13 0.26 50 Cost of Equity 3.93% 3.94% 3.96% 3.98% 4.02% 4.06% 4.13% 4.24% 4.47% 5.15% 51 % Drop in EBITDA 0.00% -40.00% -50.00% -50.00% -50.00% -50.00% -50.00% -50.00% -50.00% -50.00% 52 EBITDA $1,228 $1,228 $1,228 $1,228 $1,228 $1,228 $1,228 $1,228 $1,228 $1,228 53 Depreciation $426 $426 $426 $426 $426 $426 $426 $426 $426 $426 54 EBIT $802 $802 $802 $802 $802 $802 $802 $802 $802 $802 55 Interest SO $3,475 $34,477 56 Taxable Income $802 ($2,673) 57 Tax $196 $106 ($33,675) $106 58 Net Income $606 59 (+)Deprec'n $426 $426 50 Funds from Op. $1,032 ($2,353) ($2,779) ($33,781) $426 ($33,355) $66,332 $88,443 $132,664 ($65,530) ($87,641) ($109,751) ($131,862) $106 $106 $106 $106 ($65,636) ($87,747) ($109,858) ($131,968) $426 $426 $426 $426 ($65,210) ($87,321) ($109,432) ($131,542) $110,554 $154,775 $176,886 $198,997 ($153,973) $106 ($154,079) $426 ($153,653) ($176,084) ($198,194) $106 $106 ($176,190) ($198,300) $426 $426 ($175,764) ($197,874) 51 52 Pre-tax Int. cov 00 0.23 0.02 0.01 0.01 0.01 0.01 0.01 0.00 0.00 63 Funds/Debt 00 -0.03 -0.24 -0.32 -0.32 -0.32 -0.32 -0.32 -0.32 -0.32 64 Likely Rating Aaa/AAA C2/C D2/D D2/D D2/D D2/D D2/D D2/D D2/D D2/D 55 Pre-tax cost of debt 5.05% 25.05% 32.13% 32.13% 32.13% 32.13% 32.13% 32.13% 32.13% 32.13% 66 Tax rate for debt (deduction constraint) 24.45% 2.59% 0.26% 0.14% 0.10% 0.08% 0.07% 0.06% 0.05% 0.05% 67 Tax rate for debt tax benefits (Interest limits 24.45% 5.64% 0.57% 0.30% 0.22% 0.18% 0.15% 0.13% 0.11% 0.10% 58 Tax rate to use in after-tax cost of debt 24.45% 2.59% 0.26% 0.14% 0.10% 0.08% 0.07% 0.06% 0.05% 0.05% 69 COST OF CAPITAL CALCULATIONS 70 D/(D+E) 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 71 D/E 72 S Debt 73 Cost of equity 0.00% 11.11% 25.00% 42.86% 66.67% 100.00% 150.00% 233.33% 400.00% 900.00% SO $68,816 $137,633 $206,449 $275,266 $344,082 $412,899 $481,715 $550,532 $619,348 3.93% 3.94% 3.96% 3.98% 4.02% 4.06% 4.13% 4.24% 4.47% 5.15% 74 Cost of debt 3.82% 24.40% 32.05% 32.09% 32.10% 32.10% 32.11% 32.11% 32.11% 32.12% 75 Cost of Capital 3.93% 5.99% 9.58% 12.41% 15.25% 18.08% 20.92% 23.75% 26.58% 29.42% 76 1 0 0 0 0 0 0 0 0 0 7 Value (perpetual growth) $4,033,203 $249,706 $94,784 $63,599 $47,869 $38,378 $32,027 $27,480 $24,064 $21,403 78

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started