Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the book: Principles of Finance with excel by Benninga, Mofkadi. Ch.2 exercise 23. please fill out the excell and state the excel functions and

From the book: Principles of Finance with excel by Benninga, Mofkadi. Ch.2 exercise 23. please fill out the excell and state the excel functions and equations for each cell.

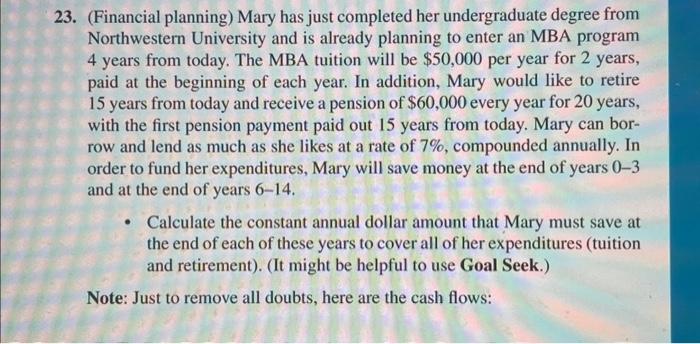

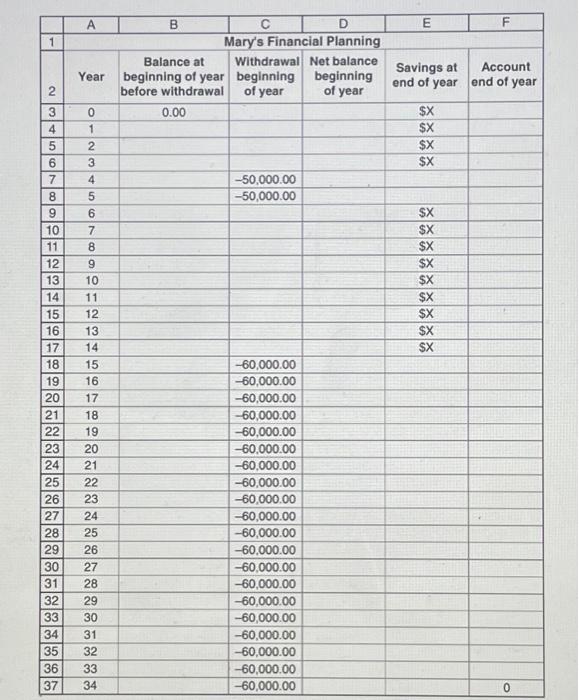

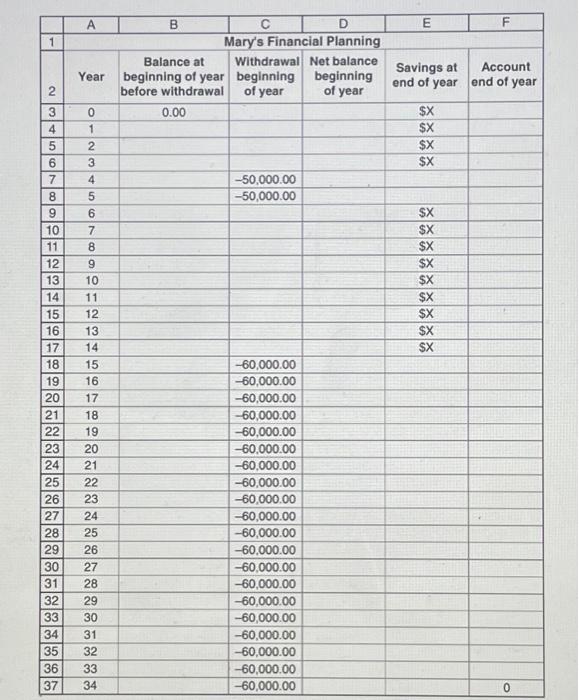

23. (Financial planning) Mary has just completed her undergraduate degree from Northwestern University and is already planning to enter an MBA program 4 years from today. The MBA tuition will be $50,000 per year for 2 years, paid at the beginning of each year. In addition, Mary would like to retire 15 years from today and receive a pension of $60,000 every year for 20 years, with the first pension payment paid out 15 years from today. Mary can borrow and lend as much as she likes at a rate of 7%, compounded annually. In order to fund her expenditures, Mary will save money at the end of years 03 and at the end of years 6-14. - Calculate the constant annual dollar amount that Mary must save at the end of each of these years to cover all of her expenditures (tuition and retirement). (It might be helpful to use Goal Seek.) Note: Just to remove all doubts, here are the cash flows: 23. (Financial planning) Mary has just completed her undergraduate degree from Northwestern University and is already planning to enter an MBA program 4 years from today. The MBA tuition will be $50,000 per year for 2 years, paid at the beginning of each year. In addition, Mary would like to retire 15 years from today and receive a pension of $60,000 every year for 20 years, with the first pension payment paid out 15 years from today. Mary can borrow and lend as much as she likes at a rate of 7%, compounded annually. In order to fund her expenditures, Mary will save money at the end of years 03 and at the end of years 6-14. - Calculate the constant annual dollar amount that Mary must save at the end of each of these years to cover all of her expenditures (tuition and retirement). (It might be helpful to use Goal Seek.) Note: Just to remove all doubts, here are the cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started