Answered step by step

Verified Expert Solution

Question

1 Approved Answer

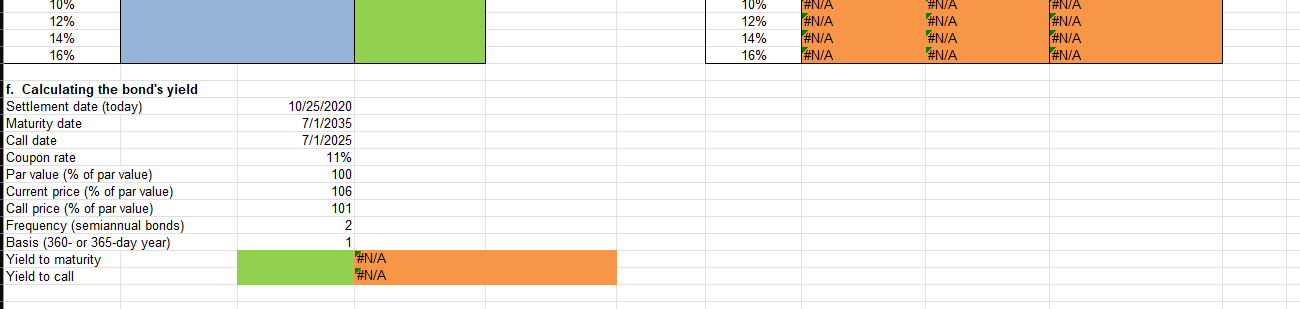

from the date of issue at a call price of $1,010. Use your spreadsheet to find the bond's yield. Round your answers to two decimal

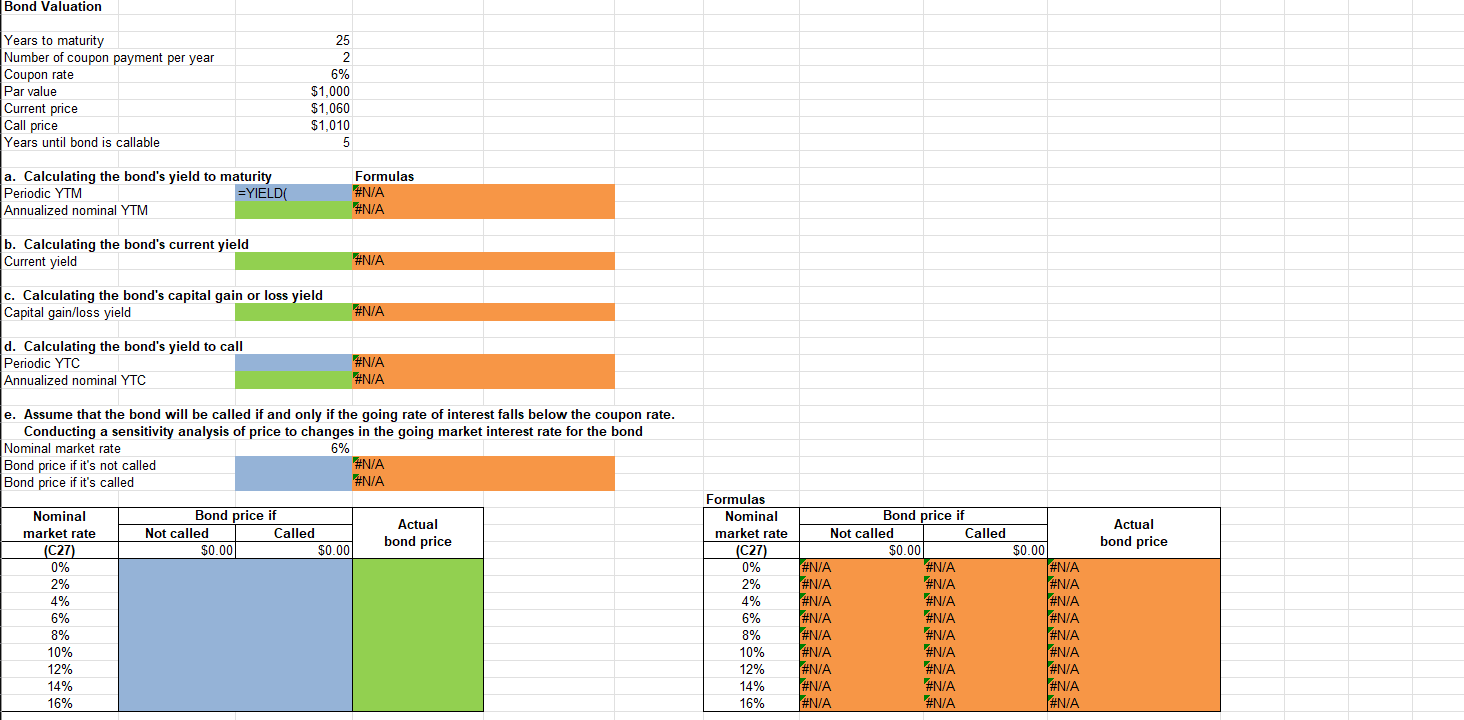

from the date of issue at a call price of $1,010. Use your spreadsheet to find the bond's yield. Round your answers to two decimal places. Yield to maturity: Yield to call: % % the bond has just been issued.) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. X Download spreadsheet Ch04 P24 Build a Model-025185.xlsx a. What is the bond's yield to maturity? Round your answer to two decimal places. % b. What is the bond's current yield? Round your answer to two decimal places. % c. What is the bond's capital gain or loss yield? Round your answer to two decimal places. Use a minus sign to enter a negative value, if any. % d. What is the bond's yield to call? Round your answer to two decimal places. % called if and only if the going rate of interest fa/ls below the coupon rate. This is an oversimplification, but assume it for purposes of this problem.) Round your answers to the nearest cent

from the date of issue at a call price of $1,010. Use your spreadsheet to find the bond's yield. Round your answers to two decimal places. Yield to maturity: Yield to call: % % the bond has just been issued.) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. X Download spreadsheet Ch04 P24 Build a Model-025185.xlsx a. What is the bond's yield to maturity? Round your answer to two decimal places. % b. What is the bond's current yield? Round your answer to two decimal places. % c. What is the bond's capital gain or loss yield? Round your answer to two decimal places. Use a minus sign to enter a negative value, if any. % d. What is the bond's yield to call? Round your answer to two decimal places. % called if and only if the going rate of interest fa/ls below the coupon rate. This is an oversimplification, but assume it for purposes of this problem.) Round your answers to the nearest cent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started