Question

From the financial statements provided, calculate: i. The dividend yield for both years. (8 marks) ii. The PE ratios for both years ( 8 marks)

From the financial statements provided, calculate:

i. The dividend yield for both years. (8 marks)

ii. The PE ratios for both years ( 8 marks)

iii. The dividend payout ratio for both years (5 marks)

iv. Explain the significance of Dividend Yield and PE ratio to investors.

B. Write a report to the CEO of the company you have chosen and provide an analysis of the results in Part A for the two years?

C. Make recommendations to the CEO about actions to be taken to improve the dividend yield, PE ratios, and dividend payout ratios?

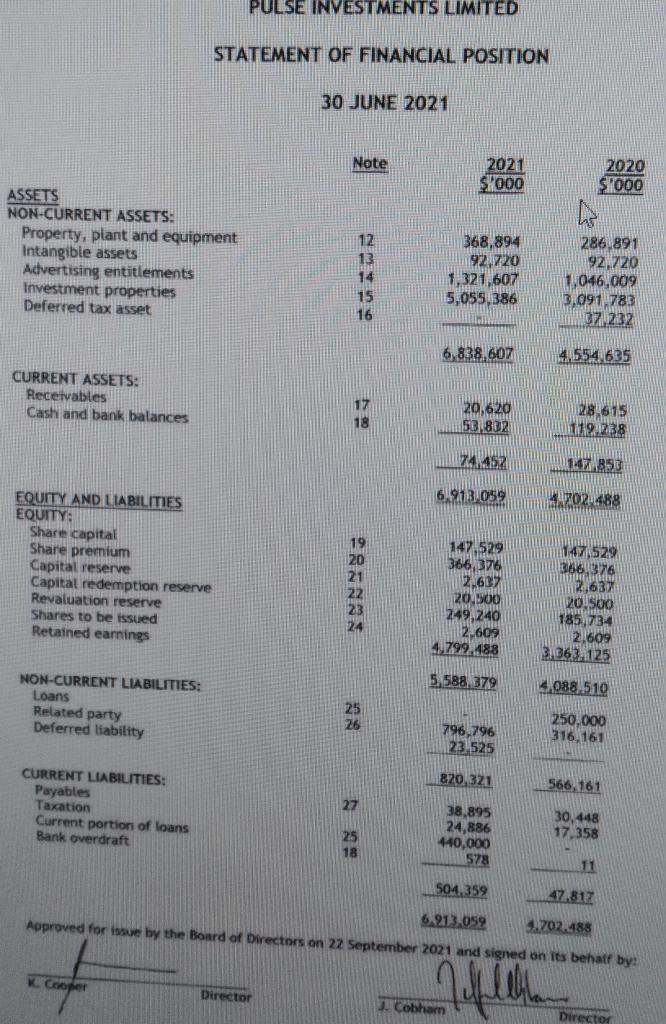

ASSETS NON-CURRENT ASSETS: Property, plant and equipment Intangible assets Advertising entitlements Investment properties Deferred tax asset CURRENT ASSETS: Receivables Cash and bank balances EQUITY AND LIABILITIES EQUITY: Share capital Share premium Capital reserve Capital redemption reserve Revaluation reserve Shares to be issued Retained earnings NON-CURRENT LIABILITIES: Loans Related party Deferred liability PULSE INVESTMENTS LIMITED STATEMENT OF FINANCIAL POSITION 30 JUNE 2021 CURRENT LIABILITIES: Payables Taxation Current portion of loans Bank overdraft K. Cooper Note Director 18 PANNON 2021 $'000 368.894 92,720 1,321,607 5,055,386 6,838,607 20,620 53,832 74.457 6.913.059 147.529 366,376 2,637 20.500 249,240 2,609 4.799.488 5,588,379 796,796 23.525 820,321 38,895 24,886 440,000 578 J. Cobham 504,359 6.913.059 2020 $'000 286,891 92,720 1,046,009 3,091,783 37.232 4.554.635 28.615 119.238 147,853 4.702-488 147,529 366.376 2,637 47.817 4.702.488 Approved for issue by the Board of Directors on 22 September 2021 and signed on its behalf by: 20.500 185,734 2,609 3.363.125 4,088.510 250.000 316,161 566,161 30,448 17,358 11 Director

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i The dividend yield for both years The dividend yield is a measure of the return that an investor receives from a companys di vidend payments The dividend yield is calculated by dividing the annual d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started