Answered step by step

Verified Expert Solution

Question

1 Approved Answer

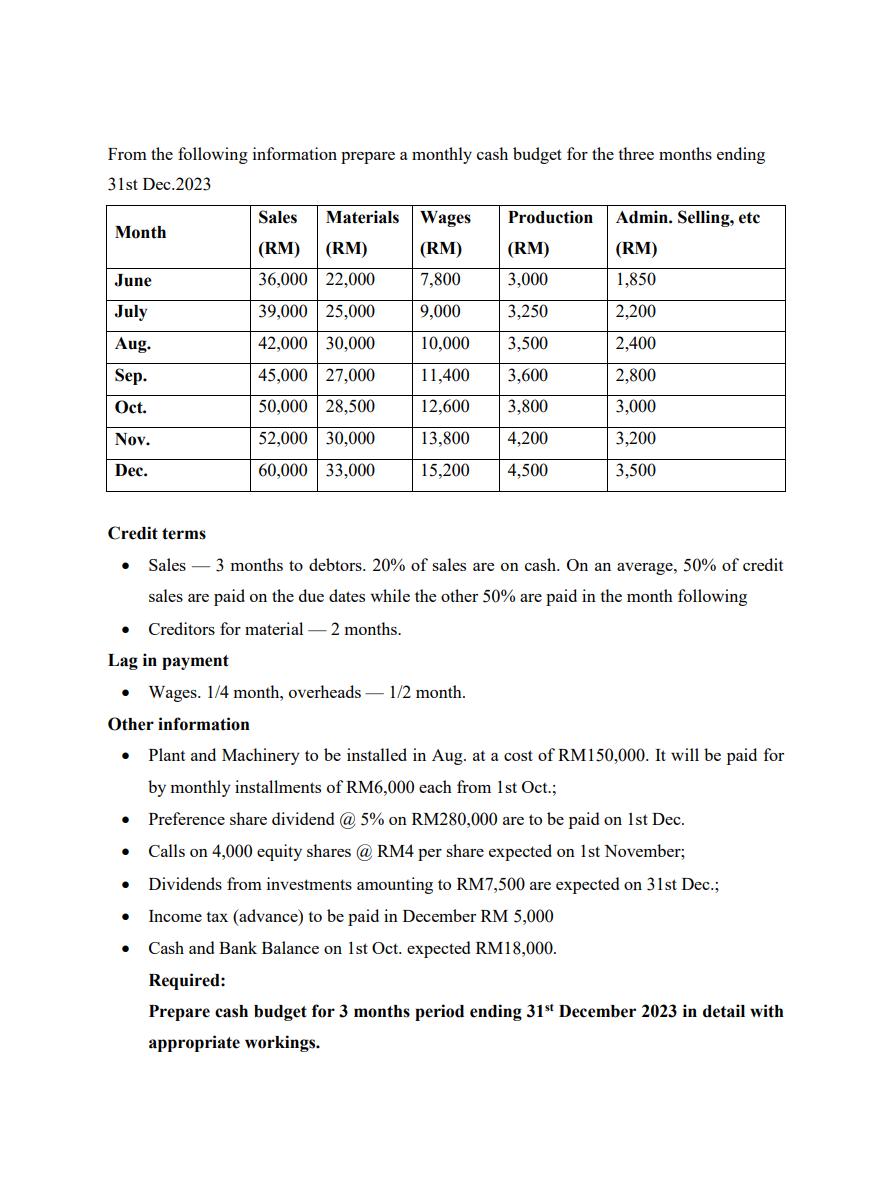

From the following information prepare a monthly cash budget for the three months ending 31st Dec.2023 Month June July Aug. Sep. Oct. Nov. Dec.

From the following information prepare a monthly cash budget for the three months ending 31st Dec.2023 Month June July Aug. Sep. Oct. Nov. Dec. Credit terms Sales 3 months to debtors. 20% of sales are on cash. On an average, 50% of credit sales are paid on the due dates while the other 50% are paid in the month following Creditors for material - 2 months. Lag in payment Sales Materials (RM) (RM) 36,000 22,000 39,000 25,000 42,000 30,000 45,000 27,000 50,000 28,500 52,000 30,000 60,000 33,000 Wages (RM) (RM) 7,800 3,000 9,000 3,250 10,000 3,500 11,400 3,600 12,600 3,800 13,800 4,200 15,200 4,500 Other information Plant and Machinery to be installed in Aug. at a cost of RM150,000. It will be paid for by monthly installments of RM6,000 each from 1st Oct.; Preference share dividend @ 5% on RM280,000 are to be paid on 1st Dec. Calls on 4,000 equity shares @ RM4 per share expected on 1st November; Dividends from investments amounting to RM7,500 are expected on 31st Dec.; Income tax (advance) to be paid in December RM 5,000 Cash and Bank Balance on 1st Oct. expected RM18,000. Production Wages. 1/4 month, overheads - 1/2 month. Admin. Selling, etc (RM) 1,850 2,200 2,400 2,800 3,000 3,200 3,500 Required: Prepare cash budget for 3 months period ending 31st December 2023 in detail with appropriate workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This is a request to prepare a cash budget for the three months ending December 31 2023 by using the given information To prepare a cash budget we will have to consider the inflows and outflows of cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started