Answered step by step

Verified Expert Solution

Question

1 Approved Answer

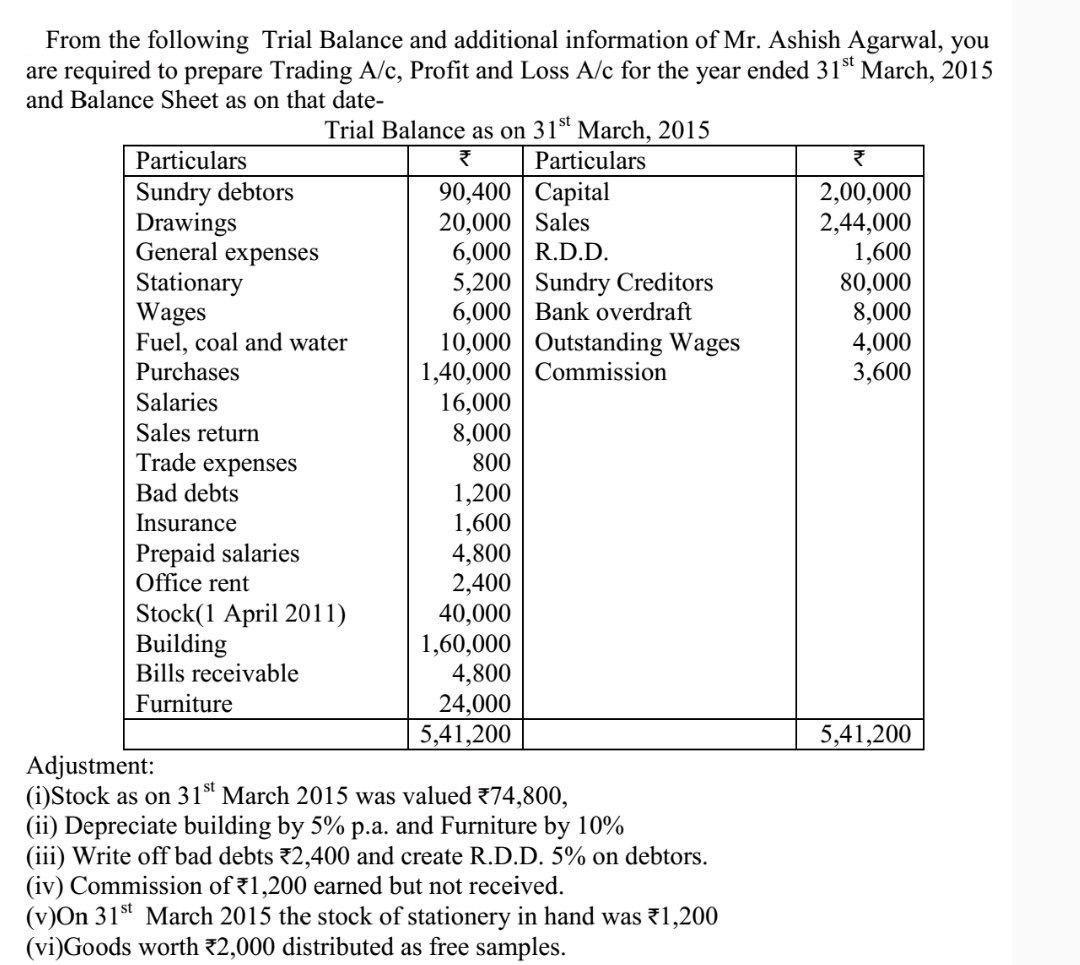

From the following Trial Balance and additional information of Mr. Ashish Agarwal, you are required to prepare Trading A/c, Profit and Loss A/c for

From the following Trial Balance and additional information of Mr. Ashish Agarwal, you are required to prepare Trading A/c, Profit and Loss A/c for the year ended 31st March, 2015 and Balance Sheet as on that date- Particulars Sundry debtors Drawings General expenses Stationary Wages Fuel, coal and water Purchases Salaries Sales return Tr Bad debts expenses Trial Balance as on 31st March, 2015 Insurance Prepaid salaries Office rent Stock(1 April 2011) Building Bills receivable Furniture Particulars 90,400 Capital 20,000 Sales 6,000 R.D.D. 5,200 Sundry Creditors 6,000 Bank overdraft 10,000 1,40,000 Commission 16,000 8,000 1,200 1,600 4,800 2,400 40,000 1,60,000 4,800 24,000 5,41,200 Outstanding Wages Adjustment: (i)Stock as on 31st March 2015 was valued *74,800, (ii) Depreciate building by 5% p.a. and Furniture by 10% (iii) Write off bad debts 2,400 and create R.D.D. 5% on debtors. (iv) Commission of 1,200 earned but not received. (v)On 31st March 2015 the stock of stationery in hand was 1,200 (vi)Goods worth 2,000 distributed as free samples. 2,00,000 2,44,000 1,600 80,000 8,000 4,000 3,600 5,41,200

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Particular Opening stock Purchase Gross profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started