Answered step by step

Verified Expert Solution

Question

1 Approved Answer

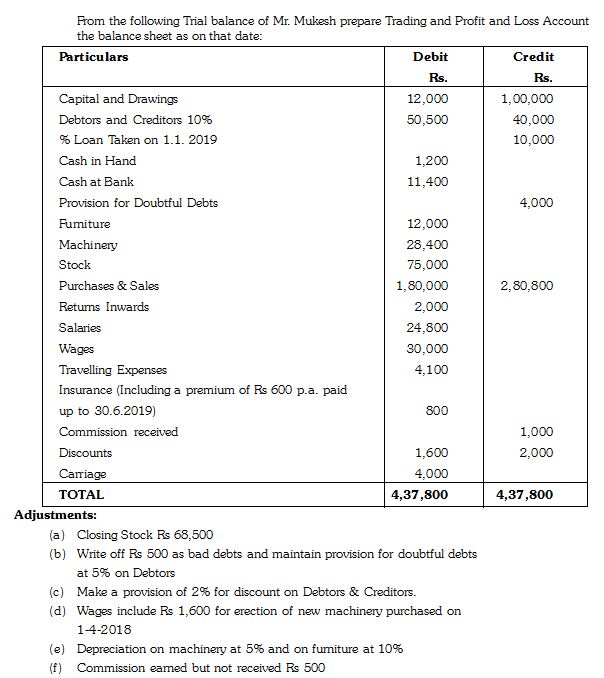

From the following Trial balance of Mr. Mukesh prepare Trading and Profit and Loss Account the balance sheet as on that date: Particulars Debit

From the following Trial balance of Mr. Mukesh prepare Trading and Profit and Loss Account the balance sheet as on that date: Particulars Debit Credit Rs. Rs. Capital and Drawings 12,000 1,00,000 Debtors and Creditors 10% 50,500 40,000 % Loan Taken on 1.1. 2019 10,000 Cash in Hand 1,200 Cash at Bank 11,400 Provision for Doubtful Debts 4,000 Furniture 12,000 Machinery 28,400 Stock 75,000 Purchases & Sales 1,80,000 2,80,800 Returns Inwards 2,000 Salaries 24,800 Wages 30,000 Travelling Expenses 4,100 Insurance (Including a premium of Rs 600 p.a. paid up to 30.6.2019) Commission received Discounts Carriage TOTAL Adjustments: (a) Closing Stock Rs 68,500 800 1,000 1,600 2,000 4,000 4,37,800 4,37,800 (b) Write off Rs 500 as bad debts and maintain provision for doubtful debts at 5% on Debtors (c) Make a provision of 2% for discount on Debtors & Creditors. (d) Wages include Rs 1,600 for erection of new machinery purchased on 1-4-2018 (e) Depreciation on machinery at 5% and on furniture at 10% (f) Commission eamed but not received Rs 500

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Trading and Profit and Loss Account for the year ended Date Particulars Amount Rs Sales 28080...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started