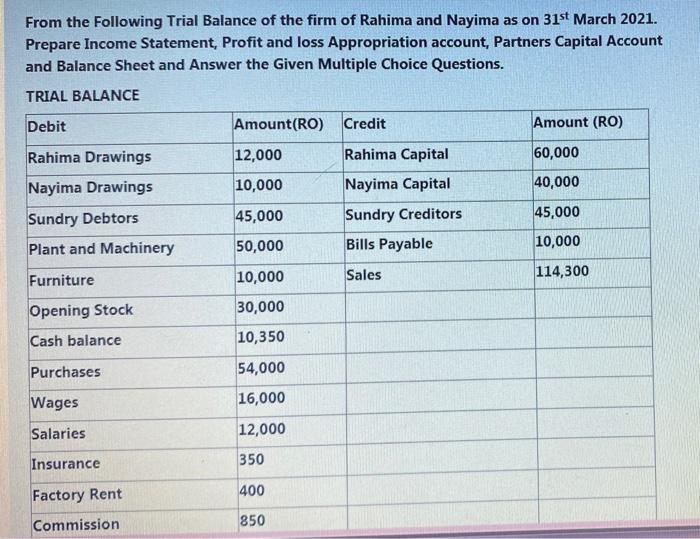

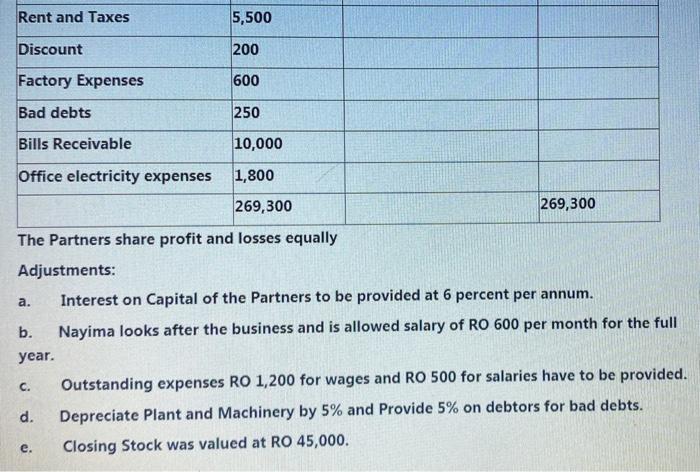

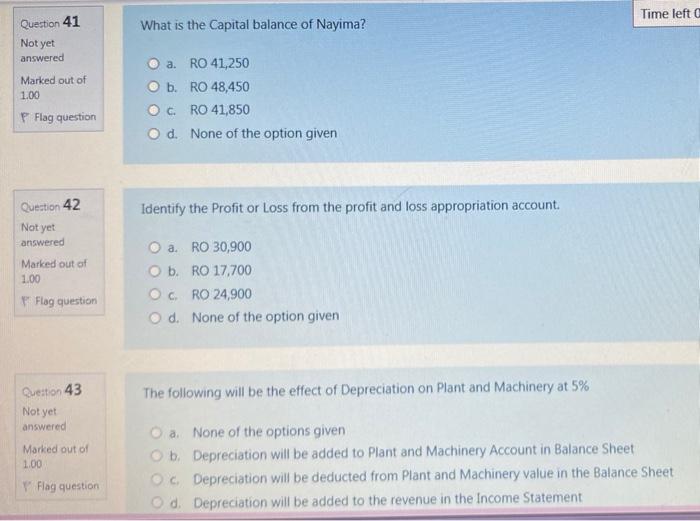

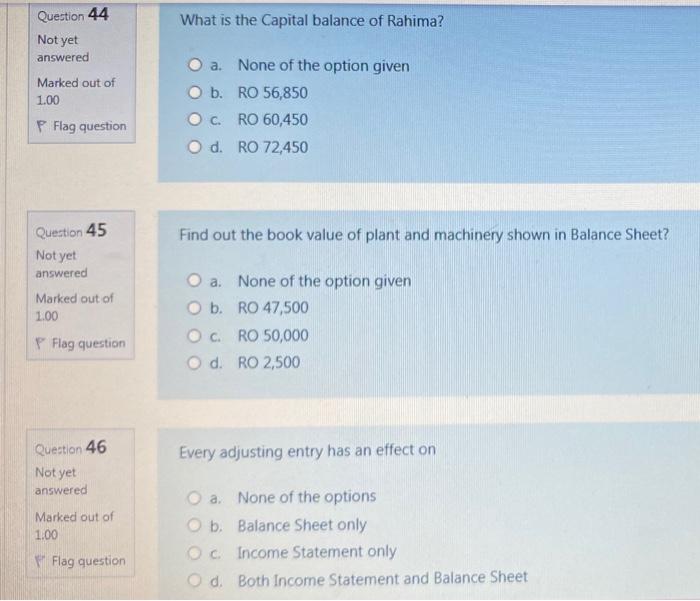

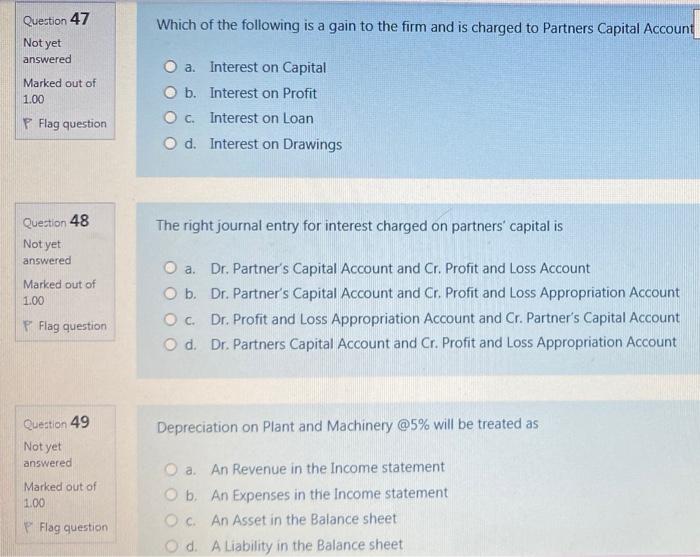

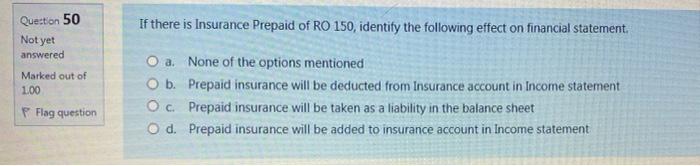

From the following Trial Balance of the firm of Rahima and Nayima as on 31st March 2021. Prepare Income Statement, Profit and loss Appropriation account, Partners Capital Account and Balance Sheet and Answer the Given Multiple Choice Questions. TRIAL BALANCE Debit Amount(RO) Credit Amount (RO) 12,000 Rahima Capital 60,000 40,000 10,000 Nayima Capital Rahima Drawings Nayima Drawings Sundry Debtors Plant and Machinery 45,000 Sundry Creditors 45,000 50,000 Bills Payable 10,000 Furniture 10,000 Sales 114,300 Opening Stock 30,000 Cash balance 10,350 Purchases 54,000 Wages 16,000 Salaries 12,000 Insurance 350 Factory Rent 400 Commission 850 Rent and Taxes 5,500 Discount 200 Factory Expenses 600 Bad debts 250 Bills Receivable 10,000 Office electricity expenses 1,800 269,300 269,300 The Partners share profit and losses equally Adjustments: a. Interest on Capital of the Partners to be provided at 6 percent per annum. b. Nayima looks after the business and is allowed salary of RO 600 per month for the full year. Outstanding expenses RO 1,200 for wages and RO 500 for salaries have to be provided. d. Depreciate Plant and Machinery by 5% and Provide 5% on debtors for bad debts. Closing Stock was valued at RO 45,000. C. e. Time left Question 41 What is the Capital balance of Nayima? Not yet answered Marked out of 1.00 O a RO 41,250 O b. RO 48,450 Oc RO 41,850 O d. None of the option given P Flag question Question 42 Identify the Profit or Loss from the profit and loss appropriation account Not yet answered Marked out of 1.00 a. RO 30,900 O b. RO 17,700 OC RO 24,900 d. None of the option given Flag question Question 43 The following will be the effect of Depreciation on Plant and Machinery at 5% Not yet answered Marked out of 1.00 a. None of the options given b. Depreciation will be added to plant and Machinery Account in Balance Sheet OC Depreciation will be deducted from Plant and Machinery value in the Balance Sheet Od Depreciation will be added to the revenue in the Income Statement Flag question Question 44 What is the Capital balance of Rahima? Not yet answered Marked out of 1.00 O a. None of the option given b. RO 56,850 Oc. RO 60,450 O d. RO 72,450 P Flag question Question 45 Find out the book value of plant and machinery shown in Balance Sheet? Not yet answered Marked out of 1.00 O a. None of the option given O b. RO 47,500 Oc RO 50,000 O d.RO 2,500 P Flag question Question 46 Every adjusting entry has an effect on Not yet answered Marked out of 1.00 O a. None of the options b. Balance Sheet only OC Income Statement only Od. Both Income Statement and Balance Sheet Flag question Question 47 Which of the following is a gain to the firm and is charged to Partners Capital Account Not yet answered Marked out of 1.00 O a. Interest on Capital b. Interest on Profit O c. Interest on Loan O d. Interest on Drawings P Flag question Question 48 The right journal entry for interest charged on partners' capital is Not yet answered Marked out of 1.00 O a. Dr. Partner's Capital Account and Cr. Profit and Loss Account O b. Dr. Partner's Capital Account and Cr. Profit and Loss Appropriation Account OC. Dr. Profit and Loss Appropriation Account and Cr. Partner's Capital Account O d. Dr. Partners Capital Account and Cr. Profit and Loss Appropriation Account P Flag question Question 49 Depreciation on Plant and Machinery @5% will be treated as Not yet answered Marked out of 1.00 a. An Revenue in the Income statement b. An Expenses in the Income statement c. An Asset in the Balance sheet Od A Liability in the Balance sheet Flag question Question 50 If there is Insurance Prepaid of RO 150, identify the following effect on financial statement. Not yet answered Marked out of 1.00 O a None of the options mentioned O b. Prepaid insurance will be deducted from Insurance account in Income statement Oc. Prepaid insurance will be taken as a liability in the balance sheet O d. Prepaid insurance will be added to insurance account in Income statement Flag