Question

From the Franklin Lumber Case 21 ( Capital Budgeting Procedures ) Q1 - Calculate the annual cash flows of the Dakota (the Nakoi's cash flow

From the Franklin Lumber Case 21 ( Capital Budgeting Procedures )

Q1 - Calculate the annual cash flows of the Dakota (the Nakoi's cash flow is 265,820 per year , not including its after - tax terminal value)

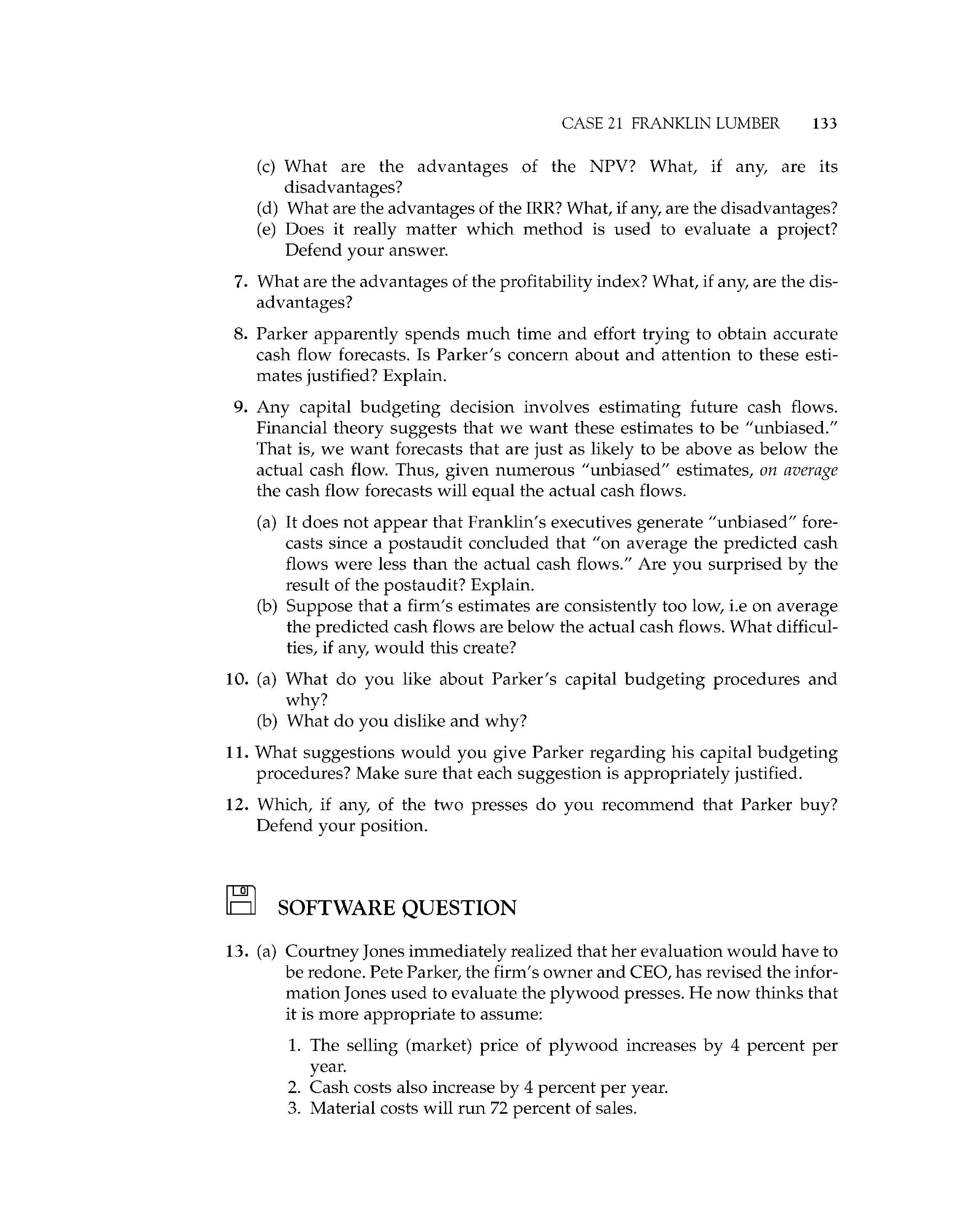

Q2- Calculate the Dakota's :

a- Payback period

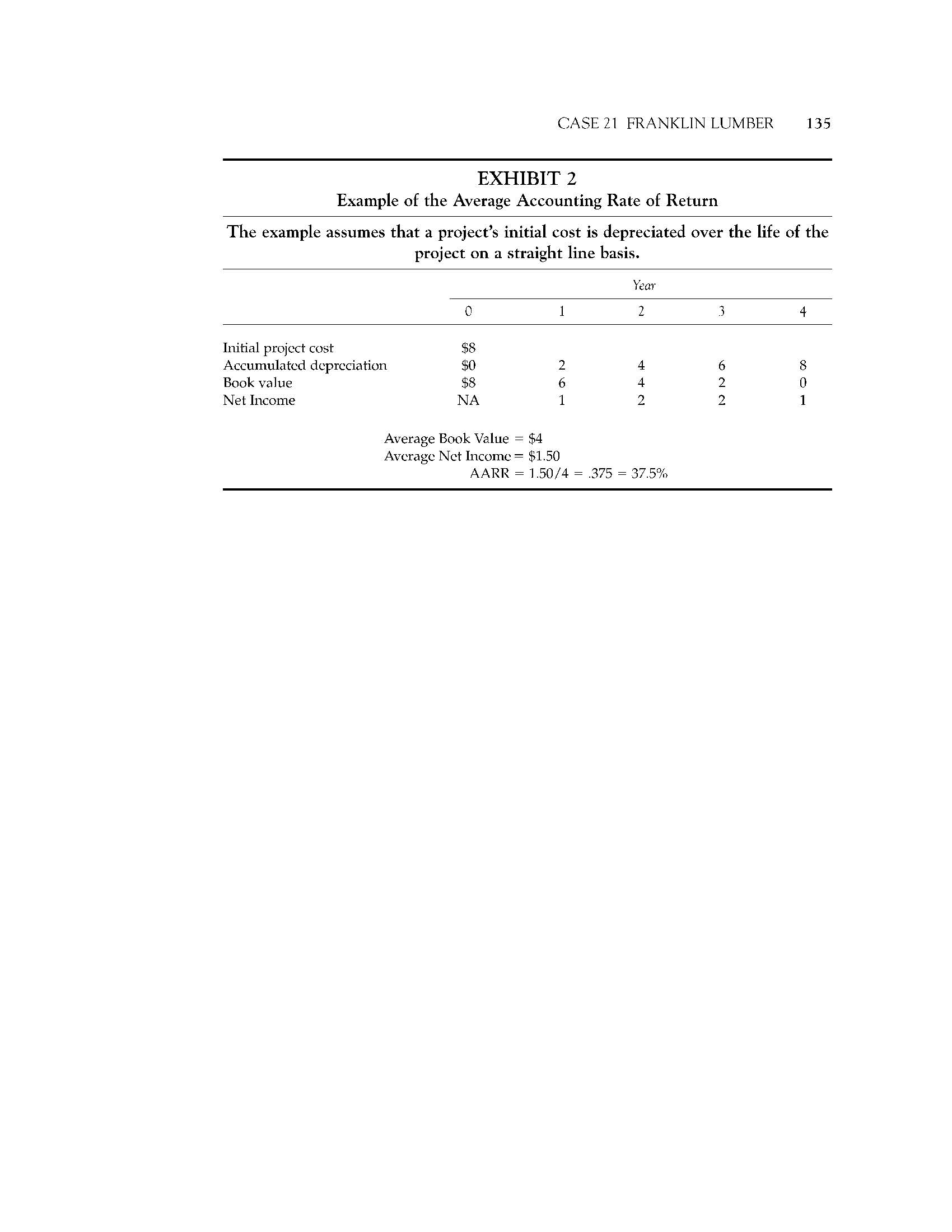

b- Average accounting rate of return (AARR)

c- IRR

Q3- Rank the plywood presses by the five techniques listed in question 2

Q4- Do the techniques rank the projects the same ? If not , why do the rankings differ ?

Q5- Parker's two primary capital budgeting methods are the payback and the average accounting rate of return.

a- What are the disadvantages of the payback ? What , if any, are its advantages?

b- What are the disadvantages of the AARR ? What , if any , are it's advantages?

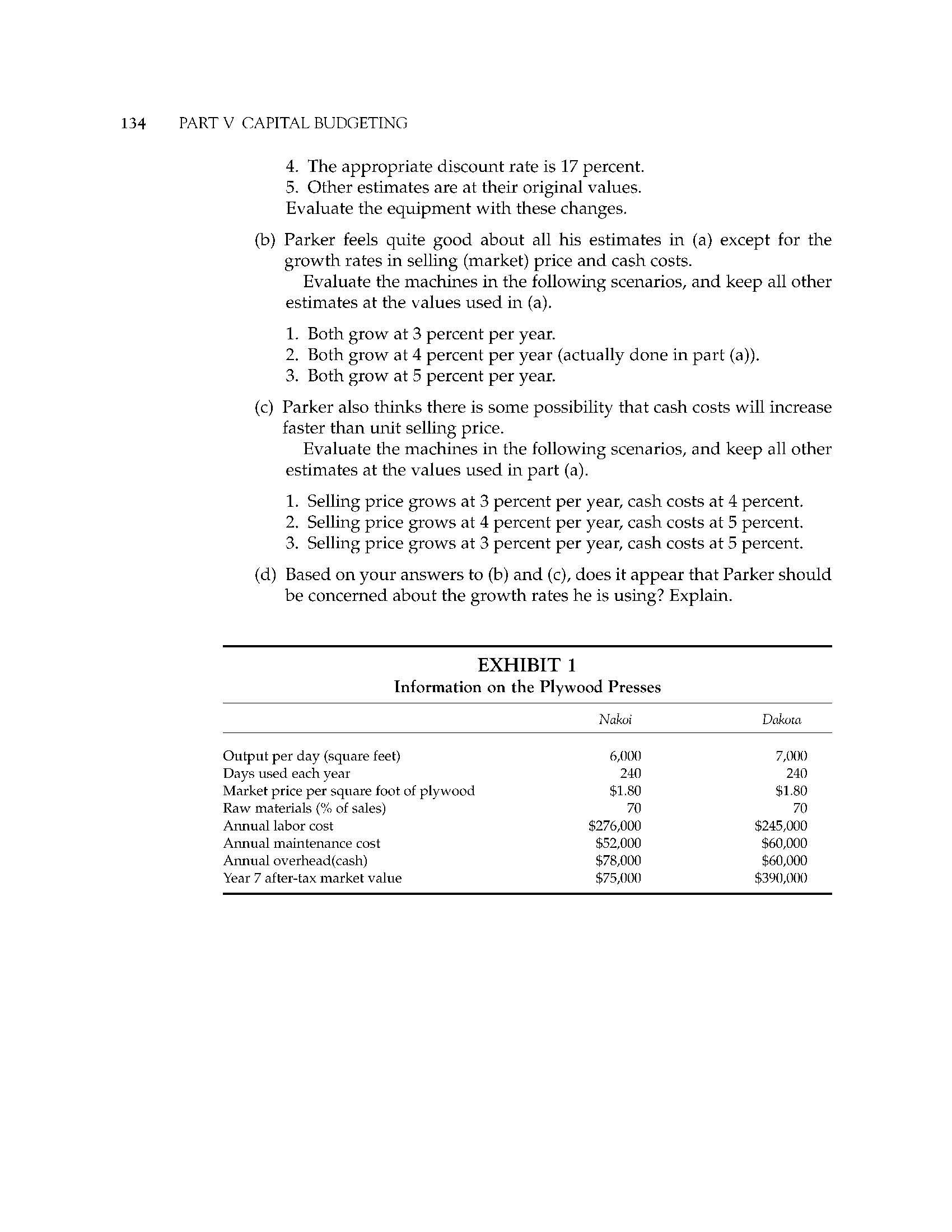

CASE 2 1 FRANKLIN LUMBER CAPITAL BUDGETING PROCEDURES Pete Parker, the owner and CEO of Franklin Lumber, is being quite frank with Courtney Jones, a recent hire. "As I told you at our interview, I'm hiring you despite your MBA. I haven't had good experiences with MBA's. They tend to be too technical, lack communication skills, and view problems as mere aca- demic exercises. But vou seem to be different. Your recommendations cited vour sensitivity to real-world complexities and I've been impressed with vour communication and people skills. I think you can help us. Jones received her MBA four weeks ago from a southern university with a strong regional and a bit of a national reputation. She received a number of "big city" job offers but turned them down to accept a position with Franklin Lumber, a firm based in Lenoir, North Carolina. The company has four plants in the southeast, and primarily manufactures lumber that is used to produce various types of furniture such as desks and doors Jones took the job because she wanted a position with a small firm where she "could make a difference," the company is located very near her family, and the compensation is surprisingly attractive. She is also impressed with Parker Though a bit gruff, he seems sharp, fair, direct, and willing to give her much job freedom and responsibility. In fact, her first assignment is of some importance and consists of two parts. Parker wants Jones to (1) perform a financial evalua- tion on two new machines that he is considering and (2) "critique" the com pany's capital budgeting policies. PLYWOOD PRESSES The plywood division is an important component of the firm's business and nearly two entire plants are devoted to the production of plywood panels. InStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started