Question

From the given case information, calculate the firms WACC; then use the WACC to calculate NPV and evaluate IRR for proposed capital budgeting projects with

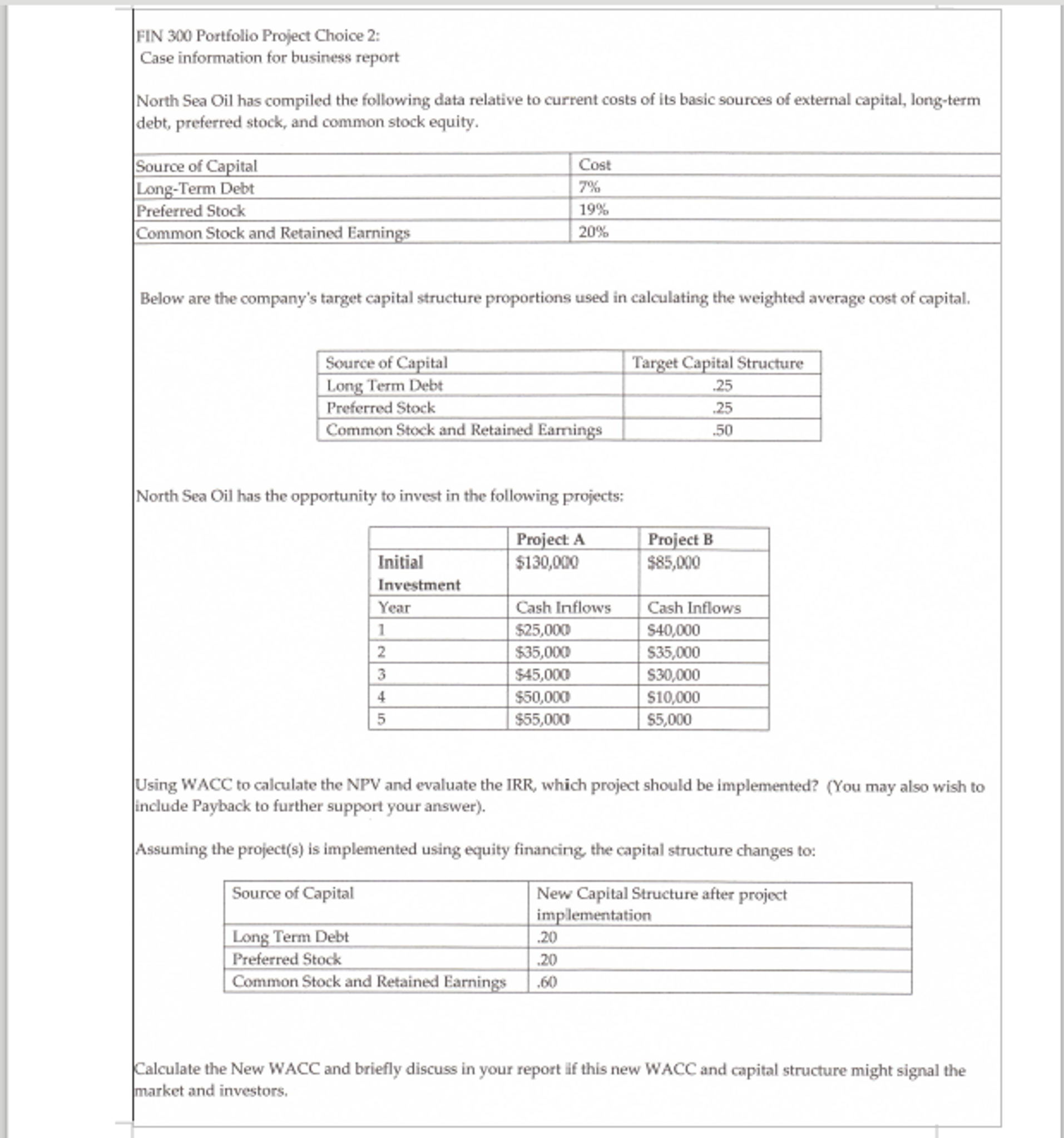

From the given case information, calculate the firms WACC; then use the WACC to calculate NPV and evaluate IRR for proposed capital budgeting projects with a capital rationing constraint. After you choose the project(s), recalculate the capital structure based on the assumption that the project(s) are implemented and determine if the new capital structure will signal the investors either positively, negatively, or not at all. Write a business report on your findings. Include an executive summary and appendices if applicable. See rubric for specific graded criteria. Click on the attached document for additional information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started