Answered step by step

Verified Expert Solution

Question

1 Approved Answer

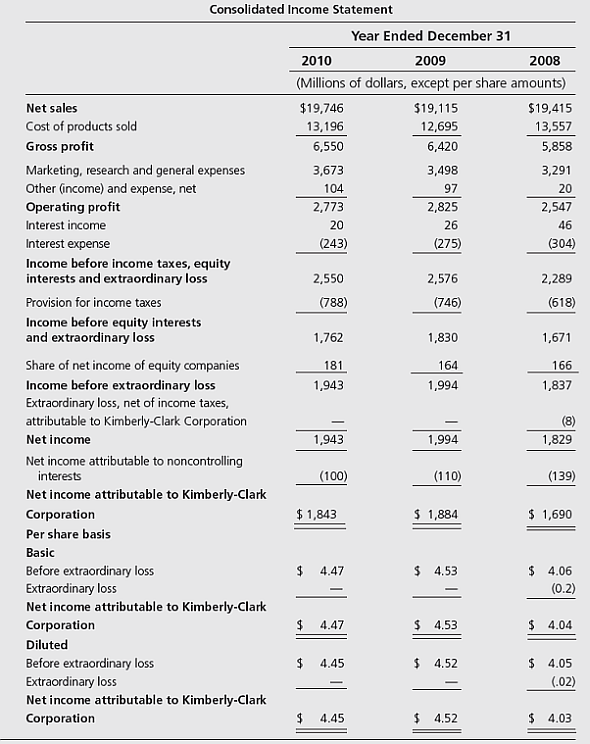

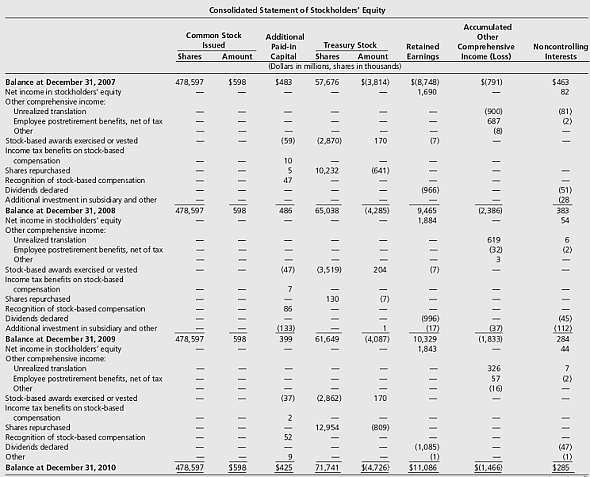

From the income statement above, we see that the net income attributable to non controlling interests is 100 in 2010, however in the corresponding Shareholder's

From the income statement above, we see that the net income attributable to non controlling interests is 100 in 2010, however in the corresponding Shareholder's Equity statement, we see that the net income corresponding to minority interest is 44. Where is the difference coming from?

20 Consolidated Income Statement Year Ended December 31 2010 2009 2008 (Millions of dollars, except per share amounts) Net sales $19,746 $19,115 $19,415 Cost of products sold 13,196 12,695 13,557 Gross profit 6,550 6,420 5,858 Marketing, research and general expenses 3,673 3,498 3,291 Other (income) and expense, net 104 97 Operating profit 2,773 2,825 2,547 Interest income 20 26 46 Interest expense (243) (275) (304) Income before income taxes, equity interests and extraordinary loss 2.550 2,576 2,289 Provision for income taxes (788) (746) (618) Income before equity interests and extraordinary loss 1,762 1,830 1,671 Share of net income of equity companies 181 164 166 Income before extraordinary loss 1,943 1,994 1,837 Extraordinary loss, net of income taxes, attributable to Kimberly-Clark Corporation Net income 1,943 1,994 1,829 Net income attributable to noncontrolling interests (100) (110) (139) Net income attributable to Kimberly-Clark Corporation $ 1,843 $ 1,884 $ 1,690 Per share basis Basic Before extraordinary loss 4.47 $ 4.53 $ 4.06 Extraordinary loss (0.2) Net income attributable to Kimberly-Clark Corporation 4.47 $ 4.53 $ 4.04 Diluted Before extraordinary loss $ 4.45 4.52 $ 4.05 Extraordinary loss (.02) Net income attributable to Kimberly-Clark Corporation 4.45 $ 4.52 $ 4.03 $ - $ $ $ Consolidated Statement of Stockholders' Equity Common Stock Issued Shares Amount Additional Paid-in Treasury Stock Capital Shares Amount (Dolars in milions, shares in thousands) 5483 57,676 $(3,814) Accumulated Other Comprehensive Income (Loss) Retained Earnings Noncontrolling Interests 478,597 $598 $(791) 5(8,748) 1,690 $463 82 (900) 687 (8) (81) (2) 111! (59) (2,870) 170 (7) 10 5 47 10.232 1641) 1966) 478,597 (51) (28 383 54 598 485 65,038 (4,285) 12,386) 9,465 1,884 111 619 62) 3 6 (2) Balance at December 31, 2007 Net income in stockholders' equity Other comprehensive income Unrealized translation Employee postretirement benefits, net of tax Other Stock-based awards exercised ex vested Income tax benefits on stock-based compensation Shares repurchased Recognition of stock-based compensation Dividends dedared Additional investment in subsidiary and other Balance at December 31, 2008 Net income in stockholders' equity Other comprehensive income: Unrealized translation Employee postretirement benefits, net of tax Other Stock-based awards exercised or vested Income tax benefits on stock-based compensation Shares repurchased Recognition of stock-based compensation Dividends dedared Additional investment in subsidiary and other Balance at December 31, 2009 Net income in stockholders' equity Other comprehensive income Unrealized translation Employee postretirement benefits, net of tax Other Stock-based awards exercised or vested Income tax benefits on stock-based compensation Shares repurchased Recognition of stock-based compensation Dividends dedared Other Balance at December 31, 2010 13.519) 204 111e 1119 118 118 1116 MICI 7 130 85 (133) 399 1996) (17) 10,329 1,843 137) (1,833) (45) (112) 284 44 478,597 598 61,649 (4,087) 326 57 (16) 7 Q) (37) (2,862) 170 12.954 (809) 52 (1,085) (1) $11.096 (47) (1) $285 478,597 5598 $425 71.741 14.726) $(1.466Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started