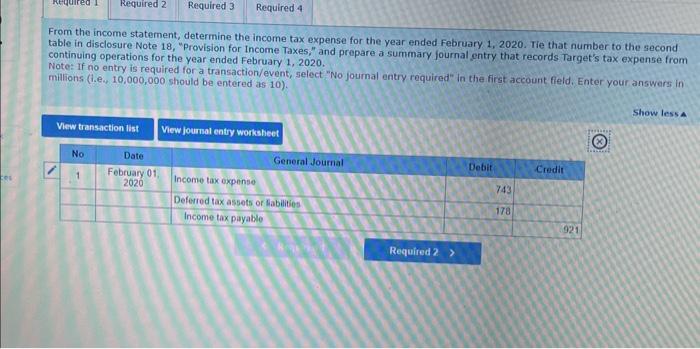

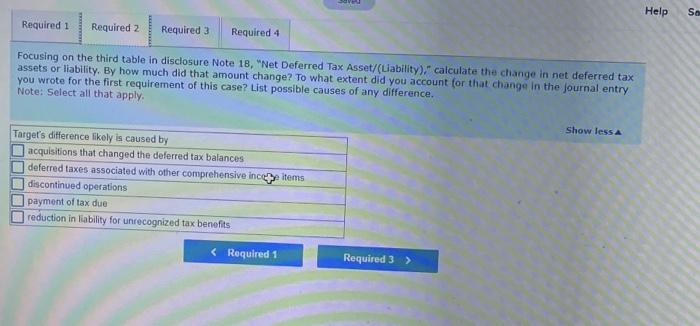

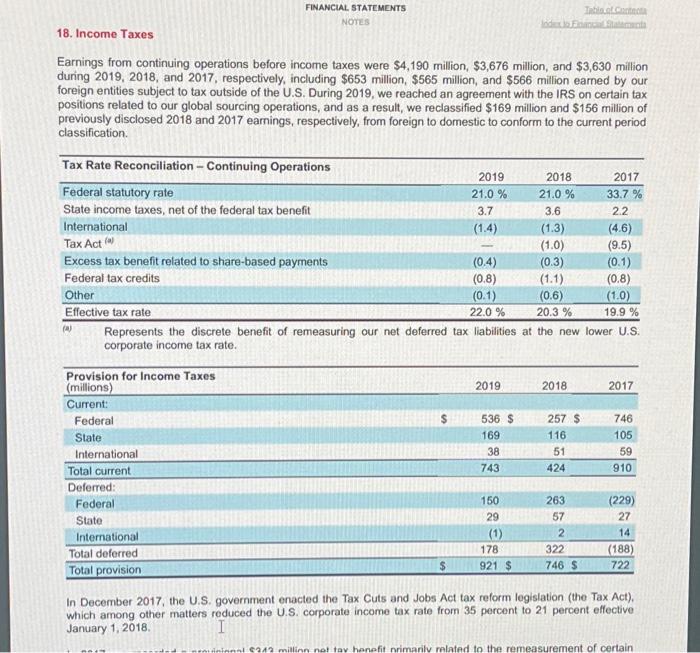

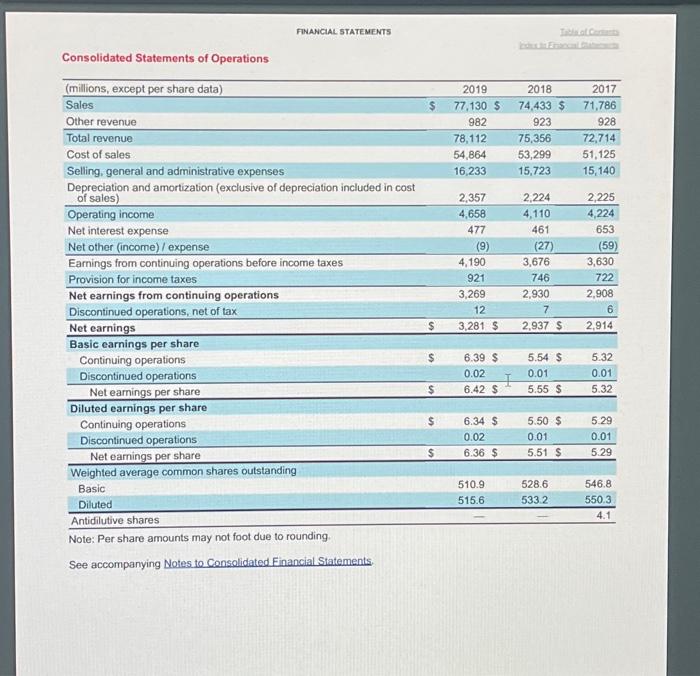

From the income statement, determine the income tax expense for the year ended February 1,2020. Tie that number to the second table in disclosure Note 18, "Provision for Income Taxes," and prepare a summary foumal entry that records Target's tax expense from continuing operations for the year ended February 1, 2020. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Earnings from continuing operations before income taxes were $4,190 million, $3,676 million, and $3,630 million during 2019,2018, and 2017, respectively, including $653 million, $565 million, and $566 million earned by our foreign entities subject to tax outside of the U.S. During 2019, we reached an agreement with the IRS on certain tax positions related to our global sourcing operations, and as a result, we reclassified $169 million and $156 million of previously disclosed 2018 and 2017 earnings, respectively, from foreign to domestic to conform to the current period classification. (a) Represents the discrete benefit of remeasuring our net deferred tax liabilities at the new lower U.S. corporate income tax rate. In December 2017, the U.S. government enacted the Tax Cuts and Jobs Act tax reform legislation (the Tax Act). which among other matters reduced the U.S. corporate income tax rate from 35 percent to 21 percent effective January 1,2018. Focusing on the third table in disclosure Note 18, "Net Deferred Tax Asset/(Liability)," calculate the cliange in net deferred tax assets or liability. By how much did that amount change? To what extent did you account for that change in the journal entry you wrote for the first requirement of this case? List possible causes of any difference. Note: Select all that apply. FINANCIAL STATEMENTS Twhatconas: Consolidated Statements of Operations \begin{tabular}{|c|c|c|c|c|c|c|} \hline (millions, except per share data) & & 2019 & & 2018 & & 2017 \\ \hline Sales & $ & 77,130 & $ & 74,433$ & $ & 71,786 \\ \hline Other revenue & & 982 & & 923 & & 928 \\ \hline Total revenue & & 78,112 & & 75,356 & & 72,714 \\ \hline Cost of sales & & 54,864 & & 53,299 & & 51,125 \\ \hline Selling, general and administrative expenses & & 16,233 & & 15,723 & & 15,140 \\ \hline Depreciationandamortization(exclusiveofdepreciationincludedincostofsales) & & 2,357 & & 2,224 & & 2,225 \\ \hline Operating income & & 4,658 & & 4,110 & & 4,224 \\ \hline Net interest expense & & 477 & & 461 & & 653 \\ \hline Net other (income) / expense & & (9) & & (27) & & (59) \\ \hline Earnings from continuing operations before income taxes & & 4,190 & & 3,676 & & 3,630 \\ \hline Provision for income taxes & & 921 & & 746 & & 722 \\ \hline Net earnings from continuing operations & & 3,269 & & 2,930 & & 2,908 \\ \hline Discontinued operations, net of tax & & 12 & & 7 & & 6 \\ \hline Net earnings & $ & 3,281 & $ & 2,937S & $ & 2,914 \\ \hline \multicolumn{7}{|l|}{ Basic earnings per share } \\ \hline Continuing operations & $ & 6.39 & $ & 5.54s & $ & 5.32 \\ \hline Discontinued operations & & 0.02 & & 0.01 & & 0.01 \\ \hline Net earnings per share & $ & 6.42 & s & 5.55S & s & 5.32 \\ \hline \multicolumn{7}{|l|}{ Diluted earnings per share } \\ \hline Continuing operations & \$ & 6.34 & $ & 5.50$ & $ & 5.29 \\ \hline Discontinued operations & & 0.02 & & 0.01 & & 0.01 \\ \hline Net earnings per share & s & 6.36 & $ & 5.51s & $ & 5.29 \\ \hline \multicolumn{7}{|l|}{ Weighted average common shares outstanding } \\ \hline Basic & & 510.9 & & 528.6 & & 546.8 \\ \hline Diluted & & 515.6 & & 533.2 & & 550.3 \\ \hline Antidilutive shares & & - & & - & & 4.1 \\ \hline \end{tabular} Note: Per share amounts may not foot due to rounding. See accompanying Notes to Consolidated Financial Statements. From the income statement, determine the income tax expense for the year ended February 1,2020. Tie that number to the second table in disclosure Note 18, "Provision for Income Taxes," and prepare a summary foumal entry that records Target's tax expense from continuing operations for the year ended February 1, 2020. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Earnings from continuing operations before income taxes were $4,190 million, $3,676 million, and $3,630 million during 2019,2018, and 2017, respectively, including $653 million, $565 million, and $566 million earned by our foreign entities subject to tax outside of the U.S. During 2019, we reached an agreement with the IRS on certain tax positions related to our global sourcing operations, and as a result, we reclassified $169 million and $156 million of previously disclosed 2018 and 2017 earnings, respectively, from foreign to domestic to conform to the current period classification. (a) Represents the discrete benefit of remeasuring our net deferred tax liabilities at the new lower U.S. corporate income tax rate. In December 2017, the U.S. government enacted the Tax Cuts and Jobs Act tax reform legislation (the Tax Act). which among other matters reduced the U.S. corporate income tax rate from 35 percent to 21 percent effective January 1,2018. Focusing on the third table in disclosure Note 18, "Net Deferred Tax Asset/(Liability)," calculate the cliange in net deferred tax assets or liability. By how much did that amount change? To what extent did you account for that change in the journal entry you wrote for the first requirement of this case? List possible causes of any difference. Note: Select all that apply. FINANCIAL STATEMENTS Twhatconas: Consolidated Statements of Operations \begin{tabular}{|c|c|c|c|c|c|c|} \hline (millions, except per share data) & & 2019 & & 2018 & & 2017 \\ \hline Sales & $ & 77,130 & $ & 74,433$ & $ & 71,786 \\ \hline Other revenue & & 982 & & 923 & & 928 \\ \hline Total revenue & & 78,112 & & 75,356 & & 72,714 \\ \hline Cost of sales & & 54,864 & & 53,299 & & 51,125 \\ \hline Selling, general and administrative expenses & & 16,233 & & 15,723 & & 15,140 \\ \hline Depreciationandamortization(exclusiveofdepreciationincludedincostofsales) & & 2,357 & & 2,224 & & 2,225 \\ \hline Operating income & & 4,658 & & 4,110 & & 4,224 \\ \hline Net interest expense & & 477 & & 461 & & 653 \\ \hline Net other (income) / expense & & (9) & & (27) & & (59) \\ \hline Earnings from continuing operations before income taxes & & 4,190 & & 3,676 & & 3,630 \\ \hline Provision for income taxes & & 921 & & 746 & & 722 \\ \hline Net earnings from continuing operations & & 3,269 & & 2,930 & & 2,908 \\ \hline Discontinued operations, net of tax & & 12 & & 7 & & 6 \\ \hline Net earnings & $ & 3,281 & $ & 2,937S & $ & 2,914 \\ \hline \multicolumn{7}{|l|}{ Basic earnings per share } \\ \hline Continuing operations & $ & 6.39 & $ & 5.54s & $ & 5.32 \\ \hline Discontinued operations & & 0.02 & & 0.01 & & 0.01 \\ \hline Net earnings per share & $ & 6.42 & s & 5.55S & s & 5.32 \\ \hline \multicolumn{7}{|l|}{ Diluted earnings per share } \\ \hline Continuing operations & \$ & 6.34 & $ & 5.50$ & $ & 5.29 \\ \hline Discontinued operations & & 0.02 & & 0.01 & & 0.01 \\ \hline Net earnings per share & s & 6.36 & $ & 5.51s & $ & 5.29 \\ \hline \multicolumn{7}{|l|}{ Weighted average common shares outstanding } \\ \hline Basic & & 510.9 & & 528.6 & & 546.8 \\ \hline Diluted & & 515.6 & & 533.2 & & 550.3 \\ \hline Antidilutive shares & & - & & - & & 4.1 \\ \hline \end{tabular} Note: Per share amounts may not foot due to rounding. See accompanying Notes to Consolidated Financial Statements